- United States

- /

- Oil and Gas

- /

- NYSE:AMPY

It's A Story Of Risk Vs Reward With Amplify Energy Corp. (NYSE:AMPY)

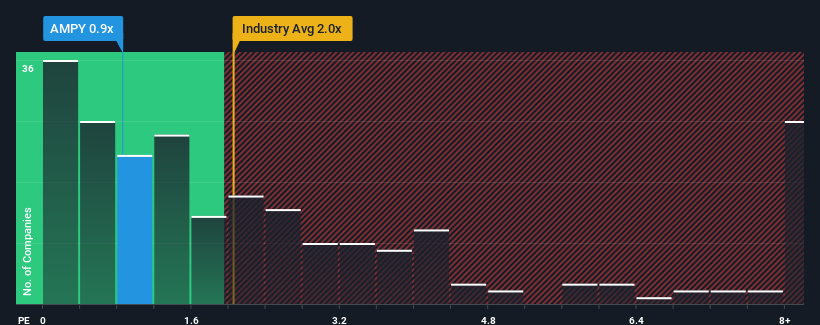

When close to half the companies operating in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") above 2x, you may consider Amplify Energy Corp. (NYSE:AMPY) as an attractive investment with its 0.9x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Amplify Energy

What Does Amplify Energy's P/S Mean For Shareholders?

Amplify Energy has been struggling lately as its revenue has declined faster than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Amplify Energy's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Amplify Energy's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 38% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 7.6% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 7.9%, which is not materially different.

With this in consideration, we find it intriguing that Amplify Energy's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Amplify Energy's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Amplify Energy remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Amplify Energy that you need to be mindful of.

If you're unsure about the strength of Amplify Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPY

Amplify Energy

Engages in the acquisition, development, exploitation, and production of oil and natural gas properties in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives