- United States

- /

- Oil and Gas

- /

- NYSE:AR

Antero Resources (AR): Assessing Valuation After Profitable Q3, Drilling Records, and Expansion Moves

Reviewed by Simply Wall St

Antero Resources delivered a strong third quarter, swinging to a net profit from last year’s loss and posting higher revenue. The company’s record drilling performance and recent acquisitions reflected disciplined growth and capital management.

See our latest analysis for Antero Resources.

Antero Resources’ shares have pulled back about 13% year-to-date, reflecting cautious investor sentiment after natural gas price headwinds and recent leadership changes. However, the stock’s robust 21% total return over the past year signals underlying confidence. Operational wins and disciplined buybacks also hint at momentum rebuilding for the longer term.

Thinking about what else might be on the move? Now is a great time to expand your universe and discover fast growing stocks with high insider ownership

But does the market fully appreciate these turnaround efforts and growth levers, or is Antero Resources' upside already reflected in its share price? Investors will be weighing whether a compelling opportunity remains or if expectations are already high.

Most Popular Narrative: 27.5% Undervalued

The latest widely followed narrative sets Antero Resources’ fair value at $42.62, a notable premium to its $30.91 closing price. This perspective is based on improving profitability, shifting market dynamics, and fresh leadership, building a case for substantial upside.

Structural improvements in domestic and global energy security priorities are catalyzing sustained demand for North American gas, reducing price volatility and making Antero's diversified customer base and global reach a long-term margin enhancer.

Want to know the fuel driving this bullish target? The narrative leans on bold forecasts for profitability and sales, plus a future earnings multiple that defies industry norms. What aggressive assumptions power that valuation? Read the full story to uncover the surprising numbers.

Result: Fair Value of $42.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds such as tightening clean energy regulation or continued pipeline constraints could dampen long-term growth and challenge even the most optimistic forecasts.

Find out about the key risks to this Antero Resources narrative.

Another View: Multiples Tell a Different Story

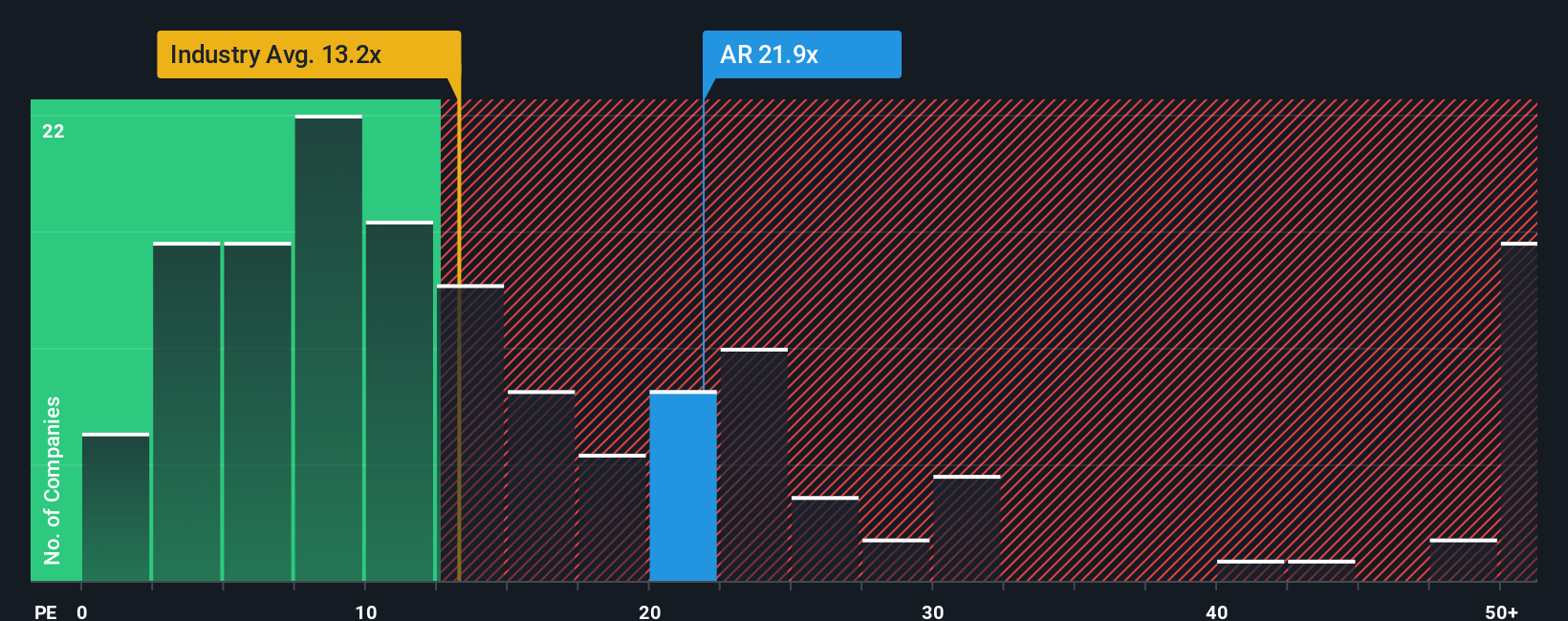

While fair value estimates based on future cash flows suggest upside for Antero Resources, looking at its current price-to-earnings ratio tells a more cautious tale. The company's P/E is 16.2x, which is higher than both its industry average of 12.9x and the calculated fair ratio of 16x. This comparison indicates that expectations may already be priced in. Should investors worry the stock is running ahead of its fundamentals, or is the premium a bet on enduring growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antero Resources Narrative

If you think there’s another angle to the story or want to test your own ideas, it's quick and easy to build your personal case in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Antero Resources.

Looking for More Investment Ideas?

Why stop at just one opportunity? Get ahead of the curve and spot tomorrow’s winners by searching for strong stocks with unique future potential right now.

- Uncover income opportunities and start building a resilient portfolio with these 22 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Begin your journey in cutting-edge tech by tapping into these 26 AI penny stocks powering breakthroughs in artificial intelligence and data science.

- Take the opportunity to spot undervalued stocks before the crowd by tracking these 840 undervalued stocks based on cash flows that offer real potential based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AR

Antero Resources

An independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives