- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Crescent Energy (CRGY): Evaluating Valuation After Strong Q3 and 2025 YTD Results Drive Earnings Growth

Reviewed by Simply Wall St

Crescent Energy (CRGY) announced its third quarter and year-to-date results, showing solid revenue growth and an improved earnings profile. Investors are taking note of the company’s narrowing losses and a jump in year-to-date net income.

See our latest analysis for Crescent Energy.

After a tough start to the year, Crescent Energy’s share price has shown some encouraging short-term momentum, notching a nearly 10% gain over the past month and surging more than 4% in just a day. Even so, the year-to-date share price return is still firmly in the red, while the 1-year total shareholder return sits at -32%. This highlights the uphill climb ahead, but signs of recovery are emerging as operational improvements get noticed.

If seeing Crescent’s recent rebound has you curious about what else could be gaining steam, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and recent operational gains boosting annual net income, investors may question whether Crescent Energy is now flying under the market’s radar or if the current price already factors in future growth.

Most Popular Narrative: 40% Undervalued

Crescent Energy’s last close of $8.86 sits well below the most widely followed narrative’s fair value estimate, creating a sizable gap that is fueling bullish attention. This contrast spotlights major catalysts and bold forecasts baked into the consensus, shifting focus to the company’s growth engine and operational leverage.

Persistent growth in global energy demand, alongside heightened energy security concerns among major economies, is likely to support stable or higher commodity prices and underpin ongoing demand for Crescent Energy's oil and gas production, providing a tailwind to future revenue and cash flow.

Want to decode what’s driving this valuation? Analysts are betting on powerful operating improvements and aggressive profit expansion to rewrite Crescent’s financial trajectory. One key growth forecast is hiding just behind these numbers. Discover what assumptions could fuel the next price surge.

Result: Fair Value of $14.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on acquisitions and exposure to sector volatility could challenge Crescent Energy's growth outlook if integration falters or if market cycles turn.

Find out about the key risks to this Crescent Energy narrative.

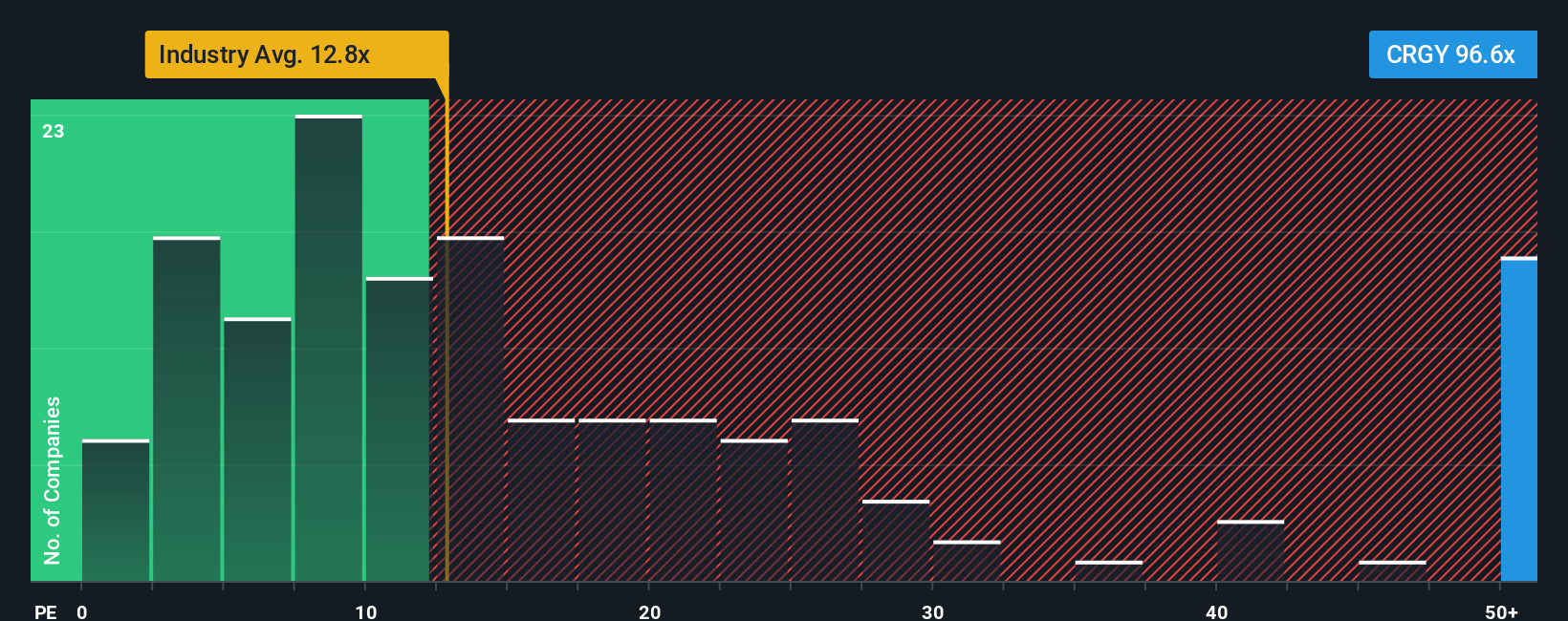

Another View: Market Multiples Perspective

While the analyst consensus suggests Crescent Energy is undervalued, a glance at its price-to-earnings ratio tells a different story. The company's ratio is currently 95.9x, which is not only much higher than the US Oil and Gas industry average of 13.5x, but also far above its peer group at 7.8x and the fair ratio estimate of 27.1x. This sharp gap raises real questions about whether near-term growth might already be priced in or if the stock’s premium is justified by future performance.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crescent Energy Narrative

If you think there's another angle to the story or want to dig into the numbers yourself, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Crescent Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Standout Opportunities?

Why limit yourself when you can tap into unique ideas rising across the market? These hand-picked strategies could help you spot tomorrow’s potential winners before everyone else.

- Uncover growth stories with real staying power by sizing up these 876 undervalued stocks based on cash flows that look overlooked by the broader market.

- Seize the advantage by spotting passive income powerhouses among these 16 dividend stocks with yields > 3% with robust yields and proven financial histories.

- Gain a futuristic edge and ride innovation waves by targeting these 25 AI penny stocks at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives