- United States

- /

- Energy Services

- /

- NYSE:AROC

A Look at Archrock (AROC) Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Archrock.

Archrock’s share price has been a bit choppy lately, slipping back 4.88% over the past month but still up a healthy 5.86% in the last 90 days. What is really impressive, though, is the company’s robust 12.22% total shareholder return over the past year and an eye-catching 356% return over five years. This points to momentum that favors longer-term investors despite some near-term volatility.

If you’re interested in finding other companies showing strong growth and insider conviction, this could be the right moment to discover fast growing stocks with high insider ownership

With shares still trading well below analyst price targets despite impressive returns, the question for investors now is whether Archrock remains undervalued or if expectations for future growth are already fully reflected in the stock price.

Most Popular Narrative: 22% Undervalued

Archrock’s fair value estimate stands well above its last close, suggesting significant upside if the business meets bold financial projections. The latest narrative spotlights factors that could drive sustained growth and profitability, setting high expectations for what comes next.

The company’s ongoing transformation to a modern, high-horsepower fleet and longer customer commitments (average contract duration now exceeding six years) is translating to higher margins, enhanced operational stability, and increased earnings visibility.

Want to know what powers this ambitious target? Rising margins, expanding contract commitments, and one aggressive growth forecast form the core of this narrative. Curious about what expectations and profit assumptions justify such an optimistic outlook? Click through and see the pivotal numbers and projections that shape this compelling fair value story.

Result: Fair Value of $31.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in U.S. natural gas demand or disruptive regulatory changes could undermine Archrock’s growth outlook and challenge its strong earnings narrative.

Find out about the key risks to this Archrock narrative.

Another View: Is the Discount Too Good to Be True?

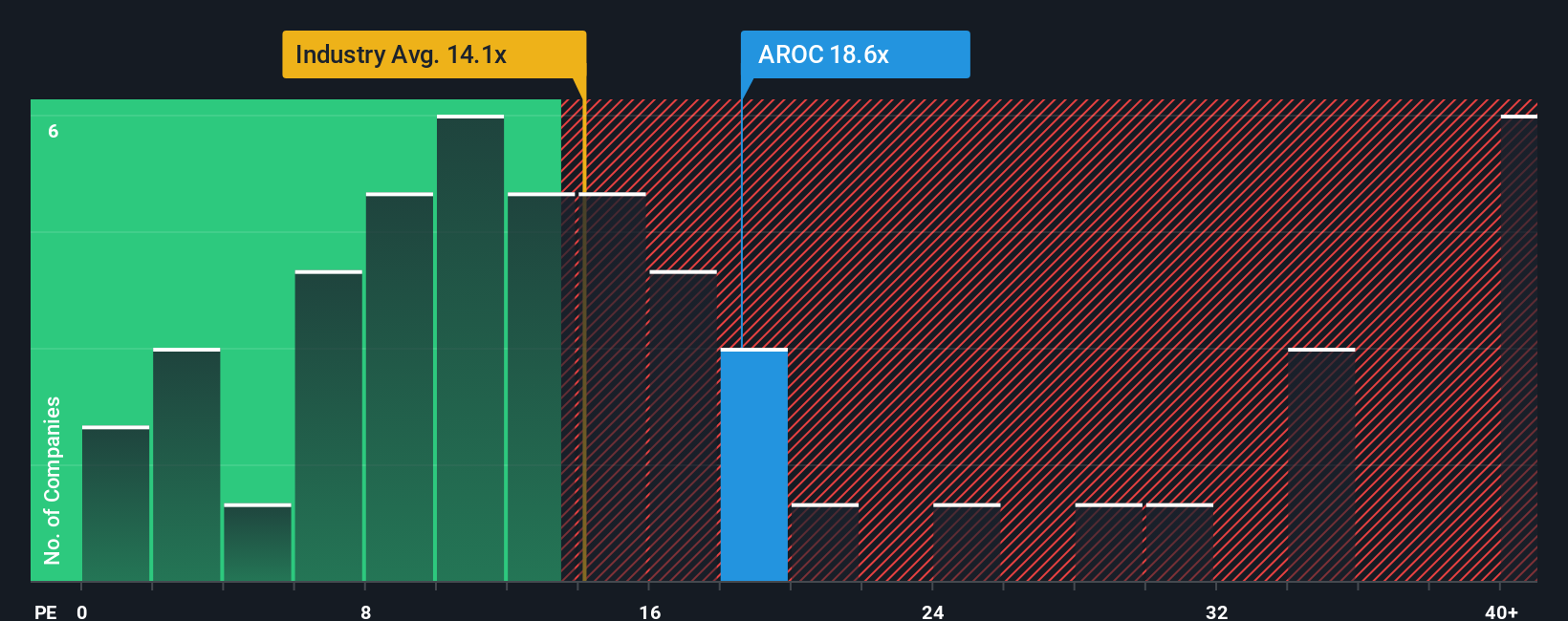

Looking at Archrock through the lens of earnings multiples, the stock trades at 16.4 times earnings, nearly identical to its calculated fair ratio. While this is close to the industry average (16.1x), it is well below the peer average of 27.4x. This small gap suggests that, despite analyst optimism, upside could be limited if market sentiment shifts. This raises the question: are all the good news and future growth hopes already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Archrock Narrative

If you have a different perspective or want to dig into the numbers personally, you can build your own narrative quickly and see what conclusions emerge. Do it your way

A great starting point for your Archrock research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Staying ahead means having access to bold, actionable stock ideas trusted by real investors. Don’t limit your growth. See what you could be missing out on right now.

- Unlock income potential by targeting steady payers with these 16 dividend stocks with yields > 3%, perfect for those who want consistent returns above 3%.

- Jump into the artificial intelligence race and gain early exposure through these 24 AI penny stocks, featuring exciting companies transforming tomorrow’s industries.

- Spot undervalued gems before the crowd does using these 876 undervalued stocks based on cash flows, and position yourself for the next overlooked opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AROC

Archrock

Operates as an energy infrastructure company in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives