- United States

- /

- Oil and Gas

- /

- NYSE:DVN

Should Investors Revisit Devon Energy After Shares Drop 16.9% in the Past Year?

Reviewed by Bailey Pemberton

- Wondering if Devon Energy might be undervalued, or if its stock still offers a hidden bargain? You are not alone, as many investors are looking to decode the real value behind this well-known energy name.

- The stock has seen some ups and downs recently, gaining 0.9% over the past week but down 7.4% in the last month. Over the past year, it has fallen 16.9%, even as its five-year return sits at an impressive 259.6%.

- Much of Devon Energy's recent movement has been driven by shifting oil prices and industry-wide happenings, such as OPEC's ongoing plans to maintain output limits. In addition, new federal initiatives around energy infrastructure continue to influence market sentiment and investment flows for major U.S. producers.

- Devon Energy currently scores 5 out of 6 on our valuation check, indicating it is undervalued in most key areas. We will explore different approaches for valuing the business, and stay tuned as we introduce another perspective to assess Devon's true worth by the end of this article.

Find out why Devon Energy's -16.9% return over the last year is lagging behind its peers.

Approach 1: Devon Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future free cash flows and then discounting them back to today's value. This approach helps investors determine what a business is worth based purely on the cash it is expected to generate.

For Devon Energy, the DCF uses a "2 Stage Free Cash Flow to Equity" model. The company's latest reported Free Cash Flow stands at $926.9 Million. Analysts provide forecasts for the next five years, with projections largely exceeding $3 Billion annually by 2026. For example, Devon Energy's projected free cash flow for 2029 is $3.54 Billion. For years beyond analyst coverage, projections use growth estimates to extend the forecast up to ten years.

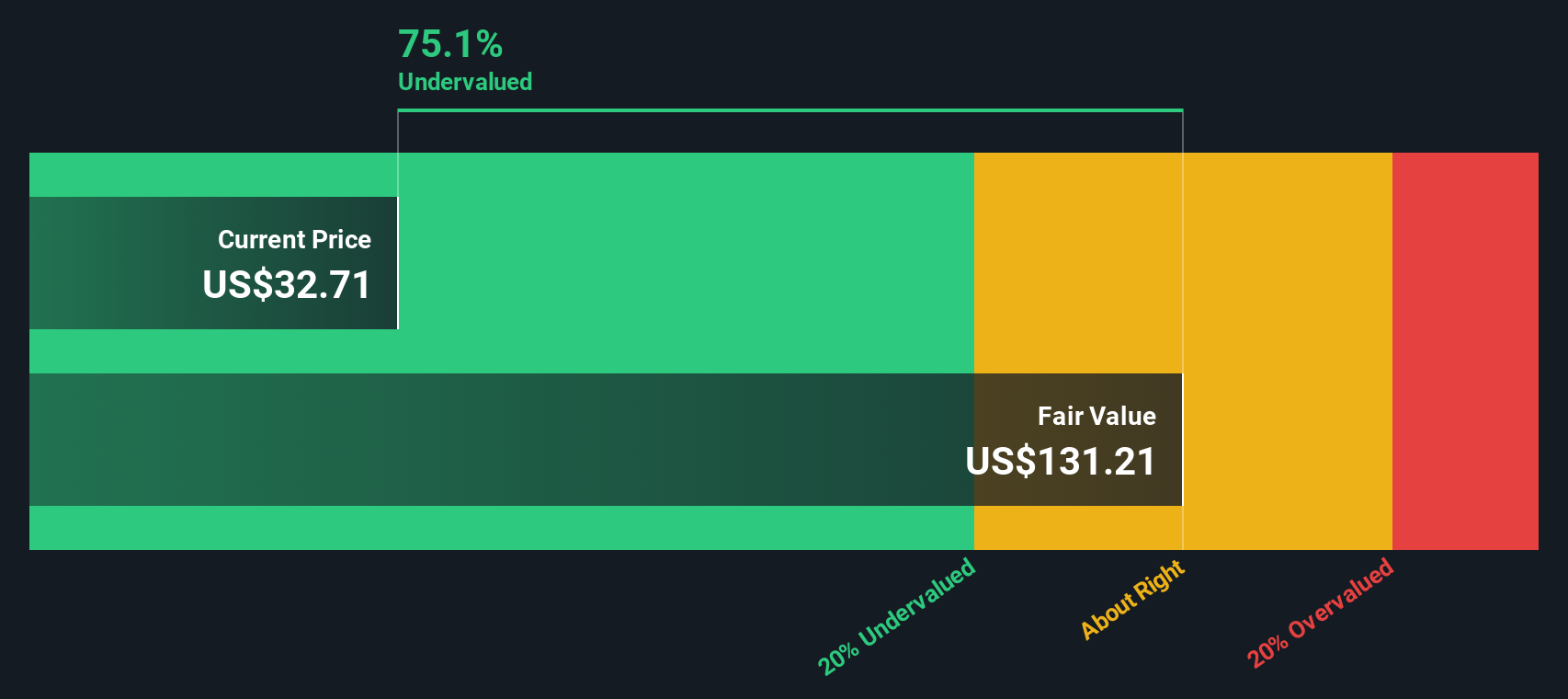

Based on these projections and after discounting to today's value, the DCF valuation suggests that Devon Energy's intrinsic value per share is $136.42. This implies the stock is trading at a 76.3 percent discount to its estimated fair value, indicating meaningful undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Devon Energy is undervalued by 76.3%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: Devon Energy Price vs Earnings

The Price-to-Earnings (PE) multiple is a time-tested way to value profitable companies like Devon Energy, as it directly compares the price investors pay for each dollar of company earnings. This makes it especially useful for established firms with consistent profits, allowing for straightforward comparisons to peers and industry benchmarks.

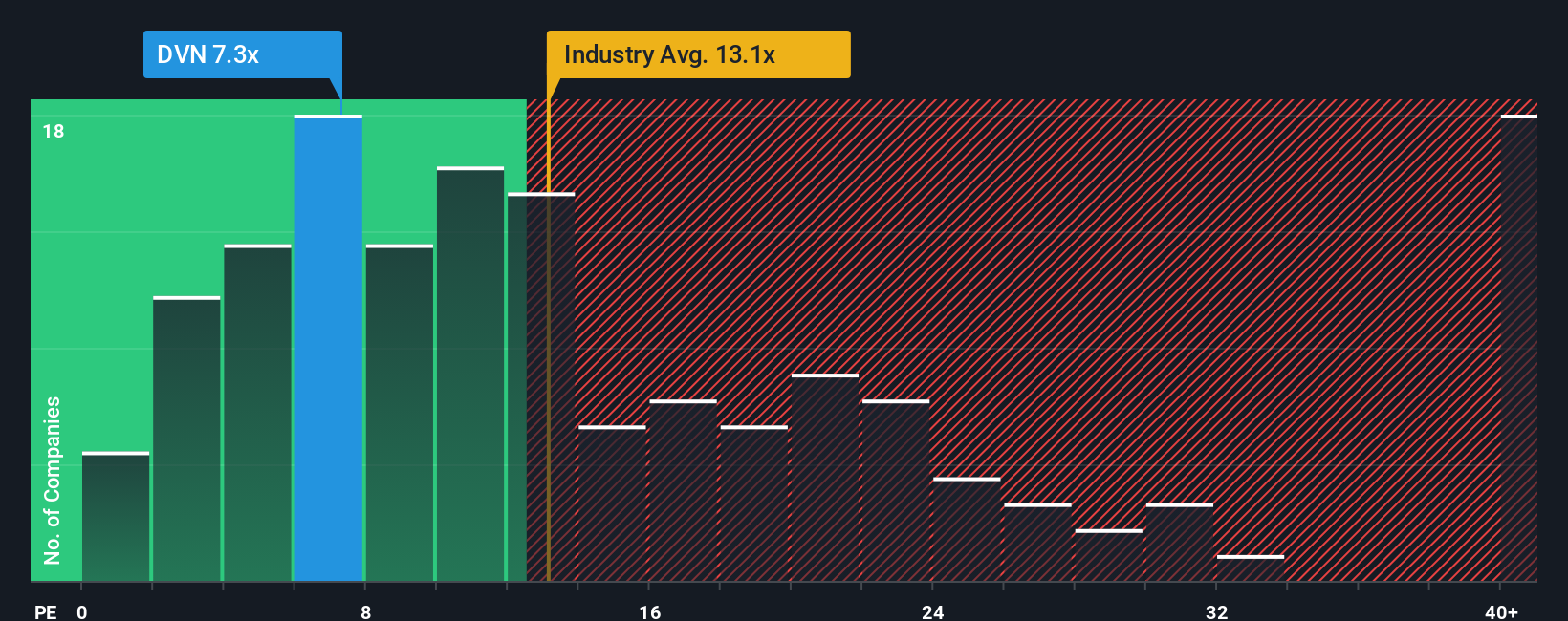

A company’s “normal” or “fair” PE ratio depends on several factors, including growth expectations and perceived risk. Higher expected earnings growth or lower risk typically justify a higher PE, while more modest growth or greater risk push it down. For Devon Energy, the current PE ratio is 7.2x. That is notably below both the industry average of 12.8x and the average of selected peers at 25.6x, signaling the market might be pricing in lower growth or higher risk relative to its sector.

Simply Wall St’s proprietary “Fair Ratio” takes these variables a step further. Unlike simple industry or peer comparisons, the Fair Ratio weighs factors such as Devon’s company-specific earnings growth, profit margins, industry outlook, market cap, and unique business risks. For Devon Energy, the Fair Ratio stands at 15.8x, considerably higher than its current PE multiple. This suggests the company is valued well below where you would expect, once all those key factors are accounted for.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Devon Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story or perspective about a company, tying together your own assumptions for its future, such as revenue, earnings, and margins, with a fair value estimate based on your expectations.

Narratives go beyond simple ratios and models, connecting the company’s unique story to a detailed financial forecast and, ultimately, to your view of what the stock should be worth. Using Simply Wall St’s platform, millions of investors contribute their Narratives within the Community page, making it accessible for anyone to see a wide range of perspectives.

This approach empowers you to decide when to buy or sell by directly comparing the fair value you believe in to the current share price. Narratives are dynamic and automatically update when new facts emerge, such as market news or earnings results, so your outlook always reflects the latest information.

For example, some Devon Energy investors build a bullish Narrative around AI-driven operational efficiency and export demand, justifying fair values as high as $70 per share. Others focus on sector risks and tighter margins, setting much lower fair values near $33. This is a powerful illustration of how diverse investor perspectives shape smarter decisions.

Do you think there's more to the story for Devon Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives