- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Is Comstock Resources Stock’s 20% Weekly Surge Backed by Fundamentals in 2025?

Reviewed by Bailey Pemberton

- Curious whether Comstock Resources stock is a hidden value or just riding recent hype? Let’s break down what’s going on beneath the surface.

- The shares have surged 20.7% in the past week and are up an impressive 64.0% over the last year. This hints at either renewed growth prospects or a shift in how investors view the company’s risk and potential rewards.

- Behind these sharp moves, the energy sector has seen increased volatility as shifting commodity prices and renewed investor attention drive sentiment. At the same time, positive news about improvements in drilling efficiency and expanded asset development in key regions like Haynesville Shale have added fresh context to Comstock’s run.

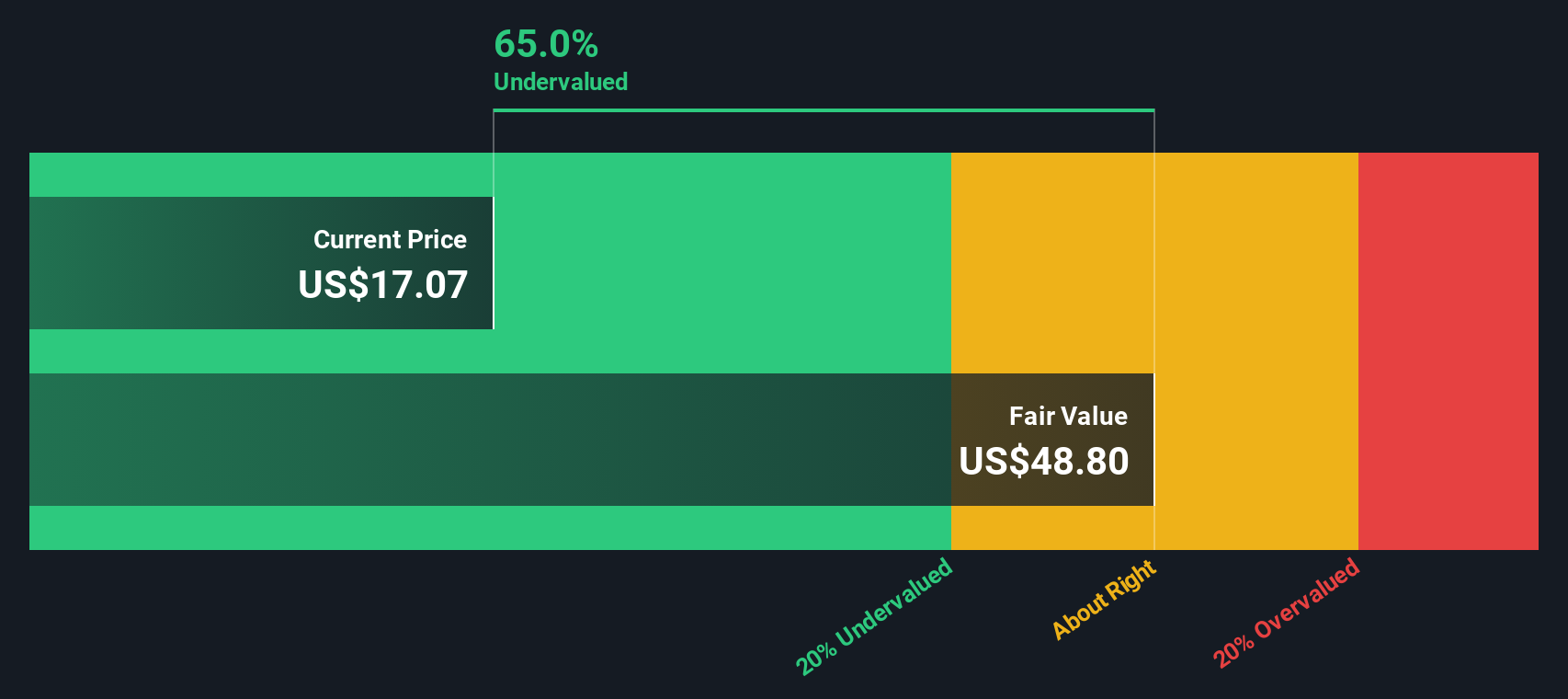

- But when it comes to fundamentals, Comstock Resources’ valuation score is 0 out of 6, meaning it isn’t currently undervalued by traditional checks. Next, we’ll look at exactly how those valuation frameworks work, as well as a possible better way to understand whether the stock’s price really matches up with its prospects.

Comstock Resources scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Comstock Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation model projects a company’s future cash flows and discounts them back to today’s value to estimate what the business is really worth right now. This approach aims to answer whether the current share price is justified by realistic future earnings.

Comstock Resources’ latest reported Free Cash Flow (FCF) was -$319.6 million. Analysts provide forecasts out to 2028, estimating a swing from negative FCF to $191 million by that year. Beyond 2028, projections are extrapolated, with estimates rising to approximately $274.5 million in 2035. All of these figures are shown in US dollars and are based on anticipated reinvestment, growth in drilling, and commodity price shifts. Notably, FCF is expected to grow steadily after breaking even.

Using this two-stage Free Cash Flow to Equity approach, the DCF model produces an intrinsic value of $17.29 per share. Compared to the current share price, the stock appears 22.3% overvalued according to this method. While future cash flow growth is encouraging, today’s price may be factoring in more optimism than fundamentals support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Comstock Resources may be overvalued by 22.3%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

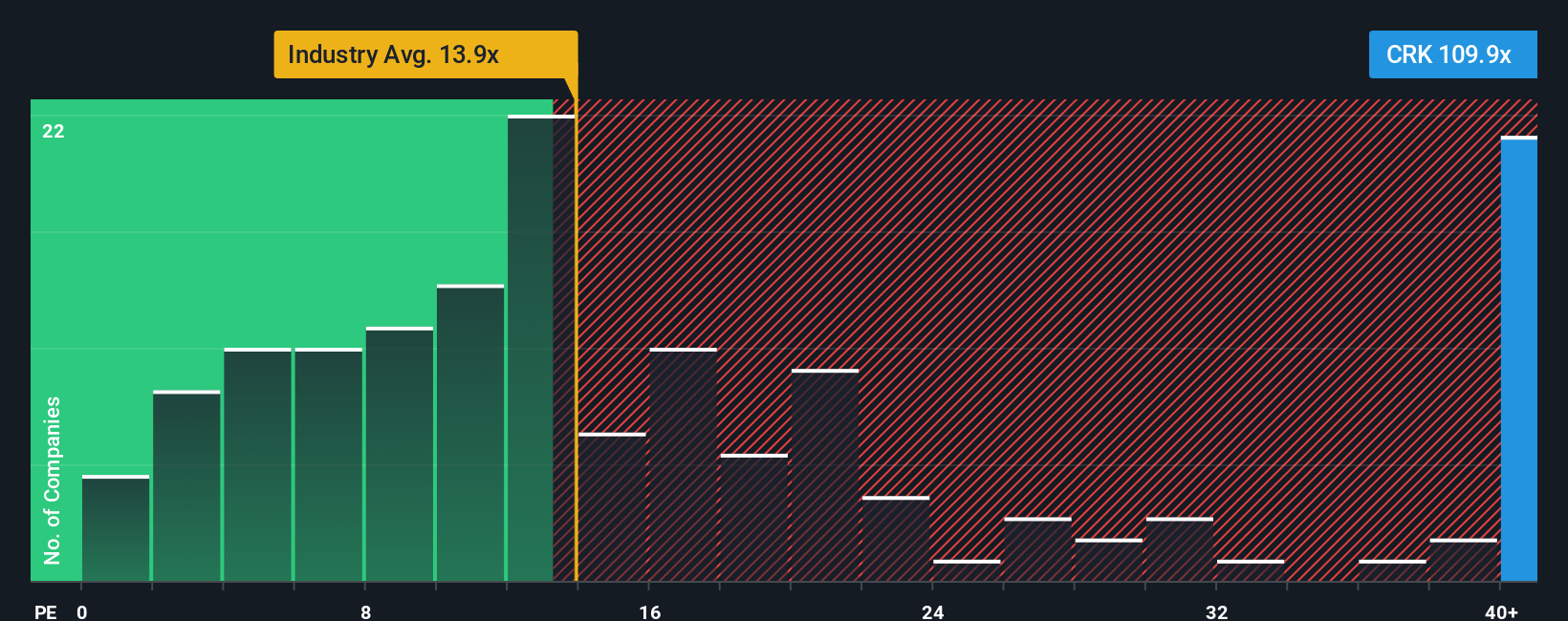

Approach 2: Comstock Resources Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely recognized as a go-to valuation tool for profitable businesses because it directly measures how much investors are willing to pay for each dollar of earnings. When a company is sustainably profitable, the PE ratio offers clear insight into whether its stock price is grounded in current realities or inflated by optimism.

Typical PE ratios are shaped by growth expectations and risk. Companies with strong projected earnings growth or lower business risk usually trade at higher PE ratios, while those facing uncertainty or slowdowns see lower multiples. Therefore, the PE ratio should be compared with what is considered “normal” given these unique factors for each company and its industry.

Currently, Comstock Resources trades at a lofty PE ratio of 91.8x. This is well above the Oil and Gas industry average of 12.8x and the peer group average of 15.0x. However, context matters. Simply Wall St calculates a Fair Ratio for Comstock Resources of 31.6x. This Fair Ratio incorporates not only industry and peer benchmarks, but also Comstock’s specific earnings trajectory, profit margins, market size, and particular risks. It is a more tailored yardstick than simply comparing general industry numbers.

With a current PE nearly triple the Fair Ratio, Comstock Resources appears valued at a significant premium, suggesting high expectations are incorporated into the current price.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

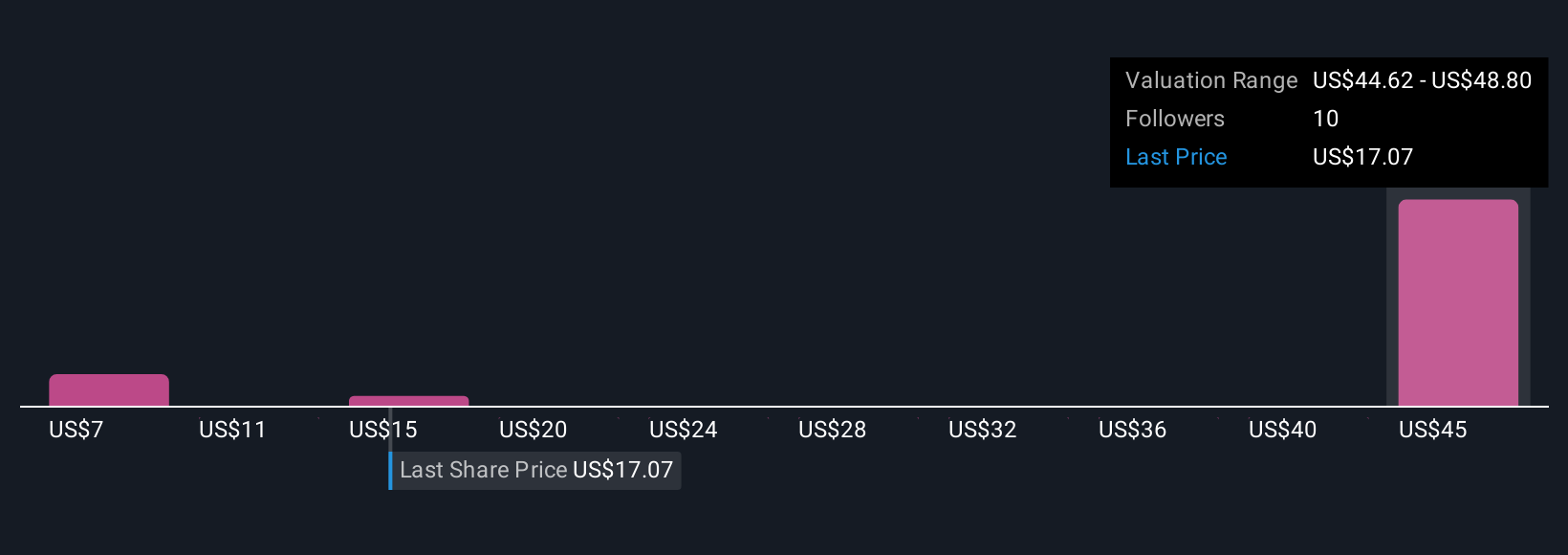

Upgrade Your Decision Making: Choose your Comstock Resources Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, data-driven storyline about a company: it combines your view of Comstock Resources’ future prospects with your own assumptions for revenue, earnings, and fair value, helping you make sense of headlines and numbers alike.

Narratives work by connecting the dots between why you believe the business will perform a certain way, how that story translates into a financial forecast, and what you think the fair share price should be. This makes the investment decision process much more transparent and relevant to you.

Available to everyone on Simply Wall St’s Community page (used by millions of investors), Narratives make it straightforward to track and update your view, and are automatically refreshed as new news or earnings come in.

This means you can compare your own view of fair value against the current price to decide when to buy or sell, empowering you to act on conviction, not just consensus.

For example, some Comstock Resources Narratives see the share worth as high as $32.00 with bullish growth in Haynesville, while others see it as low as $10.00, highlighting how real investors use different forecasts and reasoning to set their price targets.

Do you think there's more to the story for Comstock Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives