- United States

- /

- Oil and Gas

- /

- NYSE:BTU

Peabody Energy (BTU): Examining Valuation as Shares Gain Momentum in the Coal Sector

Reviewed by Simply Wall St

Peabody Energy (BTU) has recently seen movement in its stock price, prompting investors to reassess the company’s position in the coal sector. Shares changed hands near $27, with modest shifts over the month and a stronger performance in the past 3 months.

See our latest analysis for Peabody Energy.

This recent upswing in Peabody Energy’s share price highlights building momentum in the coal sector, with a standout 67% share price return in the last three months and robust total shareholder return of over 11% for the year. The numbers suggest investors are revisiting the company's growth prospects and rethinking its risk profile in the current market backdrop.

If you’re curious about what else is gaining traction beyond traditional sectors, now is the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

With shares up sharply in recent months and analyst targets still a step ahead, is Peabody Energy currently trading at an attractive discount, or is the market already factoring in all its potential for future growth?

Most Popular Narrative: 16.8% Undervalued

With Peabody Energy’s fair value set at $32.45, the latest closing price of $27 underscores a gap that has analysts watching closely for catalysts supporting further upside. This difference highlights shifting expectations around the company’s trajectory in a volatile energy market.

Structural U.S. policy tailwinds, including recently passed legislation that reduces coal royalty rates, streamlines permitting, and adds tax credits for domestic metallurgical coal, are lowering Peabody's cost base, improving regulatory certainty, and enhancing long-term competitiveness. These changes boost expected net margins and free cash flow, especially in the Powder River Basin and Shoal Creek segments.

Want to know which surprising factors analysts believe will spark a sustained rerating? Their forecast draws on aggressive profit expansion and a discounted future multiple. Discover the full narrative to find out the bold numbers shaping this valuation.

Result: Fair Value of $32.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a policy reversal or a global pivot to renewables could quickly dampen future coal demand and undermine these bullish projections.

Find out about the key risks to this Peabody Energy narrative.

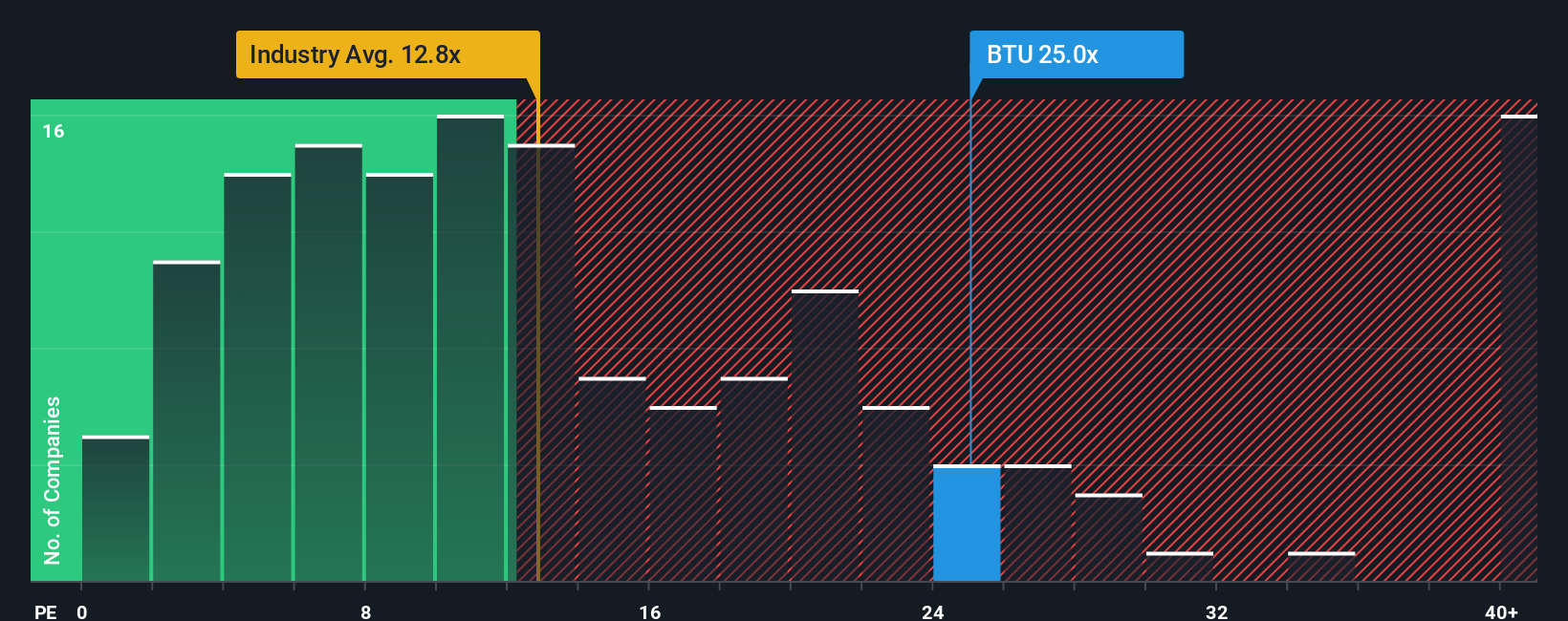

Another View: Looking Through the Lens of Earnings Multiples

While our first approach suggests Peabody Energy is trading well below its estimated fair value, there is a different takeaway when looking at its price-to-earnings ratio. At 23.3x, Peabody trades above the US Oil and Gas industry average of 13.1x, but below the peer average of 25.1x and under its calculated fair ratio of 24.3x. This suggests the stock sits in a middle ground, elevated compared to the industry but perhaps justified given its improving outlook. Do current valuations offer sufficient upside, or does premium pricing signal caution for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peabody Energy Narrative

If you have a different perspective or would rather chart your own course, you can dive into the data and construct your personal view in just a few minutes. Do it your way

A great starting point for your Peabody Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investing means staying one step ahead. Uncover overlooked sectors, tap into new financial frontiers, and take charge of your portfolio today with Simply Wall Street’s top stock ideas.

- Supercharge your returns with higher yields by analyzing these 21 dividend stocks with yields > 3%, which delivers consistent income and attractive payouts for your investment goals.

- Get ahead of the curve and reshape your portfolio by targeting these 26 AI penny stocks, which drive breakthroughs in artificial intelligence, automation, and next-generation growth.

- Seize unmatched value with these 852 undervalued stocks based on cash flows, revealing companies that might be trading below their real potential based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BTU

Good value with adequate balance sheet.

Market Insights

Community Narratives