- United States

- /

- Energy Services

- /

- NYSE:BORR

Borr Drilling (NYSE:BORR) Margin Miss Reinforces Market Skepticism Despite Steep Valuation Discount

Reviewed by Simply Wall St

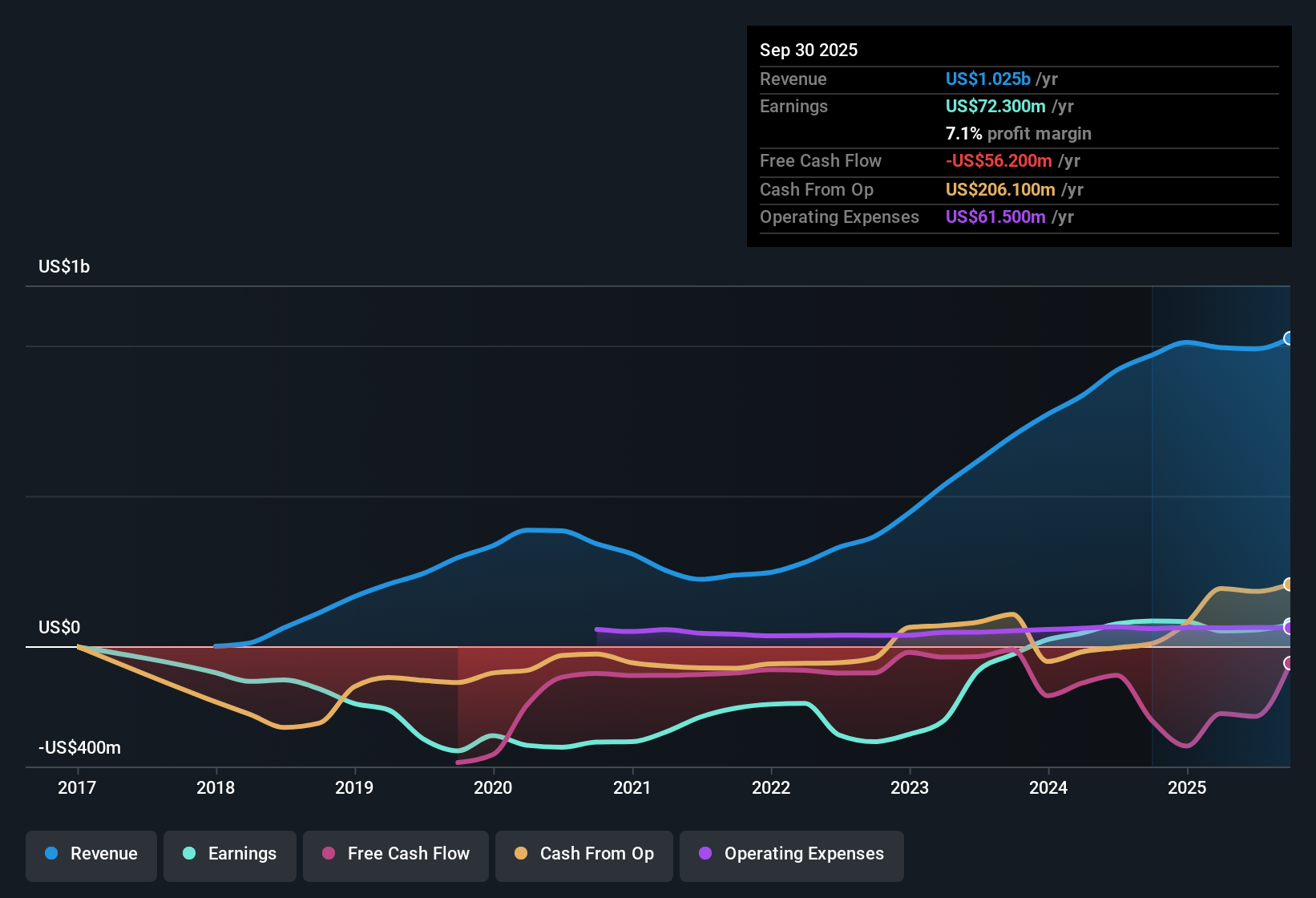

Borr Drilling (NYSE:BORR) posted standout earnings growth over the last five years, averaging a 56% rise annually and turning profitable with a net profit margin of 7.1% this year, down from 8.7% a year ago. However, the outlook has taken a sharp turn, with analysts projecting earnings to drop by 83.4% per year and revenue to decline 0.4% annually over the next three years. The stock currently trades at $3.21, well below its estimated fair value of $6.44. Its price-to-earnings ratio stands at 12.7x, which presents a steep discount compared to industry peers.

See our full analysis for Borr Drilling.With the headline numbers in hand, let’s dive into how Borr Drilling’s latest results stack up against the narratives that tend to drive sentiment and debates among investors.

See what the community is saying about Borr Drilling

Margins Decline, Pressure Ahead

- Net profit margin came in at 7.1%, down from last year's 8.7%, as analysts now expect profit margins to shrink all the way to 0.3% over the next three years.

- Analysts' consensus view highlights a challenging path for profits. Future earnings are expected to fall sharply, shrinking from $54.2 million currently to just $3.4 million by 2028.

- This points to a dramatic 83.4% annual decline, which runs directly against the company’s five-year trend of 56% annual earnings growth.

- While recent years showed strong profitability, the forecasted compression of margins signals much weaker earnings power and casts doubt on whether last year’s performance can be sustained.

- The current consensus expects Borr Drilling to endure years of profit contraction, even as its backlog and fleet remain steady. Will these numbers spark a new long-term view? 📊 Read the full Borr Drilling Consensus Narrative.

Industry Discount Widens Even as Quality Flags

- With a price-to-earnings ratio of 12.7x, Borr trades at a sizable discount to the US energy services industry average (16.1x) and even further below peer averages (21.7x), despite analysts projecting a steep drop in future earnings.

- Consensus narrative notes that investors seem to be betting on the business’s strong contract momentum and modern jack-up fleet to support high day rates and utilization, which may help justify current valuations.

- However, this market optimism may underplay persistent risks from oversupply in the rig market and the rise of short-term contracts. These factors could cut into future margins and compress valuation multiples even further.

- Recent price action, with shares well below DCF fair value of $6.44, suggests the market is weighing these risks despite headline discounts, implying uncertainty about sustained high-quality earnings.

Future Share Counts and Analyst Targets Diverge

- Analysts expect shares outstanding to decline by 5.95% per year for the next three years, an unusual move for a company under profitability pressure.

- Analysts' consensus view exposes tension in valuation expectations. The analyst price target sits at $3.13, just 8.7% above the current price of $3.21, and implies a price-to-earnings ratio of 309.0x on forecasted 2028 profits.

- This lofty future PE stands in stark contrast to both the company’s current low multiple and the sector average, highlighting uncertainty about long-term earnings sustainability.

- The slim gap between today's share price and the consensus target signals skepticism about further upside unless Borr can defy margin and earnings contraction projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Borr Drilling on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a different angle? Bring your unique take to life and shape your own story in just a couple of minutes. Do it your way

A great starting point for your Borr Drilling research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Borr Drilling faces a sharp earnings decline, margin pressure, and lingering uncertainty about whether its recent profitability can be sustained over time.

If you’d prefer stocks offering consistent, robust growth instead of unpredictable outcomes, check out stable growth stocks screener (2078 results). These companies have a history of steady expansion and proven resilience through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borr Drilling might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BORR

Borr Drilling

Operates as an offshore shallow-water drilling contractor to the oil and gas industry in the United States, the Middle East, South East Asia, Europe, Latin America, and West Africa.

Good value with questionable track record.

Similar Companies

Market Insights

Community Narratives