- United States

- /

- Oil and Gas

- /

- NYSE:EQT

Has EQT’s 54% Climb and Recent Acquisitions Changed Its Fair Value Outlook for 2025?

Reviewed by Bailey Pemberton

- Wondering if now is the right time to buy EQT? You are not alone, as many investors are curious about whether the recent run-up reflects real value or just market excitement.

- EQT's stock has soared 53.8% over the past year and is up 18.0% year-to-date, hinting at both robust growth potential and possible shifts in how the market perceives risk.

- Recent headlines have spotlighted EQT's active expansion in the energy sector and notable acquisitions, both of which have fueled speculation about future growth and competitiveness. News outlets are also discussing the evolving landscape for natural gas, as EQT pushes into new markets and navigates regulatory changes.

- On our core valuation checks, EQT scores 3 out of 6, suggesting a mixed picture between value and potential caution. We will break down what this score really means from a valuation methodology perspective, but stick around for an even more insightful way to look at EQT’s value at the end of the article.

Approach 1: EQT Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present day. Essentially, it asks what all those future cash flows are worth in today's dollars. This approach allows investors to determine if a stock is undervalued or overvalued.

For EQT, the current Free Cash Flow stands at $2.13 Billion. Looking ahead, analysts forecast that EQT's Free Cash Flow remains healthy, with ten-year projections estimating it will be approximately $2.65 Billion by the end of 2029. The projections begin with several years of analyst consensus and are then extended by Simply Wall St to complete the decade-long outlook.

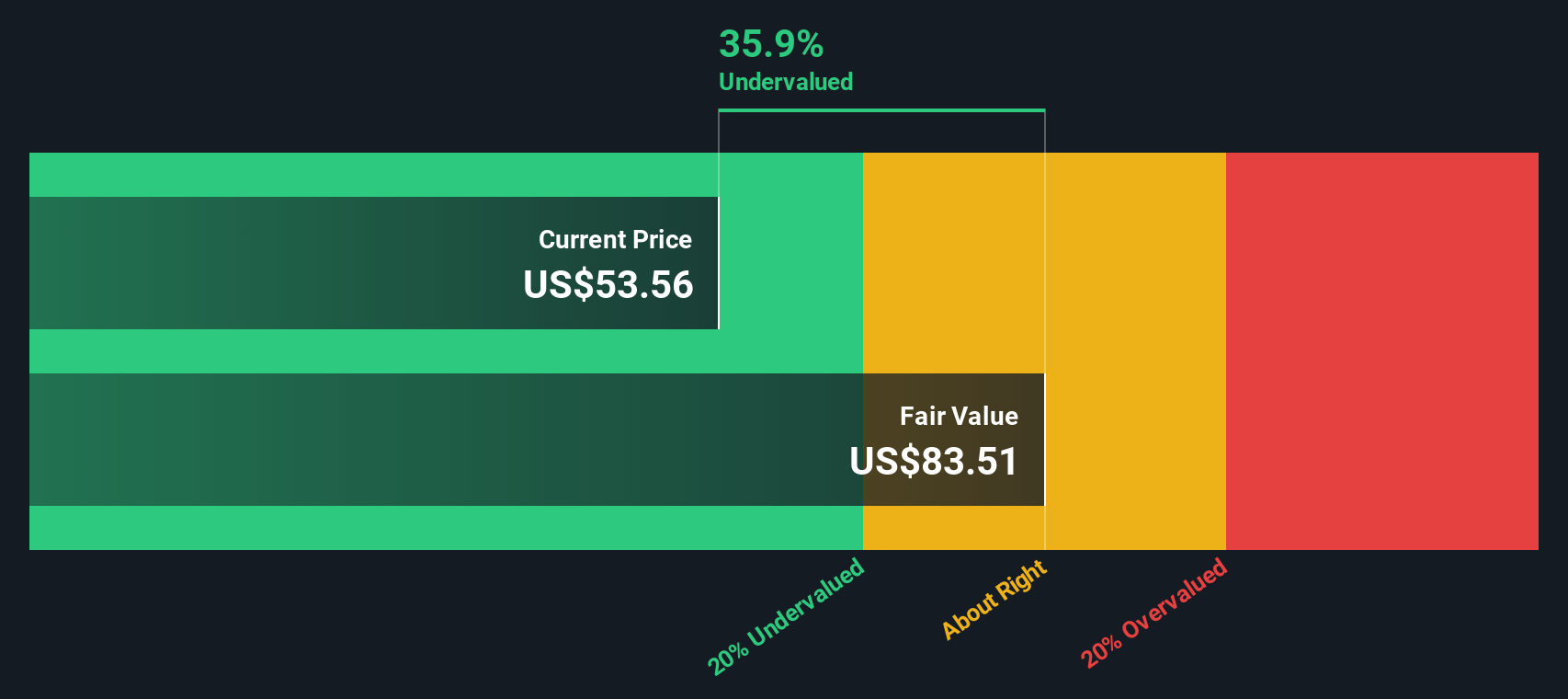

Based on these cash flow projections, the DCF calculation points to an intrinsic share value of $83.05. At current market prices, this implies that EQT stock is trading at a 32.7% discount to its estimated fair value. According to this model, the stock appears notably undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EQT is undervalued by 32.7%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: EQT Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like EQT. It compares a company’s current share price to its per-share earnings, serving as a simple gauge of how much investors are willing to pay for each dollar of profit.

What is considered a normal or fair PE ratio depends on several factors, including growth prospects and risk. Higher expected growth rates and lower risks typically justify higher PE ratios, while companies with more uncertainty or lower growth often trade at a discount.

Currently, EQT trades at a PE ratio of 19.6x. For context, this is higher than the oil and gas industry average of 12.8x and above the peer average of 14.9x. While this suggests EQT is valued more richly than many competitors, it is important to consider whether that premium is justified.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike peer or industry comparisons, the Fair Ratio offers a customized benchmark that considers EQT’s specific growth outlook, profit margins, risks, industry dynamics, and market cap. In EQT’s case, the Fair Ratio is estimated at 21.0x, which is a more tailored measure of what investors should expect to pay, taking into account the company’s full profile.

Since EQT’s actual PE of 19.6x is only modestly below its Fair Ratio of 21.0x, the stock appears to be priced about right by this more nuanced metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EQT Narrative

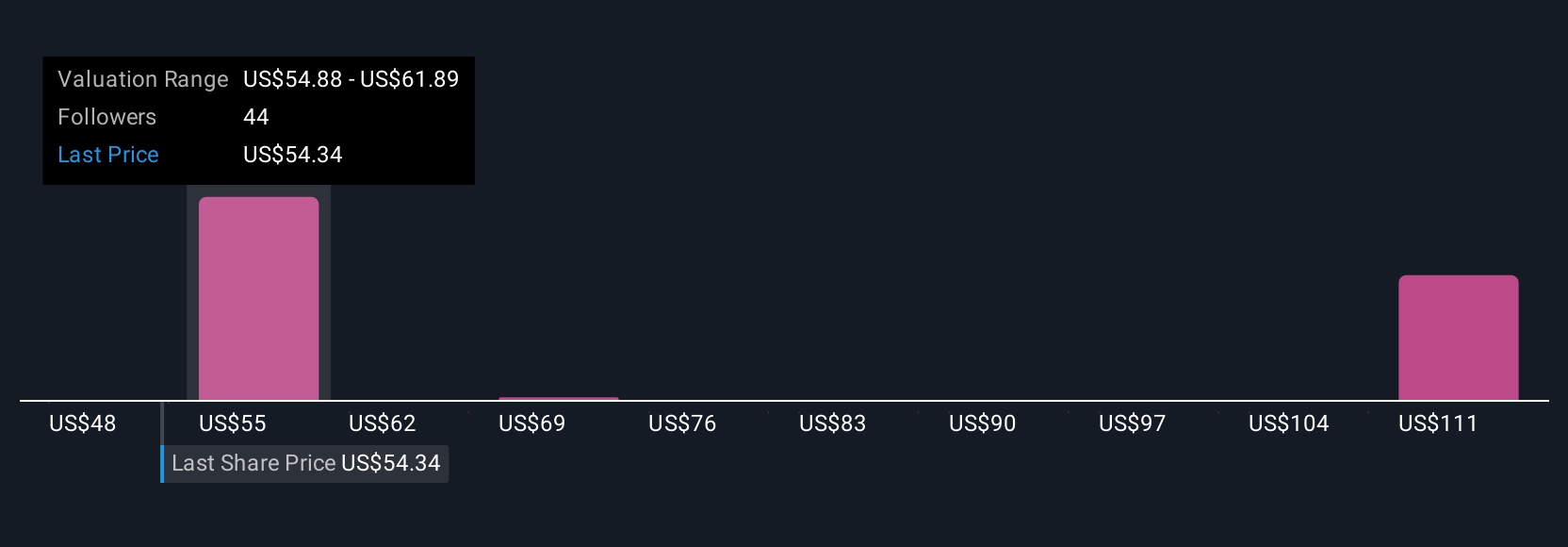

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal view on a company that connects its story, what you believe about its future opportunities and risks, to a financial forecast, and ultimately a fair value. Narratives let you put the “why” behind the numbers by building a reasoned story, including your assumptions for growth, profit margins, and how the business might be impacted by new trends or challenges.

On Simply Wall St’s Community page, investors use Narratives to quickly turn their perspectives into updated fair value estimates, which adjust automatically if news, earnings, or other data change. Narratives make it easy for anyone, not just financial experts, to test how their views translate into numbers and to compare these fair values to the current share price, helping you decide if now is the time to buy, hold, or sell.

For example, in the case of EQT, some investors are optimistic, believing the company’s long-term contracts and data center demand will propel future earnings, supporting a high fair value around $80. Others are more cautious, citing regulatory risks or volatile gas prices, and set their fair value closer to $42.

Do you think there's more to the story for EQT? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives