- United States

- /

- Oil and Gas

- /

- NYSE:CQP

Will Cheniere Energy Partners’ (CQP) Reaffirmed Distributions Offset Weaker Net Income in 2025?

Reviewed by Sasha Jovanovic

- Cheniere Energy Partners, L.P. recently reported its third quarter 2025 results, showing revenue of US$2.40 billion, an increase from last year, while net income declined to US$506 million, and reaffirmed full year distribution guidance of US$3.25 to US$3.35 per common unit.

- Management also declared a new quarterly cash distribution and maintained a base distribution of US$3.10 per common unit, underscoring the company's capital returns focus despite changes in profitability.

- We'll explore how Cheniere's reaffirmed distribution guidance shapes its investment narrative in the face of shifting net income trends.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Cheniere Energy Partners' Investment Narrative?

For those considering Cheniere Energy Partners, being a shareholder typically means a focus on regular income and the stability of contracted LNG sales, despite industry volatility. The company's reaffirmed full-year distribution guidance following the latest quarterly results keeps the spotlight on its ability to sustain payouts, even as net income continues to slip year-over-year. This updated angle could support short-term confidence in capital returns, but fundamental risks, like high leverage and net profit margin pressure, remain in play. The recent news doesn't signal a material shift in the near-term catalysts or risks; instead, it confirms management's commitment to distributions amid a backdrop of slowing earnings and revenue growth that trails both peers and the broader market. That steadiness might comfort some investors, but others may see it as a warning sign if profits continue to erode. On the other hand, a high level of debt remains a risk worth closer attention.

Cheniere Energy Partners' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

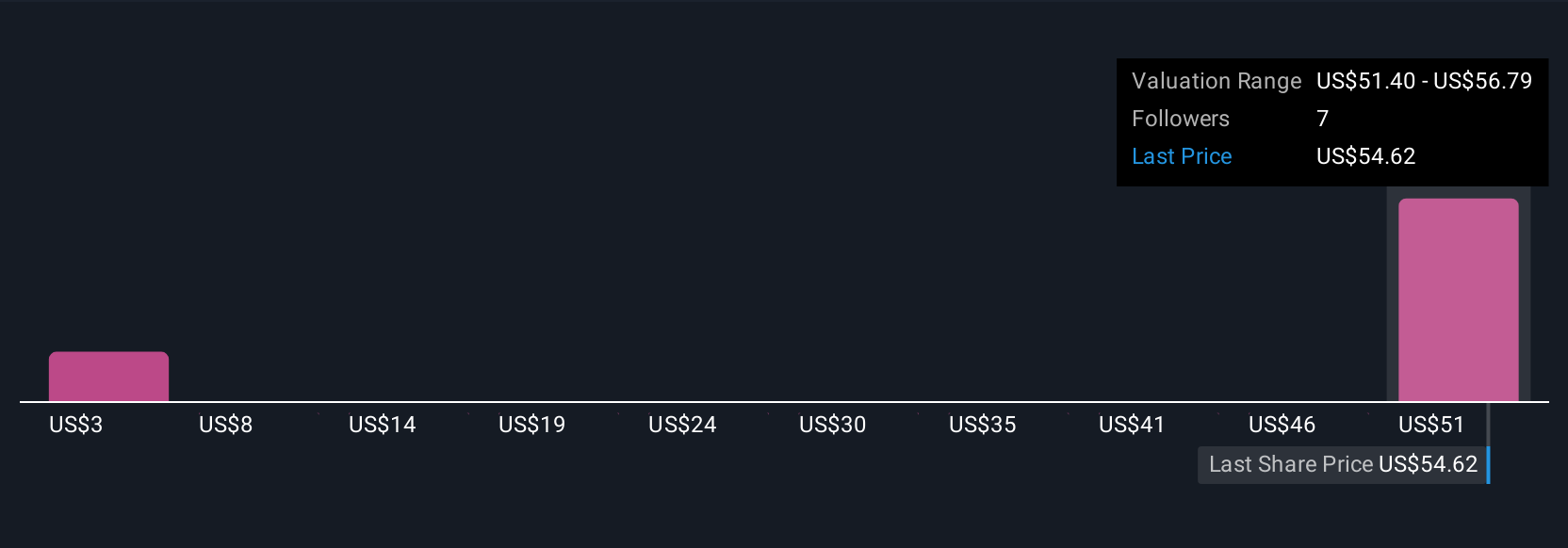

Explore 2 other fair value estimates on Cheniere Energy Partners - why the stock might be worth just $50.53!

Build Your Own Cheniere Energy Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy Partners' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CQP

Cheniere Energy Partners

Through its subsidiaries, provides liquefied natural gas (LNG) to integrated energy companies, utilities, and energy trading companies in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives