- United States

- /

- Oil and Gas

- /

- NYSE:DTM

DT Midstream (DTM): Margin Decline Challenges Bullish Narratives Despite Discount to Fair Value

Reviewed by Simply Wall St

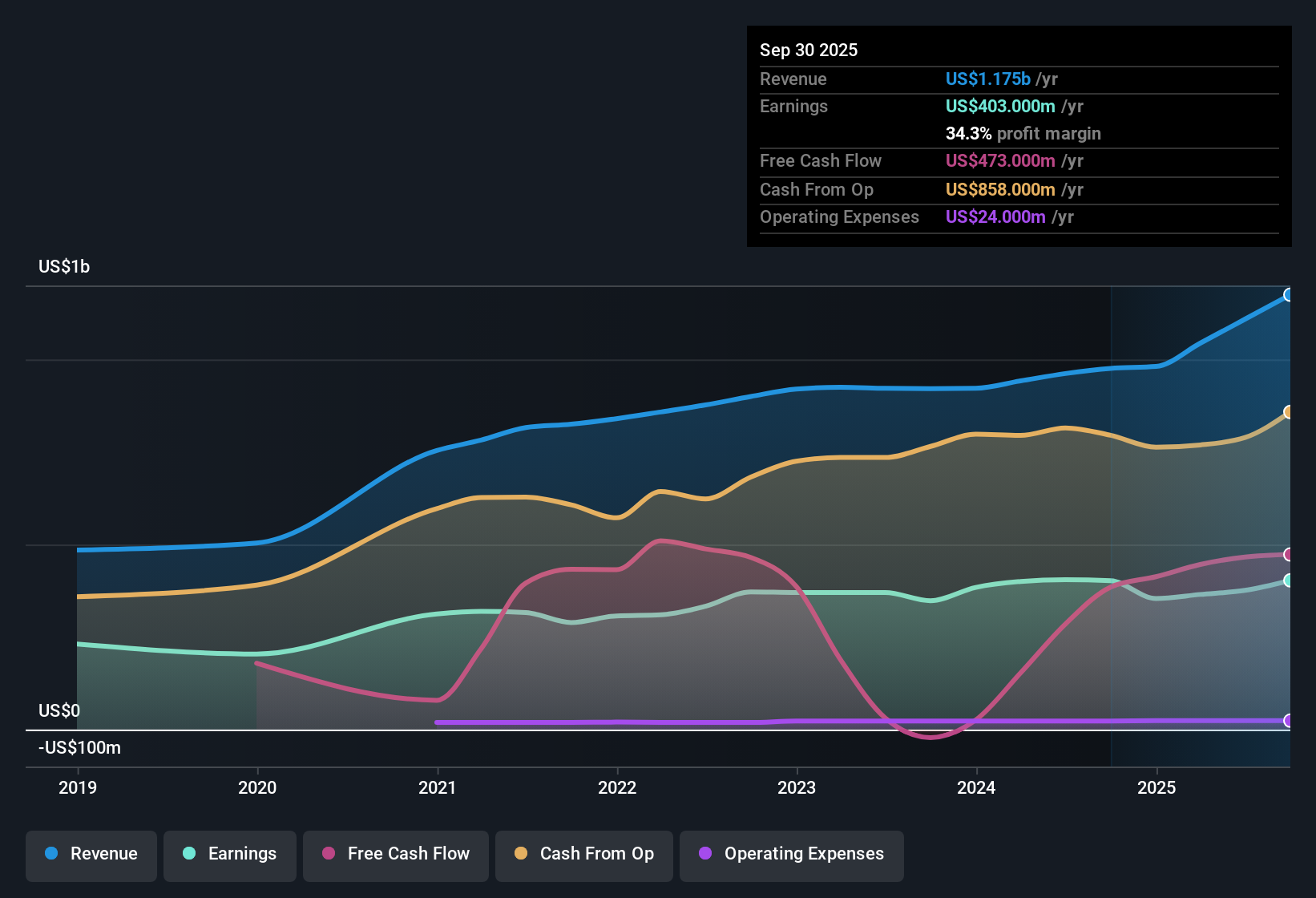

DT Midstream (DTM) posted annual earnings growth of 0.2%, lagging its five-year average rate of 5.6% per year. The company’s profit margin dropped to 34.3% from last year’s 41.2%, signaling a squeeze on profitability. Although forecasts call for earnings and revenue to climb 14.02% and 10% per year respectively, both rates trail the broader market’s averages. A higher-than-average price-to-earnings ratio might also give investors pause. Still, its reputation for high-quality past earnings and historical growth offer some optimism as value-focused investors weigh the softened outlook.

See our full analysis for DT Midstream.Next, we’ll see how these latest earnings stack up against the current narratives in the market, highlighting where consensus holds and where expectations might be in for a shakeup.

See what the community is saying about DT Midstream

Contract Coverage Shields Near-Term Margins

- Analysts forecast that profit margins will rebound from 33.9% today to 38.9% in three years, as almost all of DT Midstream’s revenue stems from long-term fee-based contracts with investment-grade utility customers.

- According to the analysts' consensus view, these durable agreements help insulate the company’s cash flows and margins.

- Strategic 20-year contracts such as the Guardian expansion anchor reduce earnings swings even as the company faces modernization spending.

- This stable outlook stands in contrast to other pipeline peers that are more exposed to short-term commodity volatility, supporting both confidence in multi-year dividend growth and resilience through industry change.

- To see more on how analysts are weighing stability and risk for DT Midstream, read the full consensus narrative. 📊 Read the full DT Midstream Consensus Narrative.

Pipeline Modernization Drives Growth, but Raises Cost Risks

- DT Midstream’s $600 million in new energy infrastructure projects contributes to an expected 12% annual revenue growth over the next three years, but comes with heavier capex and rising maintenance demands on its aging assets.

- Analysts' consensus view points out that while modernization and expansion programs should raise regulated rates and EBITDA over time,

- There is tension as a substantial portion of this capital spend may be required just to preserve current performance, potentially limiting upside if decarbonization or regional policy shifts diminish natural gas demand.

- Concentrated operations in the Midwest, Northeast, and Haynesville basins increase risk, as negative local changes could affect utilization and margins more than for diversified peers.

Valuation: Trading Below DCF Fair Value, Premium to Peers

- With a current share price of $109.49, DT Midstream trades at a 19.8% discount to its DCF fair value of $136.47, but commands a steep 27.6x price-to-earnings ratio, which is more than double the U.S. oil and gas sector average of 12.6x.

- Analysts' consensus narrative highlights that even as the DCF model suggests potential value if long-term forecasts are realized,

- The actual gap between the share price and the official analyst price target is just 5.4%, with the target set at $115.42, signaling that analysts see the stock as roughly fairly priced at current levels.

- This results in a push-and-pull effect: value models highlight possible upside for patient investors, while shorter-term market and peer comparisons point to full valuation and justify some degree of caution as premium multiples persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DT Midstream on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the latest figures? Share your perspective and build your own narrative in just a few minutes: Do it your way

A great starting point for your DT Midstream research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite robust contracts, DT Midstream’s profit margins and valuation multiples highlight concerns about long-term growth quality compared to sector peers.

If you want more dependable performance and less premium risk, consider companies in our stable growth stocks screener (2103 results) group, where steady earnings and revenue growth could deliver greater peace of mind for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTM

DT Midstream

Provides integrated natural gas services in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives