- United States

- /

- Oil and Gas

- /

- NYSE:DINO

HF Sinclair (DINO): Taking Stock of Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for HF Sinclair.

HF Sinclair’s 26% share price gain over the past three months is more than a short-term pop. This builds on strong momentum that has resulted in a 55% year-to-date jump. With a one-year total shareholder return of nearly 34%, the stock’s mix of long-term and recent strength is keeping investors interested, especially as the energy sector remains volatile and sentiment is quick to shift.

If this kind of momentum has you thinking bigger, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares surging in recent months, is HF Sinclair still trading below its true value or has the market already factored in all the expected growth? This could leave little room for more upside.

Most Popular Narrative: 6.2% Undervalued

With HF Sinclair's fair value pegged at $58.13 in the most widely watched narrative, and the last close at $54.54, the narrative points to modest upside potential. This could pique investor interest in the midst of rapid price gains.

Ongoing share repurchases and a commitment to capital returns, supported by a conservative balance sheet and robust cash flow generation, are likely to drive long-term EPS growth and shareholder value.

Curious about the narrative’s big bet? Behind this target is a bold projection for profits and margins, setting up numbers that may surprise even die-hard sector followers. Want to see exactly what growth levers the narrative leans on and which financial assumptions send fair value above today’s price? Dive in for the full story.

Result: Fair Value of $58.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering challenges in the renewables segment and unpredictable swings in global fuel demand could quickly dampen the current outlook for HF Sinclair.

Find out about the key risks to this HF Sinclair narrative.

Another View: Sizing Up Against Peers

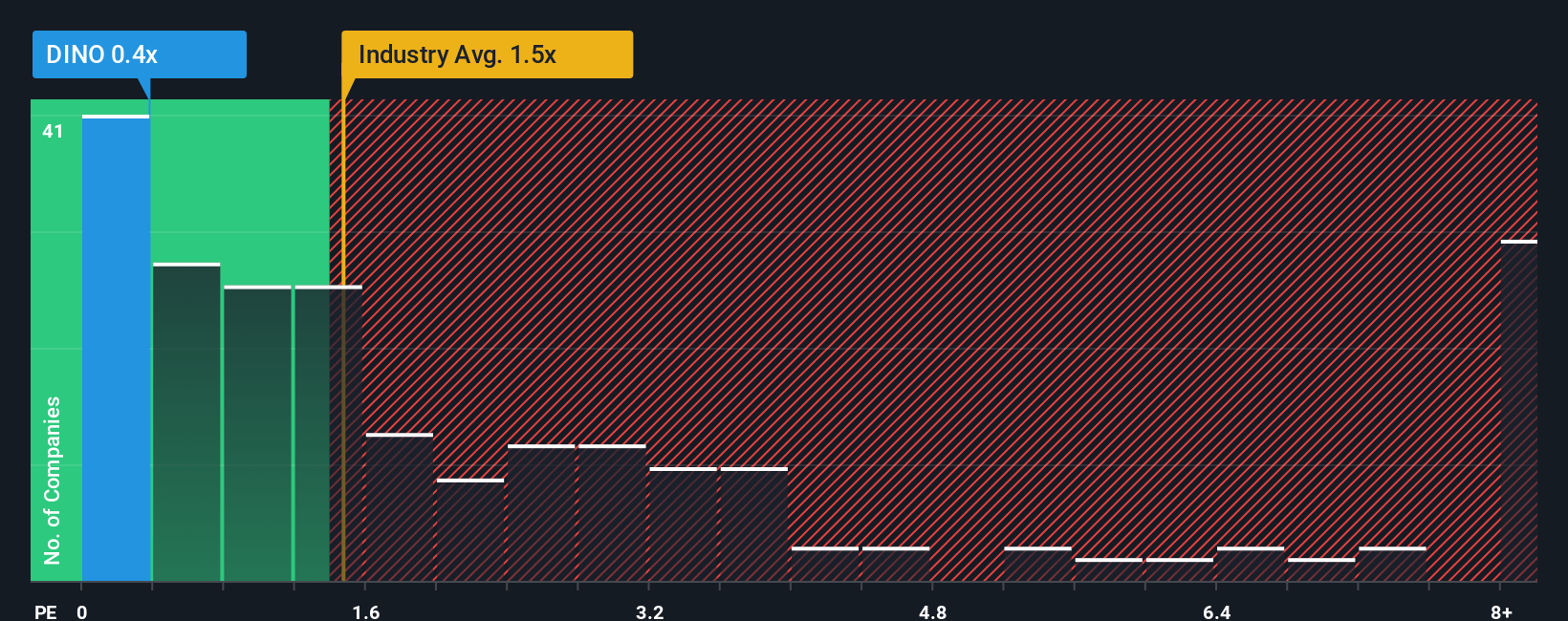

Looking at HF Sinclair's price-to-sales ratio, it matches its peers at 0.4x, but stands out as good value versus the US Oil and Gas industry average of 1.5x. Interestingly, the current ratio is still below what our fair ratio model suggests, which sits at 0.6x. This suggests there could be some room for the market to re-rate the shares, but the slim gap versus peers also raises the question of how much upside is left if industry sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HF Sinclair Narrative

If you see the numbers differently or want a hands-on look at the data, building your own HF Sinclair narrative takes just a few minutes. Do it your way

A great starting point for your HF Sinclair research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Make your next move count by tapping into new trends and powerful momentum. Explore these top investment opportunities and avoid missing out on the market's potential.

- Cash in on strong yield potential and see which companies are paying over 3% with these 17 dividend stocks with yields > 3%.

- Get ahead of the curve with companies making serious advancements in AI, starting with these 27 AI penny stocks.

- Unlock undervalued gems whose cash flows reveal quiet strength with these 881 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HF Sinclair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DINO

HF Sinclair

Operates as an independent energy company in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives