- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Why Crescent Energy (CRGY) Is Up 5.1% After Strong Q3 Results and Reduced Net Loss

Reviewed by Sasha Jovanovic

- Crescent Energy reported its third quarter and nine-month earnings for the period ended September 30, 2025, with quarterly revenue of US$866.58 million and a reduced net loss compared to the year prior.

- An important insight is the significant improvement in year-to-date net income and earnings per share, reflecting stronger ongoing business performance for Crescent Energy.

- With Crescent Energy's substantial year-to-date earnings growth, we'll explore the implications for its long-term investment narrative and outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Crescent Energy Investment Narrative Recap

For investors to maintain confidence in Crescent Energy, belief in the company’s ability to sustain and grow earnings through capital efficiency and operational improvements is essential, especially amid a business model that leans heavily on acquisitions. The latest quarterly update shows improving bottom-line metrics but does not materially alter the current short-term catalyst, capital discipline driving cash flow and shareholder returns. The most significant risk remains Crescent’s exposure to integration issues and potential underperformance from past and future acquisitions.

Of the recent company announcements, October’s borrowing base redetermination stands out in relation to the earnings event. Crescent’s expanded credit facility and extended maturity enhance liquidity, providing support for both ongoing operations and potential acquisitions, yet they also amplify the importance of deploying capital successfully as the company pursues accretive deals.

However, investors should be aware that despite these financial updates, challenges around asset integration and managing elevated interest expenses...

Read the full narrative on Crescent Energy (it's free!)

Crescent Energy's outlook anticipates $5.2 billion in revenue and $672.6 million in earnings by 2028. This scenario assumes 14.8% annual revenue growth and an earnings increase of $649.5 million from current earnings of $23.1 million.

Uncover how Crescent Energy's forecasts yield a $14.78 fair value, a 67% upside to its current price.

Exploring Other Perspectives

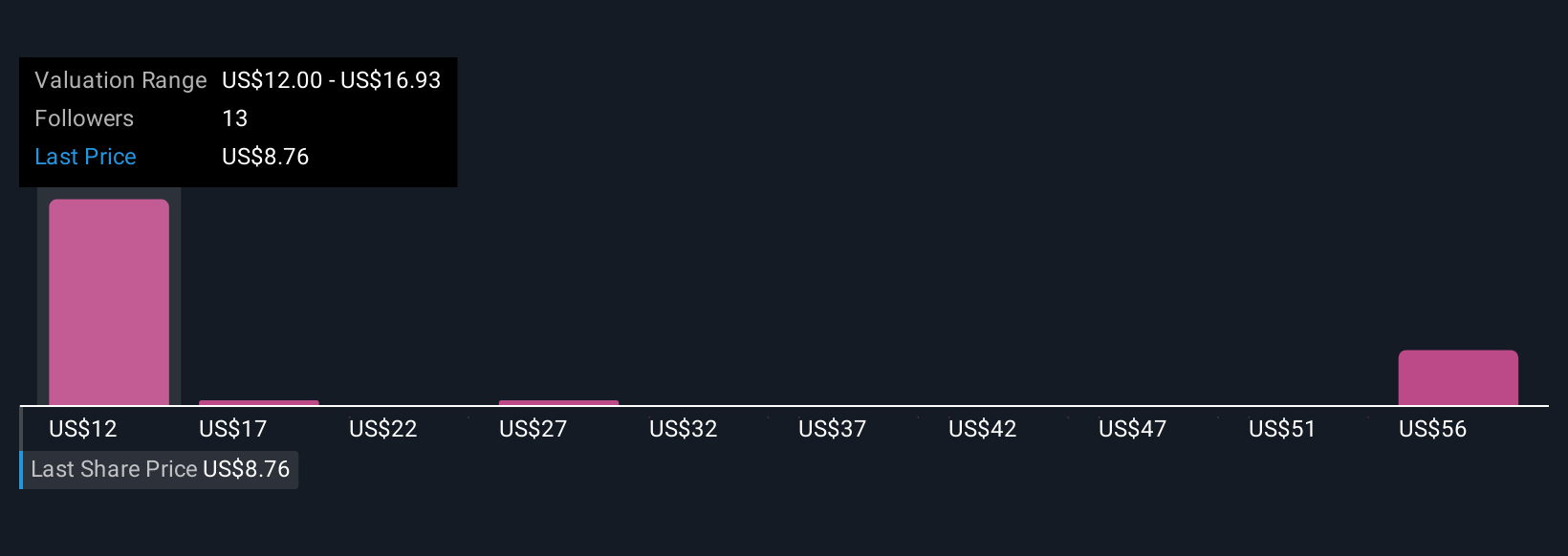

Five members of the Simply Wall St Community assessed Crescent Energy’s fair value estimates ranging from US$12 to US$59.63, highlighting broad divergence in expectations. With operational improvements spotlighted in recent results, consider the varying market views as you explore what may shape Crescent’s next phase.

Explore 5 other fair value estimates on Crescent Energy - why the stock might be worth just $12.00!

Build Your Own Crescent Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crescent Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crescent Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crescent Energy's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives