- United States

- /

- Oil and Gas

- /

- NYSE:AR

Antero Resources (AR): Assessing Valuation as Natural Gas Volatility and Insider Buying Drive New Interest

Reviewed by Simply Wall St

Antero Resources (AR) has come into focus as investors react to the company’s recent quarterly results, which were shaped by lower natural gas prices and ongoing infrastructure issues. The combination of earnings volatility and market dynamics is driving discussion.

See our latest analysis for Antero Resources.

Antero Resources' share price has seen notable shifts this year, recently climbing to $33.64 after a 9.3% gain over the last month and a 12.6% boost in the past 90 days, even as sector pressures and pipeline challenges weighed earlier in the year. While this momentum has helped the stock's short-term performance rebound, the total shareholder return over the past year stands at 5.3% and remains roughly flat over three years. The five-year total shareholder return still impresses at nearly 700%, serving as a reminder of just how dynamic the name can be when conditions align.

If you're watching how energy stocks respond to volatility, this could be the right moment to discover other opportunities by exploring fast growing stocks with high insider ownership.

With the stock trading below analyst targets yet facing sector headwinds, is Antero Resources undervalued at these levels? Or is the market already anticipating a turnaround in natural gas demand and company performance?

Most Popular Narrative: 19.9% Undervalued

The most widely followed narrative suggests Antero Resources has a fair value well above its last close. This highlights a notable disconnect between current price and the consensus valuation, an opportunity that may look compelling given recent buybacks, management changes, and resilient margins even as guidance moderates.

Antero's strategic focus on liquids-rich production and firm transport capacity to premium Gulf Coast and export markets enables it to realize higher prices than in-basin peers. This supports net margins and free cash flow growth even as domestic pipeline constraints persist.

Want to know the real reason analysts call for a valuation nearly 20% higher? Buried in the narrative is a set of aggressive forecasts, including ambitious earnings, expanding profit margins, and a future profit multiple worthy of fast growers. Get the full story on what’s fueling that bold price target.

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory shifts and clean energy adoption could curb long-term demand and margins. This may challenge the bullish outlook for Antero Resources.

Find out about the key risks to this Antero Resources narrative.

Another View: A Look at Price Ratios

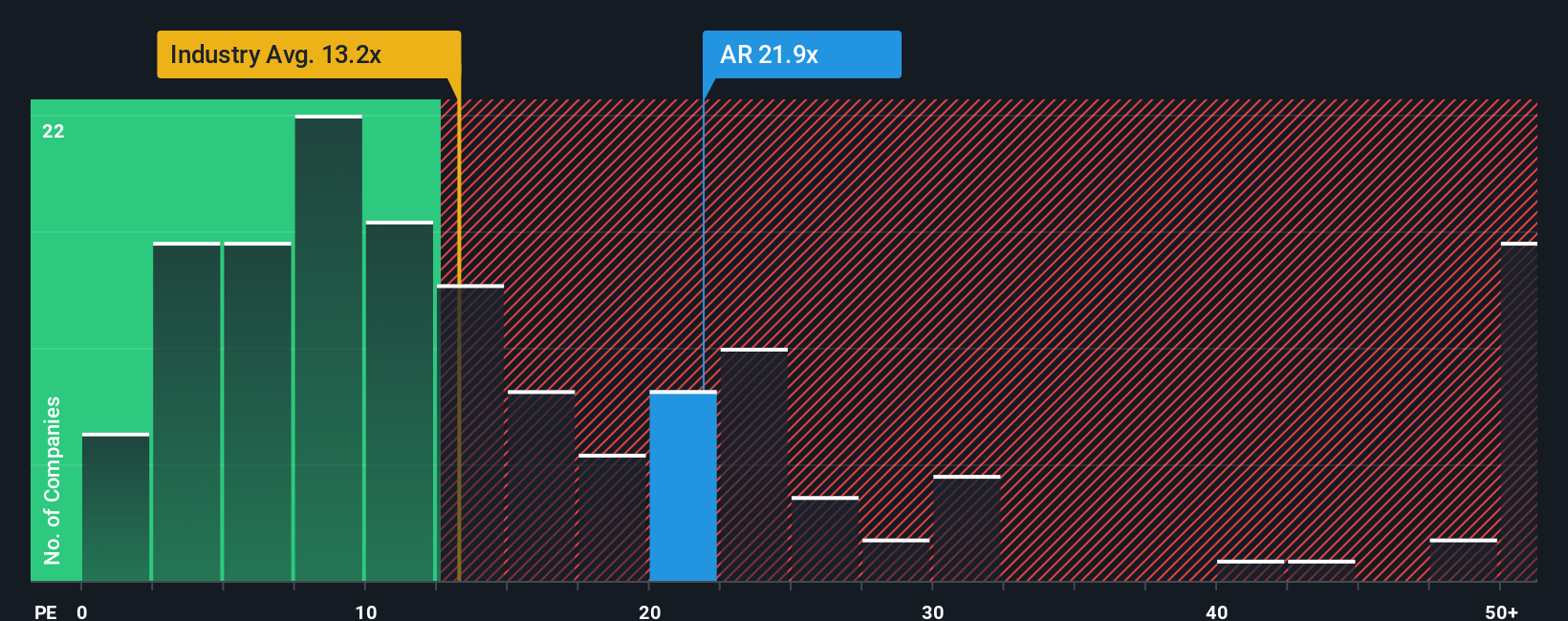

While analyst forecasts suggest upside, a quick check of Antero Resources' current price-to-earnings ratio tells a different story. The shares are trading at 17.6 times earnings, which is above both the US industry average of 14.2 and the fair ratio estimate of 17.3. This means the stock is not only pricier than its sector, but potentially even overvalued if the market cools to future growth assumptions. Could this premium point to hidden risks? Or are investors counting on more surprises ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antero Resources Narrative

If you want a different perspective or would rather investigate the data yourself, you can easily put your own narrative together in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Antero Resources.

Looking for more investment ideas?

Smart investors move ahead by finding tomorrow’s potential winners today. Don’t wait for the crowd. Use these curated lists to spot standout opportunities before others catch on.

- Capitalize on the rising demand for healthcare innovation with these 31 healthcare AI stocks, focused on companies driving the next wave of medical breakthroughs.

- Unlock underappreciated gems by checking out these 899 undervalued stocks based on cash flows, where market leaders are trading at attractive prices well below their true worth.

- Catch the next surge in digital assets by exploring these 82 cryptocurrency and blockchain stocks, featuring businesses transforming finance with blockchain and cryptocurrency technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AR

Antero Resources

An independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives