- United States

- /

- Oil and Gas

- /

- NYSE:GFR

Greenfire Resources (NYSE:GFR) Profit Margin Surge Challenges Market’s Growth Skepticism

Reviewed by Simply Wall St

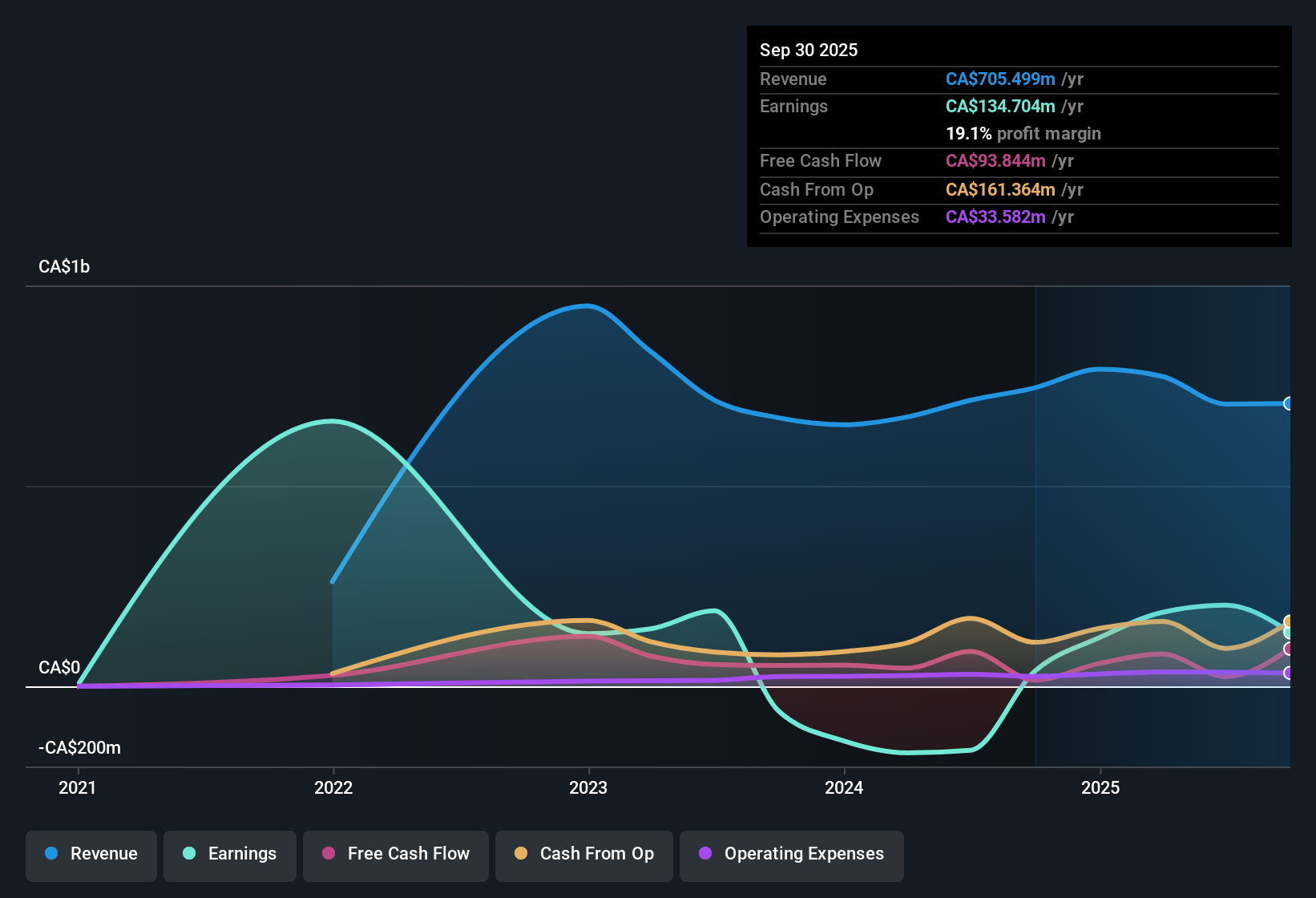

Greenfire Resources (NYSE:GFR) just posted a dramatic turnaround, with earnings growth reversing from a 20.2% annual decline over the past five years to a staggering 252.7% increase last year. The company’s net profit margin jumped to 19.1% from 5.1% a year ago, while shares now trade at just 3.3x earnings, which is far below the industry average of 12.8x and the peer average of 19.2x. This comes despite a current share price of $4.47 compared to a fair value estimate of $186.11. Momentum has shifted with rising profitability, but investors remain mindful of muted growth expectations on both the top and bottom line.

See our full analysis for Greenfire Resources.Next, we’ll look at how these headline metrics stack up against the community’s prevailing narratives. Some will be confirmed, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Rapidly Rebound

- Greenfire Resources’ net profit margin has climbed to 19.1%, a jump from 5.1% in the previous year, underscoring the company’s higher earnings quality as flagged in the latest EDGAR filing.

- The AI-generated narrative highlights that this margin improvement heavily supports views that operational execution has strengthened, but also notes:

- The magnitude of profit margin expansion stands out relative to the sector, where many peers are navigating margin compression.

- Yet, despite this progress, muted forecasts for both revenue and earnings growth raise the possibility these improvements may be at risk of stalling if top-line momentum does not return.

Bargain Valuation Versus Industry Peers

- Greenfire’s price-to-earnings ratio sits at just 3.3x, sharply below the industry average of 12.8x and peer average of 19.2x, marking it out as an outlier on relative valuation metrics.

- According to the prevailing analysis, this deep discount calls into question whether market participants are potentially over-discounting risks, especially since the company’s price of $4.47 is well below its calculated DCF fair value of $186.11.

- What is surprising is that despite strong profit margins and cheap valuation, the market remains unconvinced, likely due to weak growth expectations that are explicitly noted as a key risk in disclosures.

- Critics argue a low valuation alone is not a buying signal if market skepticism about sustainable earnings persists, suggesting investors are demanding a growth turnaround before re-rating the stock.

Growth Stalls Despite Improved Profitability

- The principal risk currently highlighted for Greenfire is the expectation that both revenue and earnings will not grow, even as profitability has increased.

- The AI-generated narrative points out this tension. On one hand, a turnaround in profit margins feeds optimism, but

- investors focused on growth remain cautious, as sustained value typically hinges on expanding revenues or earnings, not just improved margins.

- This concern may explain why, despite headline improvements, Greenfire’s valuation continues to lag behind peers.

Striking margin recovery and deep value stand out, but many are watching closely to see if growth can return and trigger a shift in market sentiment. See what the community is saying about Greenfire Resources

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Greenfire Resources's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Greenfire Resources boasts rapid profit margin expansion, the main concern is its lack of expected revenue and earnings growth to sustain long-term value.

If you’re seeking companies with steadier growth track records and reliable performance, check out stable growth stocks screener (2078 results) to discover options that consistently deliver on both top and bottom lines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GFR

Greenfire Resources

Engages in the exploration, development, and operation of oil and gas properties in the Athabasca oil sands region of Alberta, Canada.

Good value with proven track record.

Market Insights

Community Narratives