- United States

- /

- Oil and Gas

- /

- NYSE:CNX

The Bull Case For CNX Resources (CNX) Could Change Following Executive Shake-Up and Updated Production Outlook

Reviewed by Sasha Jovanovic

- CNX Resources recently announced executive changes, with Everett Good set to become Chief Financial Officer and Alan Shepard moving into the roles of President, CEO, and board member effective January 1, 2026.

- This leadership transition comes alongside strong third-quarter results and increased production guidance, highlighting both continuity in financial leadership and operational momentum for the company.

- We'll examine how the upcoming management transition and operational performance updates may reshape CNX Resources' investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

CNX Resources Investment Narrative Recap

For shareholders, the core investment thesis in CNX Resources centers on its ability to drive earnings through operational efficiency, capitalize on regulatory tailwinds, and responsibly manage free cash flow in a volatile natural gas market. The recently announced executive transition, with Everett Good set to become CFO and Alan Shepard moving to CEO, supports leadership continuity and is not expected to materially impact short-term catalysts like realization of tax credits or near-term production gains. The principal risk remains around regulatory uncertainty affecting environmental tax credit eligibility and related revenues.

Among recent company updates, the upward revision of 2025 production guidance to 620–625 Bcfe stands out. This change ties directly into short-term catalysts: it reflects production momentum and, if realized, could support stronger revenue and free cash flow, which are integral for CNX’s core narrative of earnings growth amid capital discipline. Yet even with these positive signals, it’s essential to consider how regulatory decisions around tax credits could ultimately sway results for investors...

Read the full narrative on CNX Resources (it's free!)

CNX Resources' outlook anticipates $2.3 billion in revenue and $859.1 million in earnings by 2028. This is based on an annual revenue growth rate of 8.9% and a substantial earnings increase of $703.4 million from current earnings of $155.7 million.

Uncover how CNX Resources' forecasts yield a $32.21 fair value, a 8% downside to its current price.

Exploring Other Perspectives

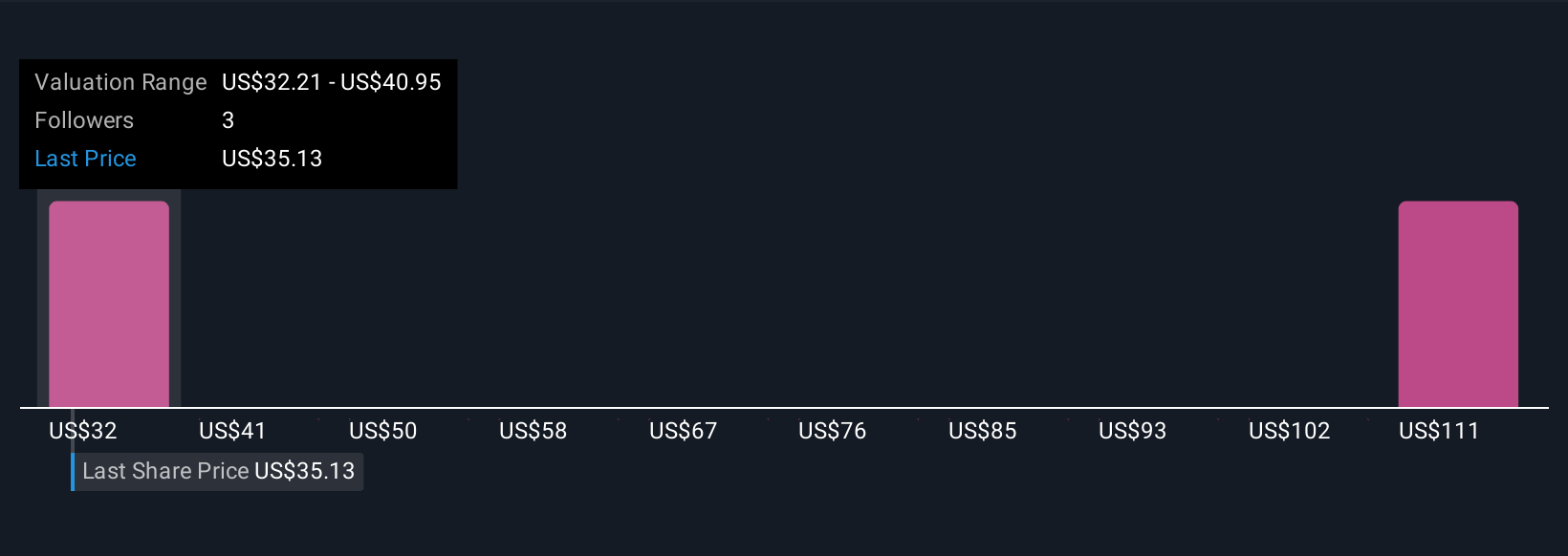

Simply Wall St Community members have posted fair value estimates for CNX Resources ranging from US$32.21 to US$118.71 based on two perspectives. As you look at these differing views, remember that regulatory shifts around environmental tax credits could weigh heavily on future profitability, so consider how such factors may shape your outlook on CNX.

Explore 2 other fair value estimates on CNX Resources - why the stock might be worth 8% less than the current price!

Build Your Own CNX Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CNX Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNX Resources' overall financial health at a glance.

No Opportunity In CNX Resources?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives