- United States

- /

- Oil and Gas

- /

- NYSE:BKV

A Fresh Look at BKV’s Valuation Following Earnings Beat and Power JV Expansion

Reviewed by Simply Wall St

BKV (BKV) has been in the spotlight after announcing third quarter earnings that surpassed expectations, along with revenue and net income growth. Investors are also paying close attention to strong production trends and strategic moves in its Power joint venture.

See our latest analysis for BKV.

After a string of upbeat earnings and the announcement of Power JV expansion, BKV’s 1-month share price return of nearly 28% has caught attention. This has pushed shares to a fresh high and highlighted accelerating momentum. Over the past year, total shareholder return stands at an impressive 18.5%. This reinforces the sense that optimism is building as investors digest accelerating production and strategic moves.

If the surge in BKV has you searching for other stocks showing strong momentum, consider widening your lens to discover fast growing stocks with high insider ownership.

BKV’s strong run has investors asking a crucial question: Is this momentum signaling further gains, or has the current price already factored in all the upside, leaving little room for a fresh buying opportunity?

Price-to-Earnings of 52.4x: Is it justified?

BKV trades at a price-to-earnings (P/E) ratio of 52.4x, substantially higher than both its US Oil and Gas industry peers and the market average. With a last close price of $25.98, this valuation suggests the market is pricing in robust future earnings growth, but it raises questions about whether these expectations are fully justified.

The price-to-earnings ratio reflects what investors are willing to pay for a dollar of the company’s earnings. For capital-intensive sectors like energy, a high P/E can signal anticipated growth, recent profitability, or a premium for quality earnings.

At 52.4x, BKV’s P/E is significantly above the US Oil and Gas industry average of 13.1x and the peer group’s average of 31.9x. Compared to its estimated fair P/E of 26.6x, the current level stands out even more, indicating that the market may be overpricing near-term optimism or reacting to the company’s recently achieved profitability. If the market moves toward this fair ratio, a sharp correction could follow.

Explore the SWS fair ratio for BKV

Result: Price-to-Earnings of 52.4x (OVERVALUED)

However, slower-than-expected revenue growth or shifts in energy prices could quickly reverse BKV’s recent momentum and challenge its high valuation.

Find out about the key risks to this BKV narrative.

Another View: What Does the DCF Model Say?

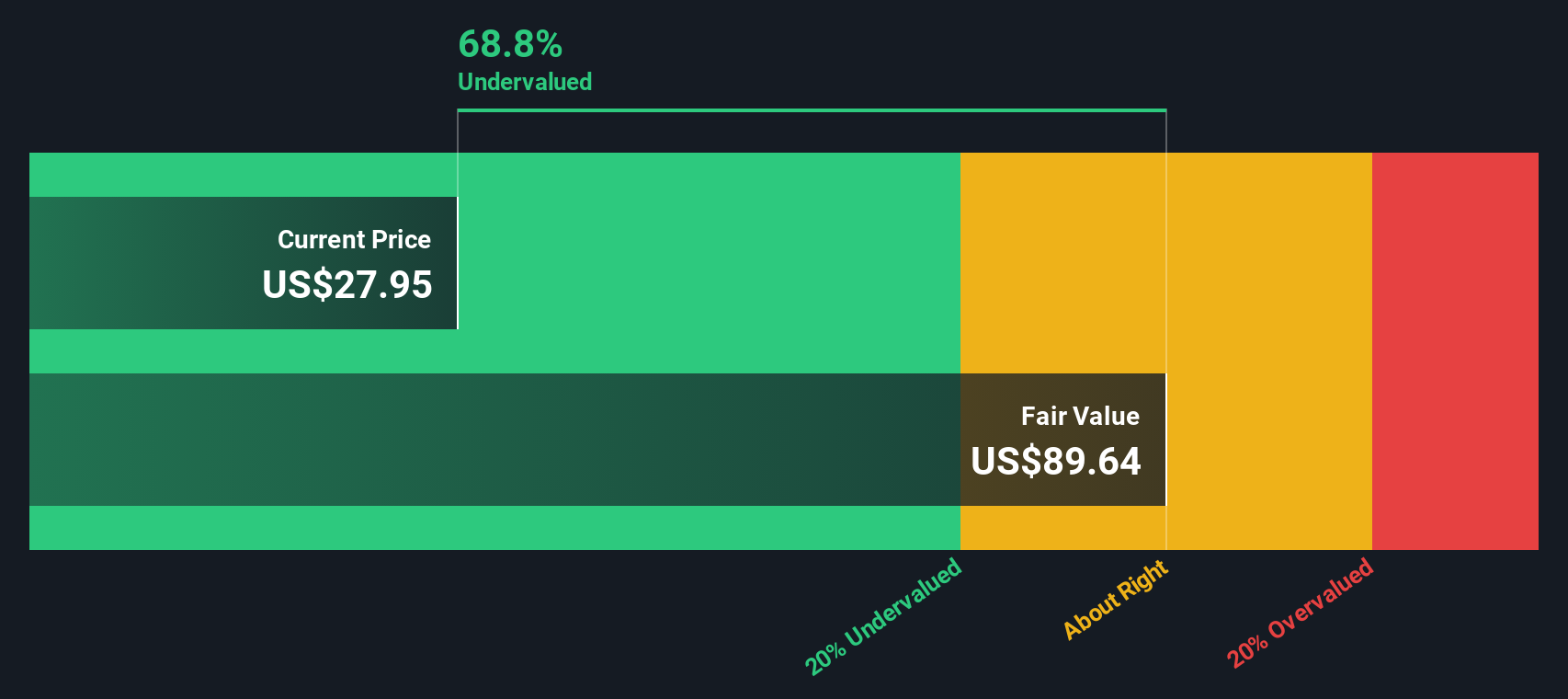

While BKV’s high earnings multiple raises concern, our DCF model shows a different perspective. The SWS DCF model estimates BKV’s fair value at $89.64, which is significantly higher than its current share price of $25.98. This indicates a substantial gap between the stock’s trading price and what its long-term fundamentals might support. Is the market overlooking BKV’s potential, or is the DCF model potentially too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BKV for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BKV Narrative

Keep in mind, these valuation models are just starting points. If you have a different view or want to uncover your own insights, you can build a personalized take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BKV.

Looking for more investment ideas?

Smart investing means staying one step ahead. Don’t miss excellent opportunities and take charge of your portfolio with unique stock ideas tailored to different strategies on Simply Wall Street.

- Expand your income stream by targeting reliable companies offering high yields through these 17 dividend stocks with yields > 3% with consistent returns and growth potential.

- Unearth growth stories at a discount when you spot bargains using these 917 undervalued stocks based on cash flows, connecting you to companies trading below their intrinsic value.

- Lead the charge into tomorrow’s technology by zeroing in on innovators leveraging artificial intelligence via these 25 AI penny stocks, fueling the next wave of market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKV

BKV

Produces and sells natural gas in the Barnett Shale in the Fort Worth Basin of Texas and in the Marcellus Shale in the Appalachian Basin of Northeast Pennsylvania.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives