- United States

- /

- Oil and Gas

- /

- NYSE:FLNG

Should FLEX LNG’s (FLNG) Consistent Dividend Signal Confidence in Its Long-Term Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- FLEX LNG Ltd. recently reported third quarter 2025 earnings, with net income of US$16.82 million and earnings per share of US$0.31, while also declaring a US$0.75 per share dividend payable in December to shareholders of record on November 28, 2025.

- Despite a slight year-over-year decrease in earnings, the continued commitment to dividend payments underscores the company's focus on shareholder returns and financial stability.

- We’ll explore how FLEX LNG’s affirmed dividend, alongside quarterly results, shapes its investment narrative and forward-looking outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FLEX LNG Investment Narrative Recap

To believe in FLEX LNG as a shareholder, you need to have conviction in the sustained growth of LNG shipping demand, supported by long-term contracts and disciplined capital returns amid global energy transition. The third quarter 2025 results, including a maintained US$0.75 dividend despite a slight dip in earnings, do not materially alter the most important short-term catalyst, a stable revenue stream from long-term charters, but do highlight ongoing risks from sector oversupply and capital allocation. The principal near-term risk remains the possibility of industry oversupply compressing charter rates and, thus, pressuring margins and future payouts.

Among recent announcements, FLEX LNG’s continued US$0.75 per share quarterly dividend is most relevant here. This repeated affirmation of sizable shareholder distributions paints a picture of ongoing cash flow confidence, but also raises questions about long-term reinvestment capacity, especially in the context of rising newbuild costs and limited expansion opportunities, which could affect the company’s flexibility if market conditions change. Contrast this optimism, investors should also be aware of the pressures created by a global influx of new LNG vessels that could...

Read the full narrative on FLEX LNG (it's free!)

FLEX LNG's narrative projects $369.5 million in revenue and $145.9 million in earnings by 2028. This requires 1.3% yearly revenue growth and a $46.8 million earnings increase from $99.1 million today.

Uncover how FLEX LNG's forecasts yield a $25.33 fair value, a 5% downside to its current price.

Exploring Other Perspectives

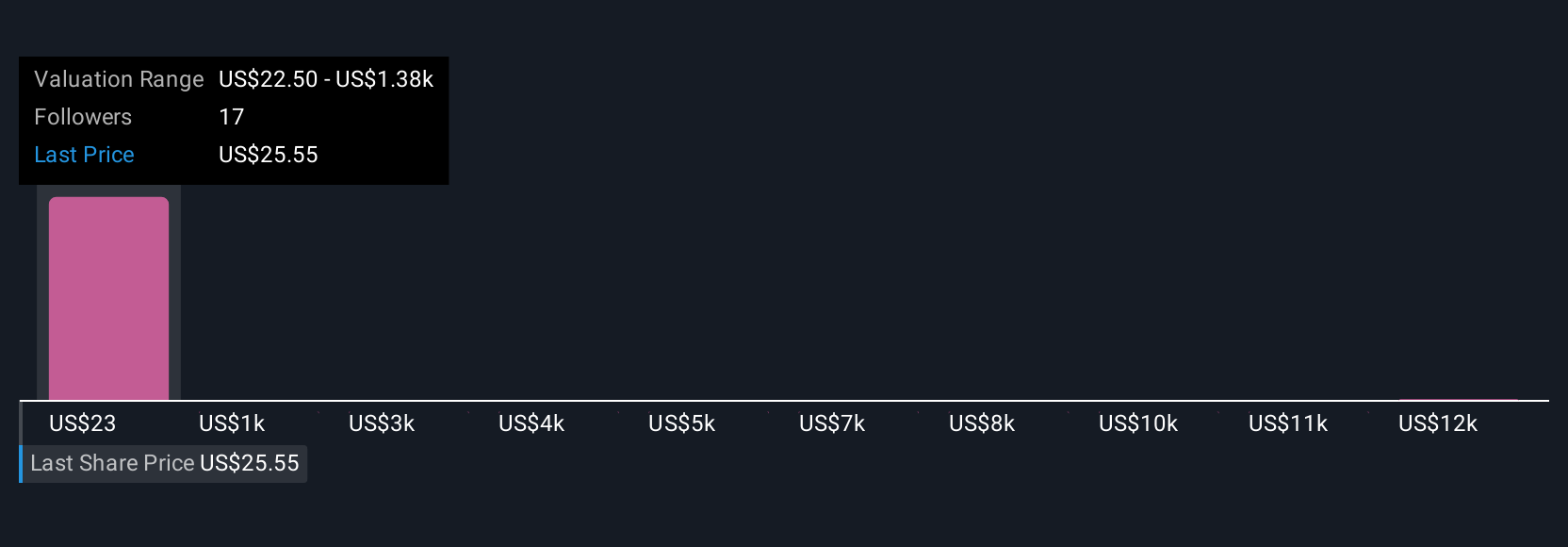

The Simply Wall St Community provided four fair value estimates for FLEX LNG shares, ranging from US$22.50 to a striking US$13,641.04. Alongside these widespread valuations, the risk of a global oversupply of LNG vessels continues to weigh heavily on future margin and payout prospects.

Explore 4 other fair value estimates on FLEX LNG - why the stock might be a potential multi-bagger!

Build Your Own FLEX LNG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FLEX LNG research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FLEX LNG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FLEX LNG's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLNG

FLEX LNG

Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives