- United States

- /

- Oil and Gas

- /

- NYSE:BTU

Peabody Energy (BTU): How Weaker Q3 Results May Influence Its Current Valuation

Reviewed by Simply Wall St

Peabody Energy (BTU) grabbed investor attention after posting its third quarter earnings. The report revealed a swing from profit to net loss and lower sales compared to the prior year. The company also announced its regular quarterly dividend.

See our latest analysis for Peabody Energy.

Peabody Energy’s share price has rebounded sharply in recent weeks despite the earnings miss, climbing 14.9% over the past 7 days and up 72.1% for the last 90 days, even as ongoing operational challenges weighed on reported results. Over the past year, the company’s total shareholder return is just under 4%, while its five-year total return remains a standout at over 3,000%. While momentum appears to be returning, long-term performance tells a more volatile story.

If strong momentum shifts catch your interest, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying hard even as financial results dip, investors are left wondering if Peabody Energy is trading at a discount after recent setbacks or if the market has already factored in expectations of a turnaround.

Most Popular Narrative: 12.5% Undervalued

Peabody Energy’s most popular narrative places its fair value at $33.95, which stands noticeably above the company’s last close at $29.72. This valuation gap sets the stage for a critical look at the assumptions driving the estimate.

Execution of accelerated ramp-up at the Centurion premium hard coking coal mine and continued portfolio optimization toward higher-margin metallurgical coal are poised to increase Peabody’s exposure to infrastructure and steel production-driven demand, mainly in Asia-Pacific, supporting future topline growth and higher operating margins.

What drives this bold target? The narrative centers on a major profit turnaround, margin expansion, and a future valuation usually reserved for the sector’s most efficient operators. The key factors include anticipated financial transformation and an aggressive growth plan. Explore the projections and industry shifts that justify this premium price.

Result: Fair Value of $33.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant regulatory changes or a rapid acceleration in renewables adoption could undermine Peabody's outlook and challenge the current undervalued narrative.

Find out about the key risks to this Peabody Energy narrative.

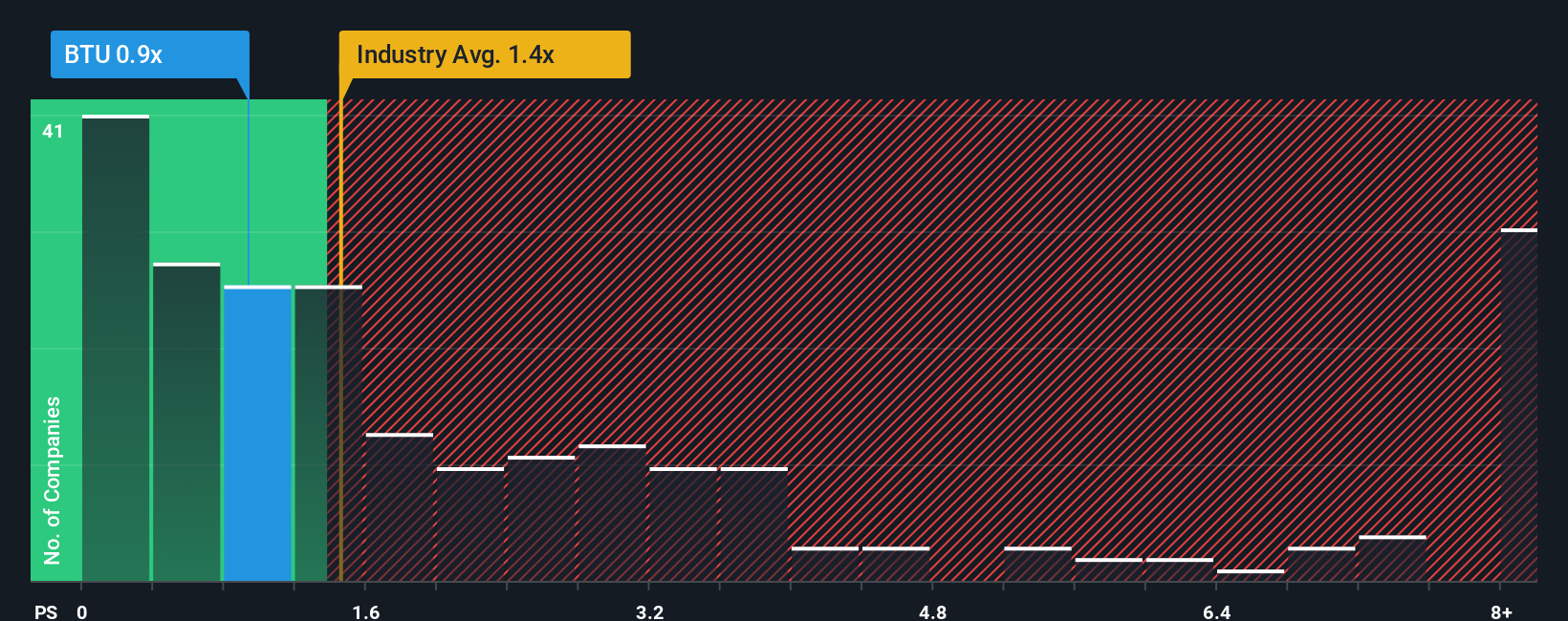

Another View: Putting Multiples in Perspective

Some investors might look past narrative-driven fair value and turn to a simple sales ratio. Peabody Energy trades at a price-to-sales ratio of 0.9x, which is lower than the US Oil and Gas industry average of 1.4x and well below the peer average of 5.1x. This could potentially signal a value opportunity. However, the current ratio is slightly higher than the fair ratio of 0.7x. Could there be hidden risks, or is this a bargain that the market is overlooking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peabody Energy Narrative

For investors who like to dig into the details or prefer to draw their own conclusions, the tools are available to piece together your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Peabody Energy.

Looking for More Smart Investment Ideas?

Don’t let opportunities slip away while others catch the next big trend. With just a few minutes, you can uncover stocks uniquely positioned to outperform using these powerful tools:

- Unlock high-yield potential by assessing these 17 dividend stocks with yields > 3% offering strong, consistent returns above 3%.

- Fuel your portfolio’s growth by spotting market disruptors with these 25 AI penny stocks that drive innovation across artificial intelligence.

- Get ahead of the crowd by evaluating these 861 undervalued stocks based on cash flows to identify stocks priced below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BTU

Good value with adequate balance sheet.

Market Insights

Community Narratives