- United States

- /

- Oil and Gas

- /

- NYSE:DEC

Is Diversified Energy (NYSE:DEC) Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Simply Wall St

Diversified Energy (NYSE:DEC) shares saw a slight uptick today, drawing attention from investors curious about the underlying drivers. With notable swings over the past month, there is interest in understanding what is impacting the stock’s recent performance.

See our latest analysis for Diversified Energy.

Diversified Energy’s 13% share price return over the past month suggests some renewed optimism, even though momentum has been mixed this year, with the stock still down 15% year-to-date and total shareholder return nearly flat across twelve months. Long-term holders have seen significant declines, but the recent lift points to shifting sentiment, perhaps as expectations around value or risk start to change.

If you’re keeping an eye on market trends, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Diversified Energy is trading below its true value or if recent gains reflect the market already factoring in its future prospects. This raises the possibility of a window for buyers, or it may be that growth is already accounted for.

Price-to-Sales of 1x: Is it justified?

At $14.80 per share, Diversified Energy’s price-to-sales (P/S) ratio stands at 1x, far below the peer average of 18.6x. This could indicate a potential undervaluation when compared with similar companies in the sector.

The price-to-sales ratio compares a company’s stock price to its revenues, offering a quick snapshot of how much investors are willing to pay for each dollar of sales. For an energy company like Diversified Energy, this metric helps gauge whether the market is underpricing the company relative to its revenue, especially during periods when profitability might temporarily lag.

With a P/S ratio of 1x, Diversified Energy appears significantly less expensive than industry peers and its own estimated fair price-to-sales ratio of 1.4x. This suggests there may be a gap between current market sentiment and the level the market could reach if revenue growth or profitability trends improve.

Explore the SWS fair ratio for Diversified Energy

Result: Price-to-Sales of 1x (UNDERVALUED)

However, lingering concerns about recent net losses and inconsistent longer-term returns could reduce optimism and make a turnaround in sentiment more difficult.

Find out about the key risks to this Diversified Energy narrative.

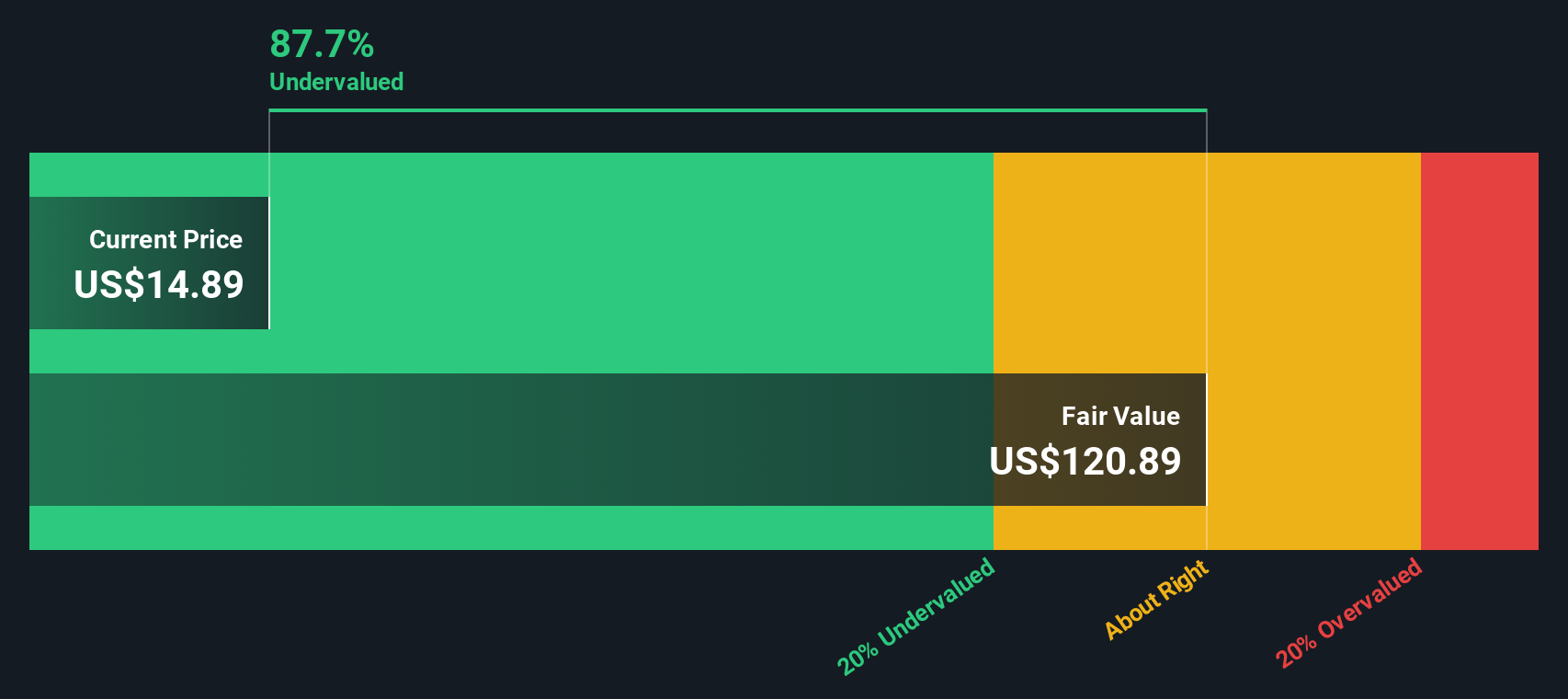

Another View: SWS DCF Model Suggests Strong Undervaluation

Looking at our DCF model for Diversified Energy presents an even starker picture. The SWS DCF model estimates a fair value of $120.25, which is significantly higher than the current market price of $14.80. This suggests the stock is trading at about 88% below its calculated intrinsic value.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diversified Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diversified Energy Narrative

If you have a different perspective or would rather dig into the figures independently, you can craft a personal take in just a few minutes, so Do it your way

A great starting point for your Diversified Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Now is the time to supercharge your investing strategy. Don't just stop at one stock when smarter opportunities are waiting to be found with a few clicks.

- Spot companies delivering high yields and boost your income potential with these 14 dividend stocks with yields > 3% offering strong dividend returns above 3%.

- Tap into tech innovation and see which firms are harnessing artificial intelligence by checking out these 26 AI penny stocks reshaping industries worldwide.

- Seize the chance to uncover market bargains and find these 922 undervalued stocks based on cash flows based on their robust cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEC

Diversified Energy

An independent energy company, focuses on the production, transportation, and marketing of natural gas and liquids primarily in the Appalachian and Central regions of the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success