- United States

- /

- Oil and Gas

- /

- NYSE:ET

Energy Transfer (ET): Evaluating Valuation Potential Following Recent Share Price Momentum

Reviewed by Simply Wall St

Energy Transfer (ET) shares have seen a slight uptick over the past week, drawing in investors interested in how recent trends might influence the stock’s near-term direction. With a steady flow, let’s dive into what is behind this move.

See our latest analysis for Energy Transfer.

Energy Transfer’s share price has shown modest momentum lately, with a 1.62% gain over the past week and a 3.16% share price return across the last month. Taking a broader view, the stock has delivered an impressive three-year total shareholder return of 74%. However, recent returns have softened, which may indicate that momentum is cooling following a period of strong performance.

If you’re curious what other parts of the market are revealing about insider confidence and growth, now is a good moment to broaden your search and discover fast growing stocks with high insider ownership

With Energy Transfer’s long-term gains and recent slowdown, the question for investors is whether shares remain fundamentally undervalued, or if the market has already factored in the company’s future growth potential. Could there still be a bargain here?

Most Popular Narrative: 22% Undervalued

With Energy Transfer closing at $16.97, the most popular narrative places fair value much higher. This narrative suggests there could be meaningful upside if core assumptions prove correct.

“Aggressive organic growth project backlog (many expected to deliver mid-teen returns from 2026 onward) and a proven history of successful M&A provide strong forward visibility into distributable cash flow and earnings growth, likely supporting valuation re-rating over time.”

Want to know the financial engine driving this lofty price target? There’s a bold earnings blueprint and ambitious margin forecast outlined in the narrative. Unlock the details that set this valuation apart and discover what could shift market sentiment in a big way.

Result: Fair Value of $21.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges such as weaker-than-expected crude volume growth or delays on major projects could shift sentiment and reshape the valuation story in the future.

Find out about the key risks to this Energy Transfer narrative.

Another View: Peers and Ratios Tell a Different Story

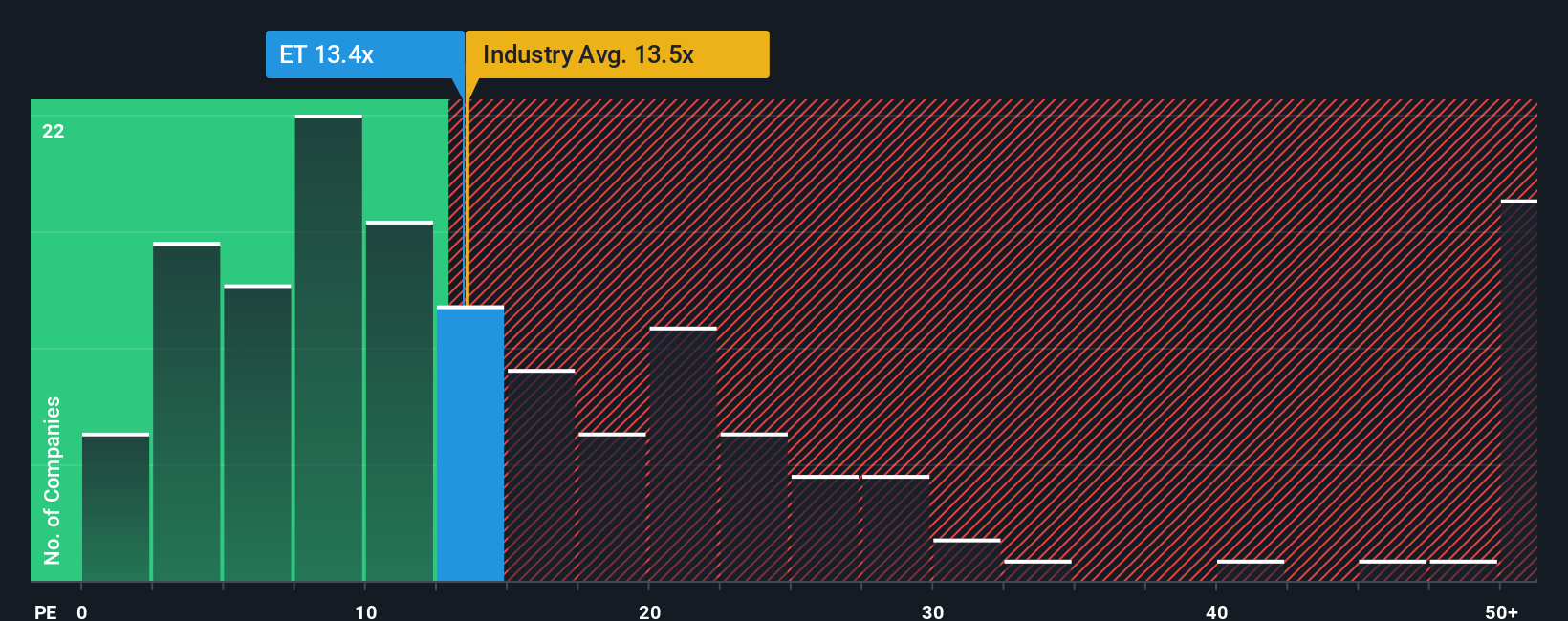

Looking through the lens of price-to-earnings, Energy Transfer trades at 13.5 times earnings, nearly identical to its industry's 13.5 but well below the peer group average of 19. Compared to our fair ratio of 20.4, this presents a sizable gap. This could suggest room for a potential upward move or, equally, a valuation that could be justified if future growth expectations cool. Is this a value opportunity, or is the market sending a cautionary signal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Energy Transfer Narrative

If you see things differently or want to dig into the details yourself, it's easy to build your own narrative and uncover unique insights in just a few minutes. Do it your way

A great starting point for your Energy Transfer research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Set yourself up for smarter choices by checking out these top stock ideas designed for forward-thinking investors like you.

- Tap into future growth by analyzing these 905 undervalued stocks based on cash flows to pinpoint stocks with compelling value potential and strong fundamentals.

- Capitalize on rising global healthcare trends by evaluating these 31 healthcare AI stocks with cutting-edge AI adoption in the medical sector.

- Catalyze your strategy with these 81 cryptocurrency and blockchain stocks, featuring companies at the forefront of blockchain innovation and digital asset transformations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives