- United States

- /

- Oil and Gas

- /

- NYSE:EOG

Can EOG’s (EOG) Share Buybacks and Dividends Offset Profit Declines Amid Higher Production?

Reviewed by Sasha Jovanovic

- EOG Resources recently announced its third quarter results, which showed a year-over-year decline in revenue and net income despite higher oil and gas production volumes, along with updated production guidance and a continued commitment to shareholder returns through dividends and share repurchases.

- An interesting detail is that the company’s continued buybacks have now retired nearly 9% of outstanding shares since late 2021, while the regular dividend remains intact and has not been suspended or reduced.

- We'll examine how EOG Resources' higher production amid lower earnings and robust capital returns impacts its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

EOG Resources Investment Narrative Recap

To own EOG Resources, an investor must believe in the company’s ability to grow production, maintain capital discipline, and return cash to shareholders, even when earnings are under pressure. The latest results, higher production alongside lower revenue and net income, do little to change the core short-term catalyst of operational efficiency, but highlight the persistent risk of commodity price volatility impacting profitability. As it stands, no material shift has occurred regarding either the company’s primary catalyst or biggest risk based on this news.

One particularly relevant update is EOG's recently affirmed regular dividend at an annual rate of US$4.08 per share, continuing its track record of uninterrupted payouts. This not only reinforces management's commitment to returning capital, but also illustrates the balance EOG aims for between reinvestment and shareholder distributions, a key part of the story for those focused on yield and disciplined capital allocation amid industry cyclicality.

Yet, in contrast to the company’s steady dividends and share buybacks, the risk of unpredictable swings in commodity pricing remains an ongoing factor that investors should be aware of…

Read the full narrative on EOG Resources (it's free!)

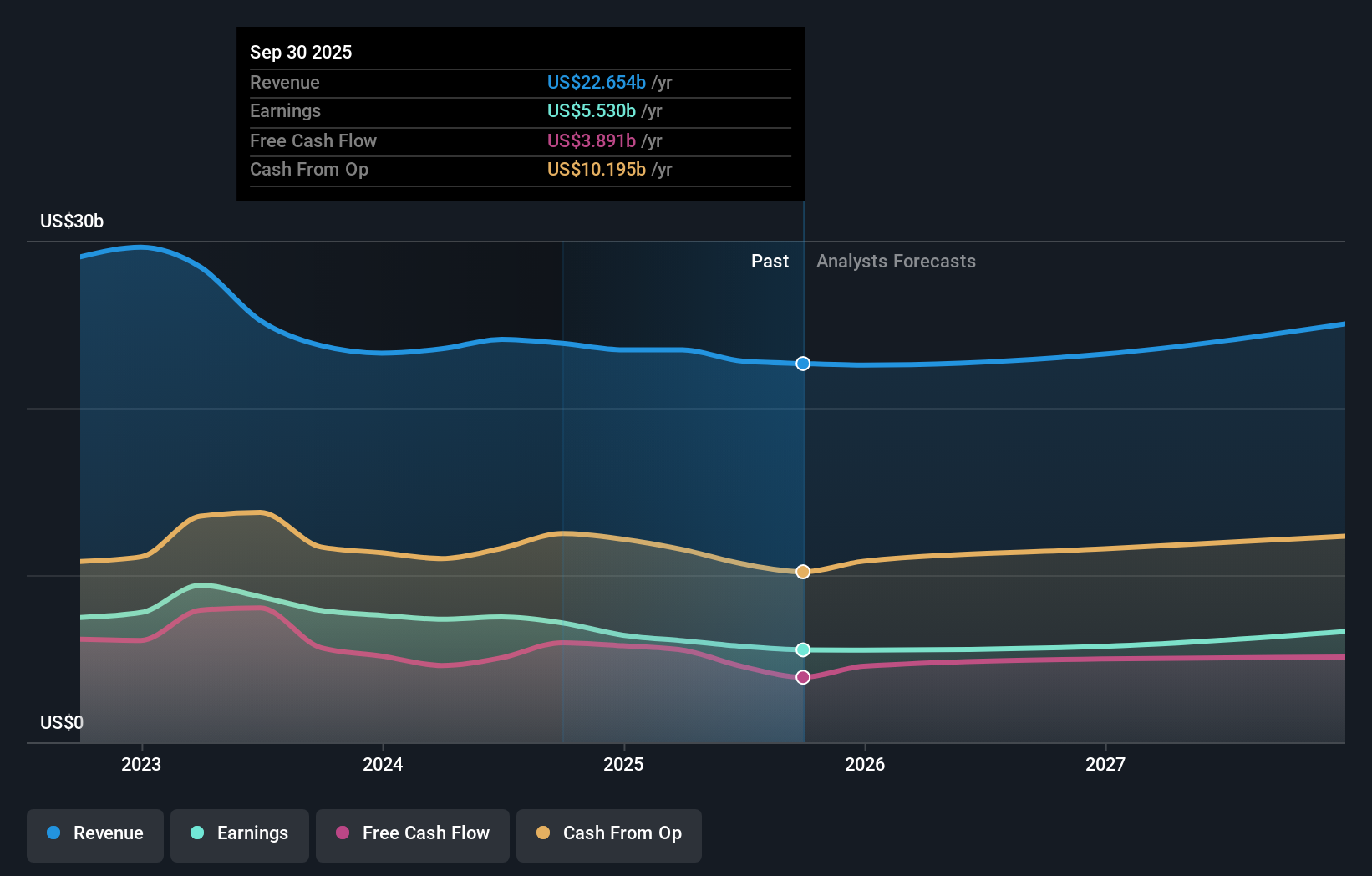

EOG Resources' outlook projects $27.1 billion revenue and $6.6 billion earnings by 2028. This is based on an expected 6.0% annual revenue growth rate and an $0.9 billion increase in earnings from the current $5.7 billion.

Uncover how EOG Resources' forecasts yield a $137.20 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community estimate EOG’s fair value from US$101 to over US$292 per share. As you compare these divergent outlooks, consider how commodity price variability could shape the company’s future results and weigh these different perspectives for yourself.

Explore 9 other fair value estimates on EOG Resources - why the stock might be worth over 2x more than the current price!

Build Your Own EOG Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EOG Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EOG Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EOG Resources' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EOG Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EOG

EOG Resources

Explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas in producing basins in the United States, the Republic of Trinidad and Tobago, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives