- United States

- /

- Oil and Gas

- /

- NYSE:CVI

CVR Energy (CVI): Evaluating Valuation After Strong Q3 Profit Recovery and Upbeat Production Guidance

Reviewed by Simply Wall St

CVR Energy (CVI) just posted a strong turnaround in its third quarter results, moving back to profitability with much higher net income and improved operating metrics. Updated production guidance also points toward continued progress in the near term.

See our latest analysis for CVR Energy.

After swinging back to profitability and rolling out upbeat production guidance, CVR Energy’s momentum has really caught investor attention. Its one-year total shareholder return stands at an impressive 97%, while the share price has surged nearly 94% year-to-date. Recent moves, including a shelf registration filing, suggest the company is positioning for flexibility amid this run, and the strength in financial results has clearly driven fresh optimism about its long-term outlook.

If you’re looking for more compelling finds beyond energy, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Despite CVR Energy’s impressive rebound and guidance upgrades, its share price now sits well above analyst targets. This raises the key question for investors: is there still a buying opportunity here, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 31.7% Overvalued

With the most widely followed narrative placing fair value at $27.67, CVR Energy’s last close of $36.45 reflects a significant premium to analyst expectations. Below, you’ll find a key catalyst shaping this outlook.

Strong demand and strategic investments in renewables and fertilizer operations could significantly boost profitability and stabilize cash flows.

Want to understand why analysts expect a lofty valuation despite muted profit margins and slow top-line growth? There is a surprising leap in profitability built into these forecasts, plus assumptions about cash flow resilience rarely seen in traditional refiners. If you’re curious about the financial leaps required to reach this price, delve into the full narrative to see the numbers that fuel this bold stance.

Result: Fair Value of $27.67 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory pressures and recent operational setbacks could quickly challenge the renewed optimism reflected in CVR Energy’s current valuation.

Find out about the key risks to this CVR Energy narrative.

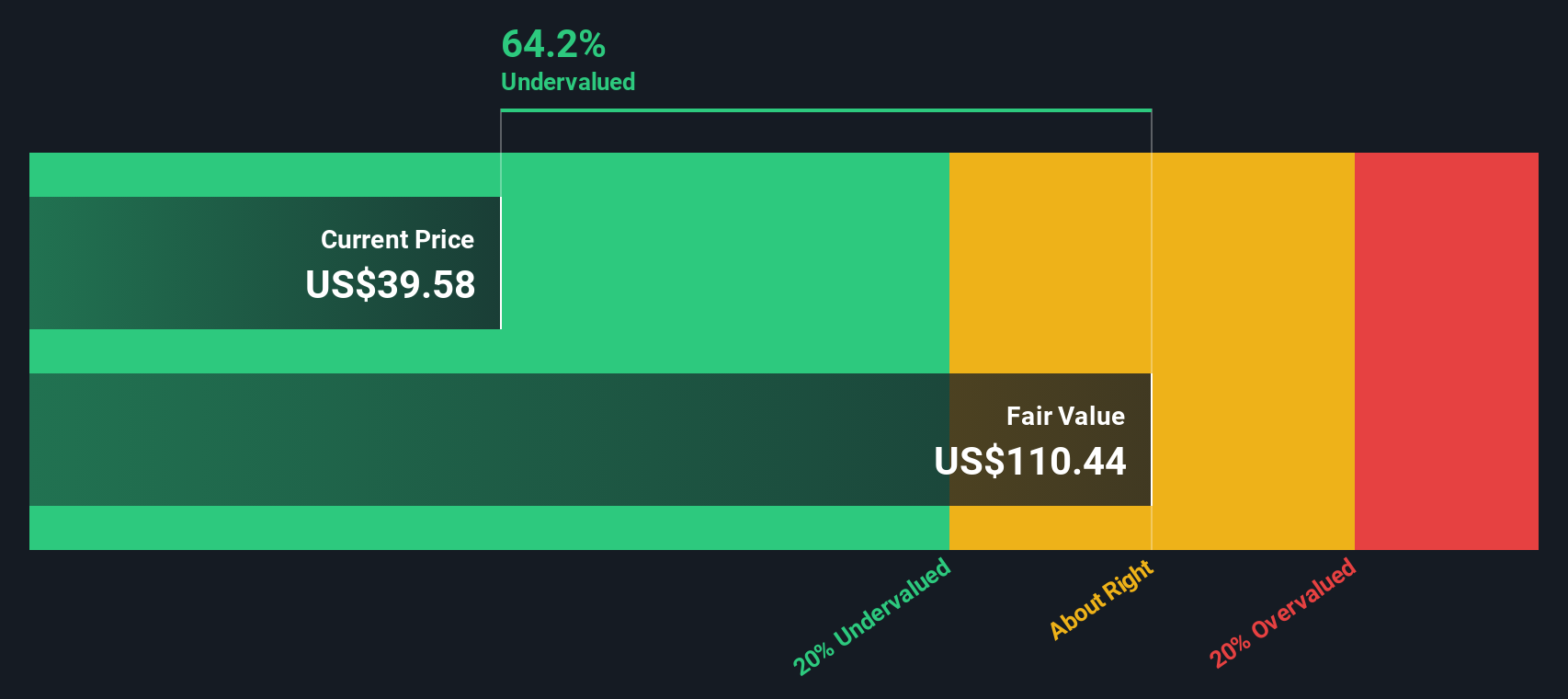

Another View: Our DCF Model Suggests Hidden Value

While analysts are wary of CVR Energy’s high share price, our SWS DCF model offers a different story. According to our DCF analysis, the stock is trading significantly below its fair value of $102.09. This suggests the market could be underestimating CVR Energy’s long-term cash flow potential, even though the current share price is higher than analyst targets. When two models paint very different pictures, which will turn out correct?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CVR Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CVR Energy Narrative

If you have a different take on CVR Energy’s outlook or want to analyze the data firsthand, you can easily craft your own perspective in just minutes. Do it your way

A great starting point for your CVR Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for what's popular when you could seize hidden opportunities? The right stock could be just a click away, and missing out may mean watching others get ahead while you wait.

- Spot undervalued gems primed for tomorrow’s growth by checking out these 878 undervalued stocks based on cash flows with strong cash flow potential and impressive fundamentals.

- Capture momentum from breakthrough innovation when you browse these 25 AI penny stocks that are driving advances in artificial intelligence and machine learning.

- Turn your focus to cash-generating opportunities with these 16 dividend stocks with yields > 3% featuring market-beating yields for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVI

CVR Energy

Engages in renewable fuels and petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

Solid track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives