- United States

- /

- Energy Services

- /

- NYSE:FTI

3 Stocks Estimated To Be Trading At Discounts Ranging From 20.7% To 38.3%

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's recent decision to cut rates, U.S. stocks have surged to new highs, reflecting investor optimism. Amid this buoyant market environment, identifying undervalued stocks can be particularly rewarding for investors seeking opportunities at a discount. A good stock in these conditions is one that not only shows potential for growth but is also trading below its intrinsic value. In this article, we explore three such stocks estimated to be trading at discounts ranging from 20.7% to 38.3%.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Harmony Gold Mining (JSE:HAR) | ZAR179.50 | ZAR358.89 | 50% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥31.96 | CN¥63.82 | 49.9% |

| Cogelec (ENXTPA:ALLEC) | €11.60 | €23.13 | 49.8% |

| Regal Partners (ASX:RPL) | A$3.41 | A$6.82 | 50% |

| Stille (OM:STIL) | SEK220.00 | SEK439.75 | 50% |

| KBR (NYSE:KBR) | US$63.58 | US$126.64 | 49.8% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹506.10 | ₹1008.35 | 49.8% |

| Securitas (OM:SECU B) | SEK129.75 | SEK258.31 | 49.8% |

| EVERTEC (NYSE:EVTC) | US$33.02 | US$65.83 | 49.8% |

| Sinch (OM:SINCH) | SEK32.36 | SEK64.37 | 49.7% |

Let's review some notable picks from our screened stocks.

Turkiye Garanti Bankasi (IBSE:GARAN)

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey, with a market cap of TRY500.64 billion.

Operations: The company's revenue segments include Retail Banking (TRY95.70 billion), Investment Banking (-TRY98.03 billion), and Corporate and Commercial Banking (TRY111.49 billion).

Estimated Discount To Fair Value: 38.3%

Turkiye Garanti Bankasi A.S. appears undervalued based on cash flows, trading at TRY 119.2, which is 38.3% below its estimated fair value of TRY 193.17. Recent earnings reports show strong growth with net interest income for Q2 at TRY 32,940.07 million and net income at TRY 21,865.16 million, both significantly higher than the previous year. Earnings are forecast to grow by approximately 26.83% annually over the next three years, indicating robust future performance despite an unstable dividend track record.

- Our earnings growth report unveils the potential for significant increases in Turkiye Garanti Bankasi's future results.

- Navigate through the intricacies of Turkiye Garanti Bankasi with our comprehensive financial health report here.

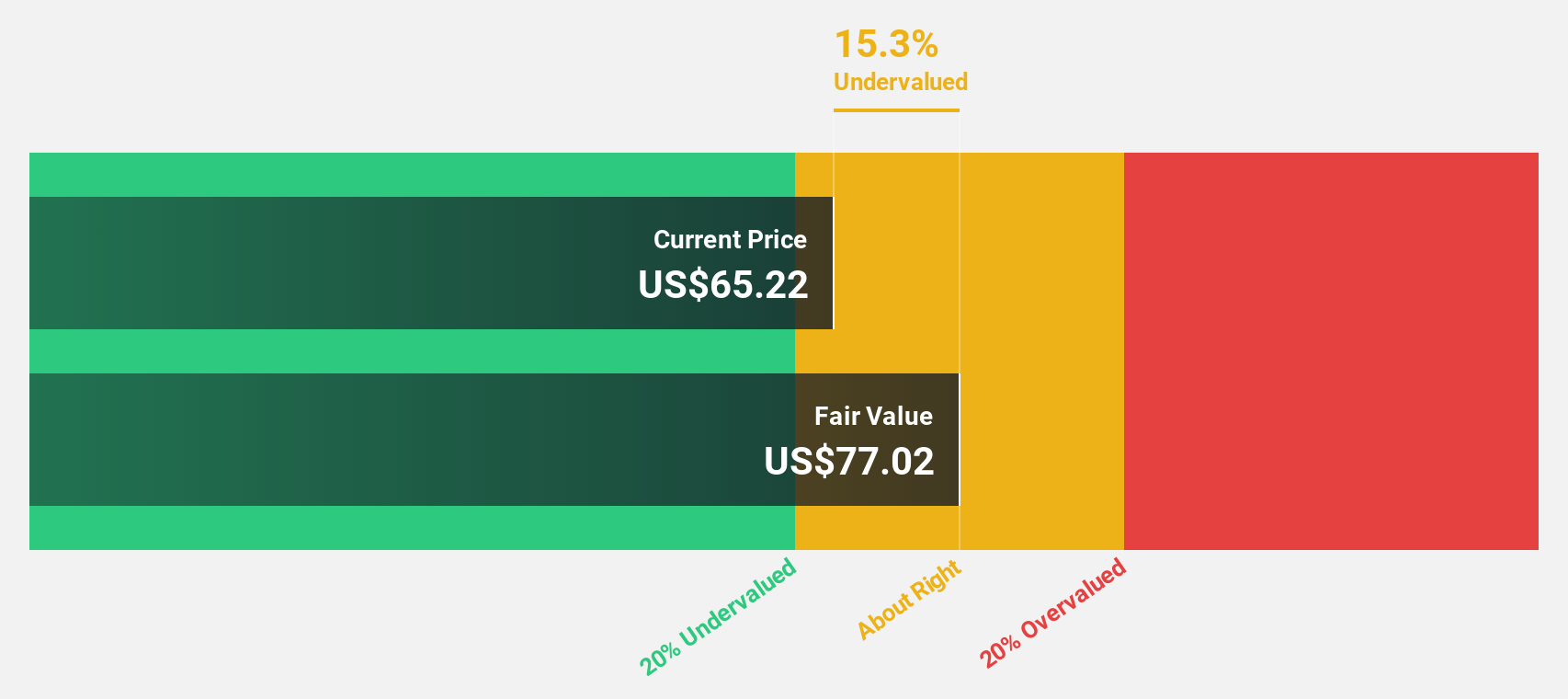

Western Digital (NasdaqGS:WDC)

Overview: Western Digital Corporation develops, manufactures, and sells data storage devices and solutions globally, with a market cap of $22.93 billion.

Operations: The company's revenue segments include Hard Disk Drives (HDD) generating $6.32 billion and Flash-Based Products (Flash) contributing $6.69 billion.

Estimated Discount To Fair Value: 24.9%

Western Digital is trading at US$66.75, significantly below its estimated fair value of US$88.82. Revenue is forecast to grow 11.2% annually, outpacing the broader market's 8.7%. The company reported Q4 sales of US$3.76 billion and net income of US$330 million, a turnaround from last year's net loss. Analysts project profitability within three years and expect earnings to grow by 32.21% annually despite recent shareholder dilution and interest coverage concerns.

- Our growth report here indicates Western Digital may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Western Digital.

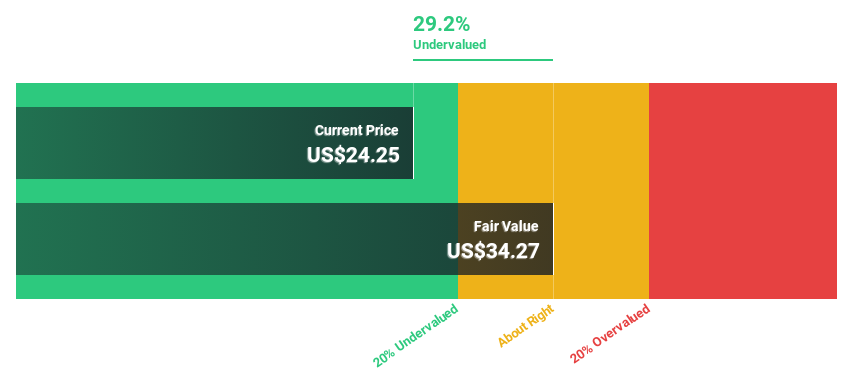

TechnipFMC (NYSE:FTI)

Overview: TechnipFMC plc operates in energy projects, technologies, and systems and services across various regions globally, with a market cap of approximately $11.66 billion.

Operations: The company's revenue segments include Subsea, generating $7.17 billion, and Surface Technologies, contributing $1.33 billion.

Estimated Discount To Fair Value: 20.7%

TechnipFMC is trading at US$27.22, below its estimated fair value of US$34.34. Recent earnings reports show a significant turnaround with Q2 sales of US$2.33 billion and net income of US$186.5 million, up from a net loss last year. The company has revised its 2024 revenue guidance upward and completed substantial share buybacks worth $555 million, enhancing shareholder value while securing major contracts with Petrobras and Energean, indicating strong future cash flows.

- The growth report we've compiled suggests that TechnipFMC's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of TechnipFMC stock in this financial health report.

Make It Happen

- Embark on your investment journey to our 937 Undervalued Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, and systems and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with reasonable growth potential.