- United States

- /

- Oil and Gas

- /

- NYSE:GEL

Genesis Energy (GEL): Assessing Current Valuation After Offshore Pipeline Turnaround and Margin Improvement

Reviewed by Simply Wall St

Genesis Energy (NYSE:GEL) delivered a meaningful turnaround in its recent quarterly results, supported by margin improvement and higher volumes in its offshore pipeline transportation segment. New deepwater projects and resolved operational issues contributed to this improvement.

See our latest analysis for Genesis Energy.

After a period of mixed returns, Genesis Energy’s latest momentum is hard to overlook, with a 1-year total shareholder return of 58.8% and shares up 55.1% year to date. The recent earnings-driven boost signals improving sentiment as free cash flow and balance sheet strength underpin optimism going forward.

If you’re looking to broaden your search beyond the latest turnaround, now is a great time to discover fast growing stocks with high insider ownership.

With the stock already up sharply this year and expectations of ongoing margin gains, the key question is whether Genesis Energy’s recent rally leaves more room for upside, or if the market is now fully accounting for future growth potential.

Price-to-Sales Ratio of 0.7x: Is it justified?

Genesis Energy currently trades at a price-to-sales (P/S) ratio of 0.7x, signaling that the market prices each dollar of the company’s sales below both its direct peers and the wider oil and gas sector. Compared to the industry average of 1.5x and a peer average of 2.2x, this is a distinct discount.

The price-to-sales ratio reflects how much investors are willing to pay for each dollar of revenue. It is relevant for companies with volatile profits or those that are unprofitable, like Genesis Energy, because it focuses on the top line rather than bottom-line earnings.

Given that Genesis Energy is currently unprofitable and experiencing revenue declines, the market’s reluctance to bid up the multiple is understandable. However, the discount to both the industry and peer averages is striking. According to regression analysis, the estimated fair P/S ratio for Genesis Energy is 0.2x, so even the current valuation could be on the higher side if fundamentals deteriorate further.

Explore the SWS fair ratio for Genesis Energy

Result: Price-to-Sales of 0.7x (OVERVALUED)

However, with declining annual revenue and ongoing unprofitability, any further operational setbacks could quickly undermine Genesis Energy’s current market momentum.

Find out about the key risks to this Genesis Energy narrative.

Another View: SWS DCF Model Suggests Undervaluation

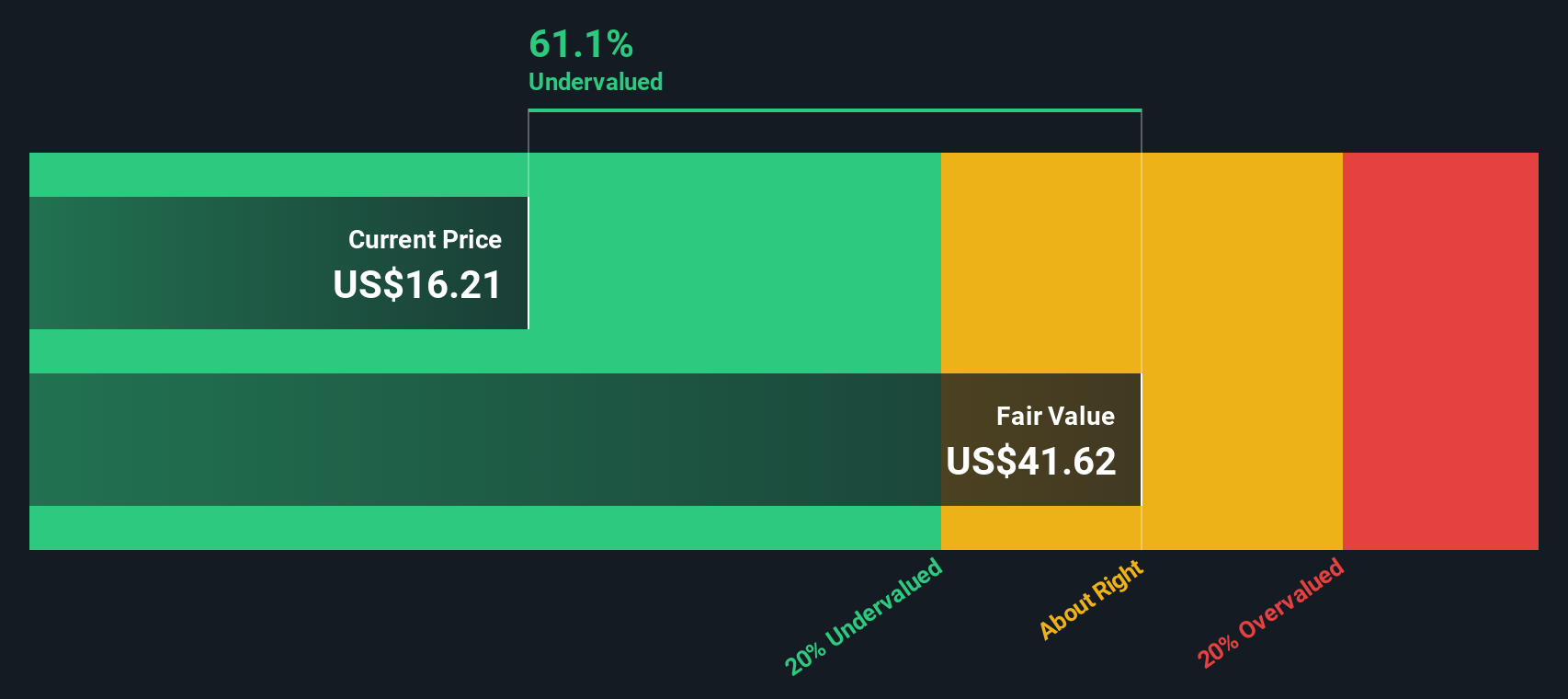

While the price-to-sales ratio signals Genesis Energy could be expensive relative to its fundamentals, our SWS DCF model presents a very different picture. It suggests the company is trading at a substantial 61.3% discount to its fair value. Could the market be underestimating future upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Genesis Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Genesis Energy Narrative

If you have a different perspective or want to dive deeper into the numbers, you can shape your own story about Genesis Energy in just minutes. Do it your way.

A great starting point for your Genesis Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors like you never settle for just one opportunity. Uncover your next winning stock by tapping into unique market trends with these hand-picked resources:

- Fuel your search for long-term gains and steady income by checking out these 20 dividend stocks with yields > 3%, which offers reliable yields over 3%.

- Get ahead of the curve on medical innovation with these 33 healthcare AI stocks, connecting technology and healthcare breakthroughs.

- Seize the chance to own part of tomorrow’s digital revolution with these 81 cryptocurrency and blockchain stocks, breaking new ground in blockchain and cryptocurrency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEL

Genesis Energy

Engages in the midstream segment of the crude oil and natural gas industry in the United States.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives