- United States

- /

- Oil and Gas

- /

- NYSE:CVI

CVR Energy (CVI) Earnings Jump as Renewables Revert—Is Its Diversification Strategy at a Crossroads?

Reviewed by Sasha Jovanovic

- CVR Energy reported third quarter earnings in late October 2025, posting net income of US$374 million and US$1.94 billion in sales, both significantly higher than the prior year, while also filing a shelf registration for multiple securities types.

- A key operational move was the reversion of a renewable diesel unit back to hydrocarbon processing due to unfavorable economics, alongside higher fertilizer segment income driven by increased ammonia and UAN prices.

- We'll examine how CVR Energy's earnings turnaround and shift in renewables strategy impacts its investment narrative and outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CVR Energy Investment Narrative Recap

To be a CVR Energy shareholder, you need to believe in the company's ability to deliver consistent profitability from its core refining and fertilizer operations, even as regulatory and cost headwinds remain significant. The third quarter earnings turnaround is an encouraging signal, but it does not materially change the most important short-term catalyst, increased throughput from stable refinery operations, or the ongoing risk tied to regulatory compliance costs and renewable fuel economics.

Among the most relevant recent announcements is the company’s decision to revert its renewable diesel unit back to hydrocarbon processing, after citing unfavorable economics in the renewables segment. This move highlights how sensitive the company remains to fluctuations in regulatory incentives and market support for alternative fuels, directly affecting margin recovery and near-term catalysts for earnings growth.

Yet, investors should be aware that while improved financial results grab headlines, the persistent risk surrounding regulatory changes and RIN prices means...

Read the full narrative on CVR Energy (it's free!)

CVR Energy's narrative projects $8.1 billion revenue and $101.0 million earnings by 2028. This requires 4.0% yearly revenue growth and a $434.0 million increase in earnings from -$333.0 million.

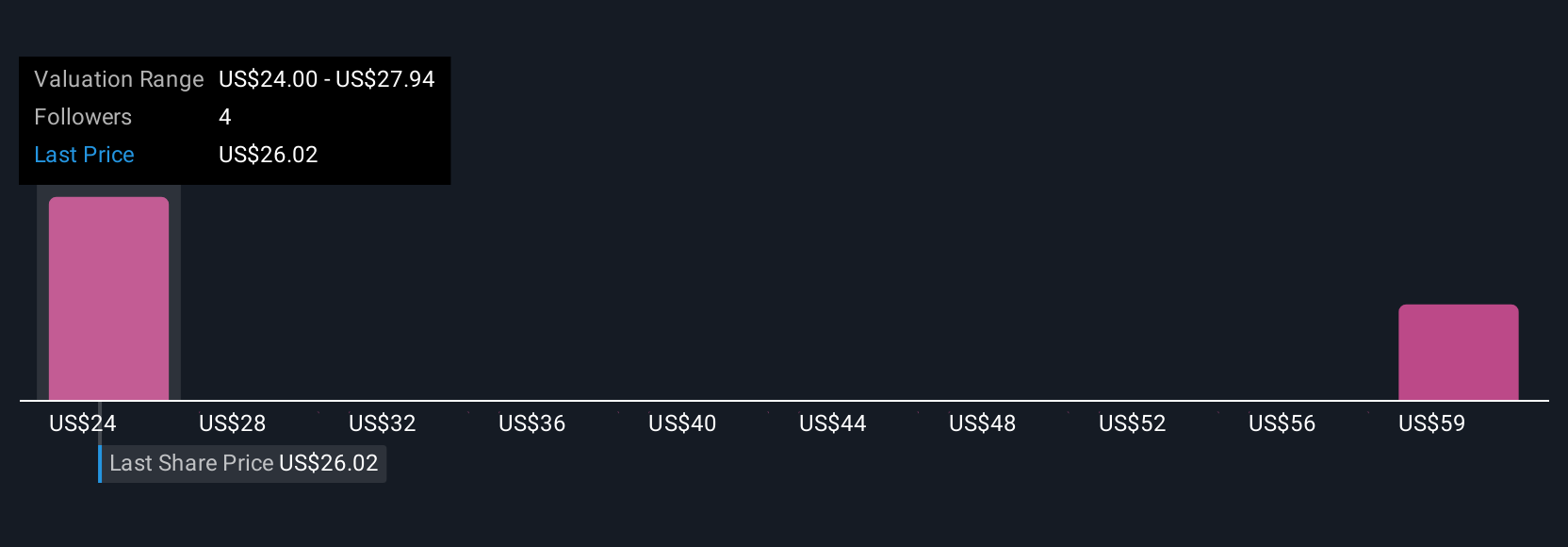

Uncover how CVR Energy's forecasts yield a $27.83 fair value, a 22% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely, from US$27.83 to US$90.57, based on two independent perspectives. While the recent renewables segment reversion casts attention on regulatory and compliance risks, outcomes for CVR Energy can vary greatly depending on how these external factors play out.

Explore 2 other fair value estimates on CVR Energy - why the stock might be worth over 2x more than the current price!

Build Your Own CVR Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CVR Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVI

CVR Energy

Engages in renewable fuels and petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

Solid track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives