- United States

- /

- Oil and Gas

- /

- NYSE:AM

How Recent Energy Sector Investments Are Influencing Antero Midstream’s 2025 Valuation

Reviewed by Bailey Pemberton

- Wondering whether Antero Midstream is a value buy right now? Let’s break down what’s driving interest in the stock, especially for anyone looking at today’s price tag and future potential.

- The shares have had a stellar run with a 21.4% gain over the past year and an impressive 287.8% return over five years. There has been a slight dip of 0.2% over the past week.

- Much of the recent buzz has centered around shifts in the energy sector, where infrastructure investments and industry consolidation have put pipeline operators like Antero Midstream in the spotlight. News of regulatory changes and long-term supply agreements have also played a role, fueling optimism among investors watching these developments unfold.

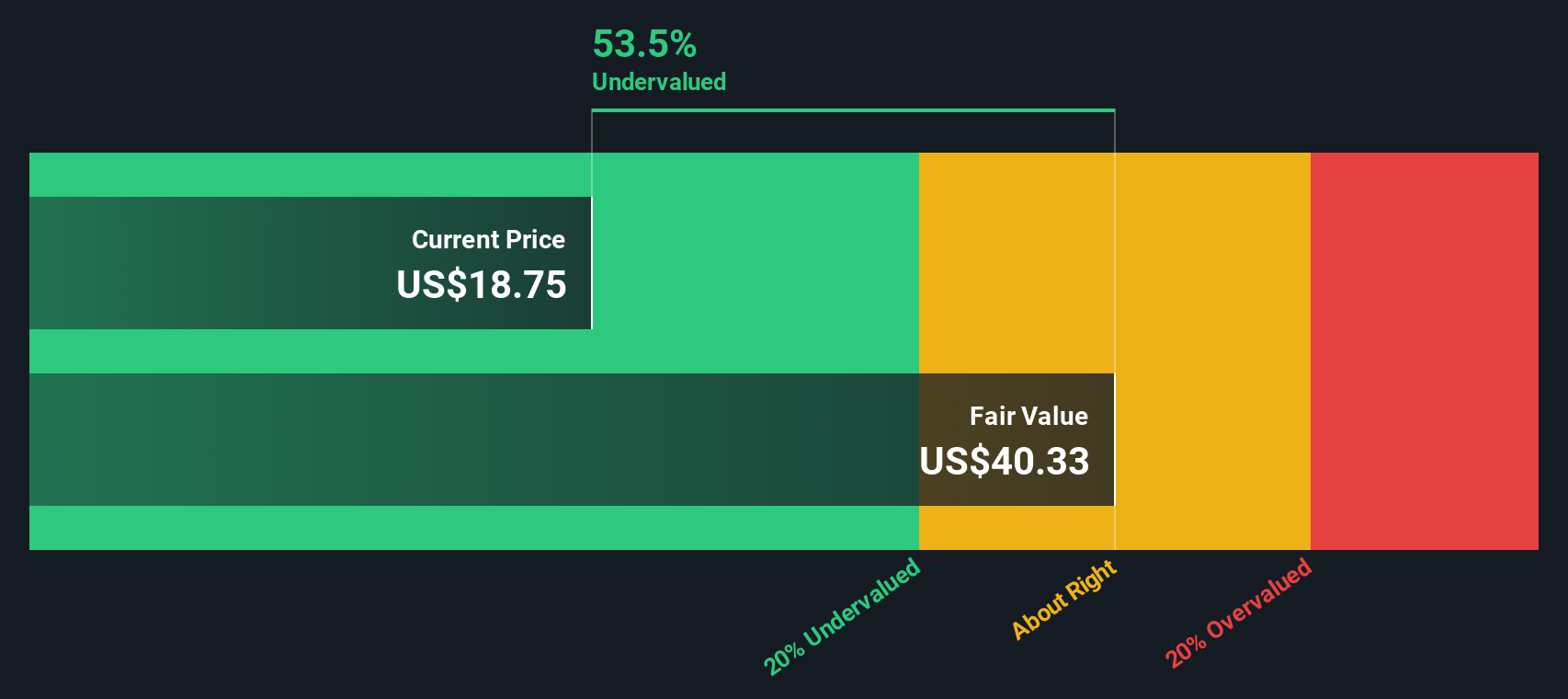

- On the valuation front, Antero Midstream scores a 4 out of 6 in our undervaluation checks. This suggests it passes most, though not all, of the key value tests. We will dig into how analysts come to these numbers next, but stick around because there is an even more insightful approach to valuation waiting for you at the end.

Approach 1: Antero Midstream Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and discounts them back to today's value, providing an estimate of the business's intrinsic worth. By evaluating the money Antero Midstream is expected to generate, this approach helps investors judge whether the current share price offers value relative to those future earnings.

For Antero Midstream, the latest reported Free Cash Flow was $616.6 million. Analyst estimates point to continued growth, with the company’s projected Free Cash Flow rising to $923.5 million by 2029. While analysts supply forecasts for the next five years, additional projections reaching nearly $1.15 billion by 2035 are extrapolated to further inform the valuation.

After discounting these projected cash flows back to their present value, the model suggests an intrinsic value per share of $48.41. Notably, this figure is 63.2% above the current share price, indicating the stock is significantly undervalued based on this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Antero Midstream is undervalued by 63.2%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Antero Midstream Price vs Earnings

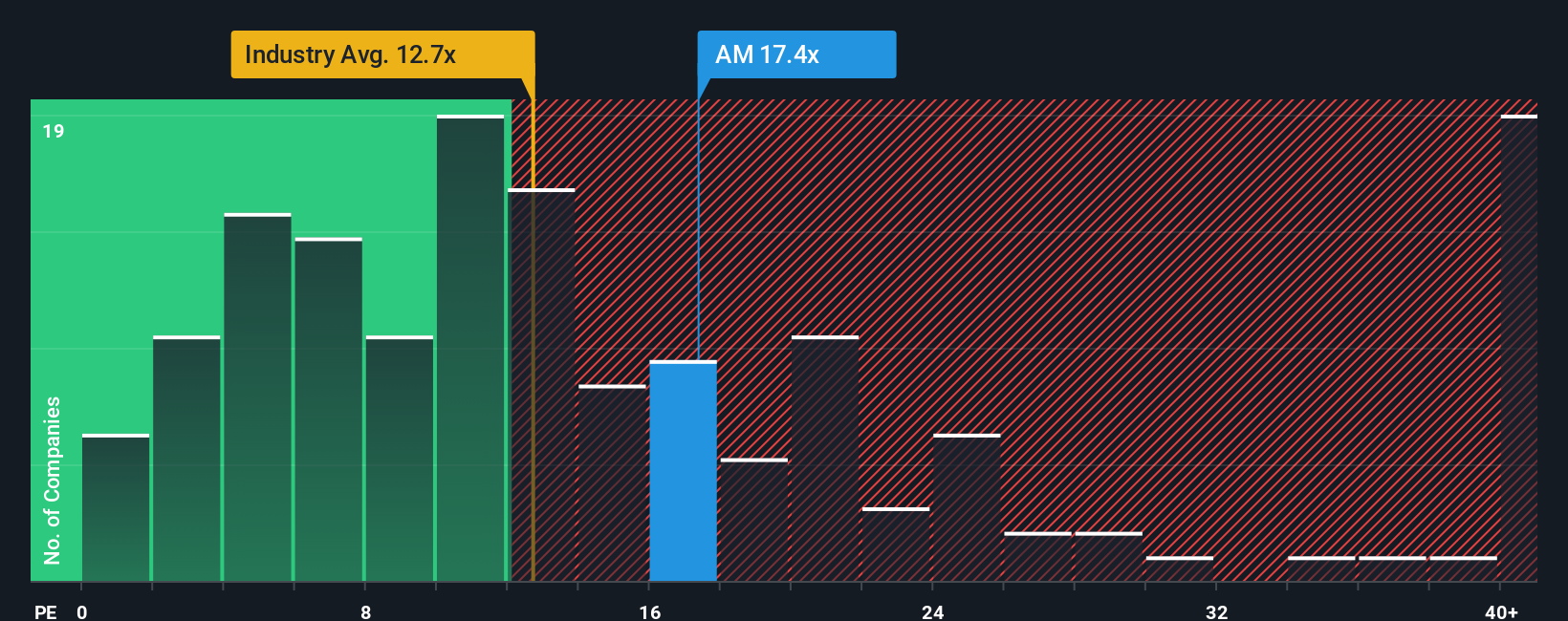

For profitable companies like Antero Midstream, the Price-to-Earnings (PE) ratio is a widely used and effective valuation metric. It shows how much investors are willing to pay for each dollar of earnings, making it a quick way to gauge whether a stock is priced reasonably relative to its profit-generating ability.

It is important to note that what counts as a “normal” or “fair” PE ratio depends on expectations for the company’s future growth and how risky the business is thought to be. Companies with higher growth prospects or less risk often command higher PE ratios, while those facing headwinds or greater uncertainty tend to trade at lower multiples.

Currently, Antero Midstream trades at a PE ratio of 18x. This is notably higher than the Oil and Gas industry average of 13.6x, but much lower than the average of its immediate peers, which stands at 36.9x. To refine this comparison, Simply Wall St offers a unique “Fair Ratio.” This proprietary PE multiple blends industry benchmarks, future growth forecasts, profit margins, market cap, and company-specific risk. As a result, it provides a more tailored and insightful yardstick for valuation.

The Fair Ratio calculated for Antero Midstream is 18.6x. Unlike straightforward comparisons to industry or peers, this Fair Ratio is tailored to the company’s own outlook and fundamental characteristics. Given that Antero’s actual PE ratio is effectively on par with its Fair Ratio, the market appears to have priced in its prospects and risks appropriately.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Antero Midstream Narrative

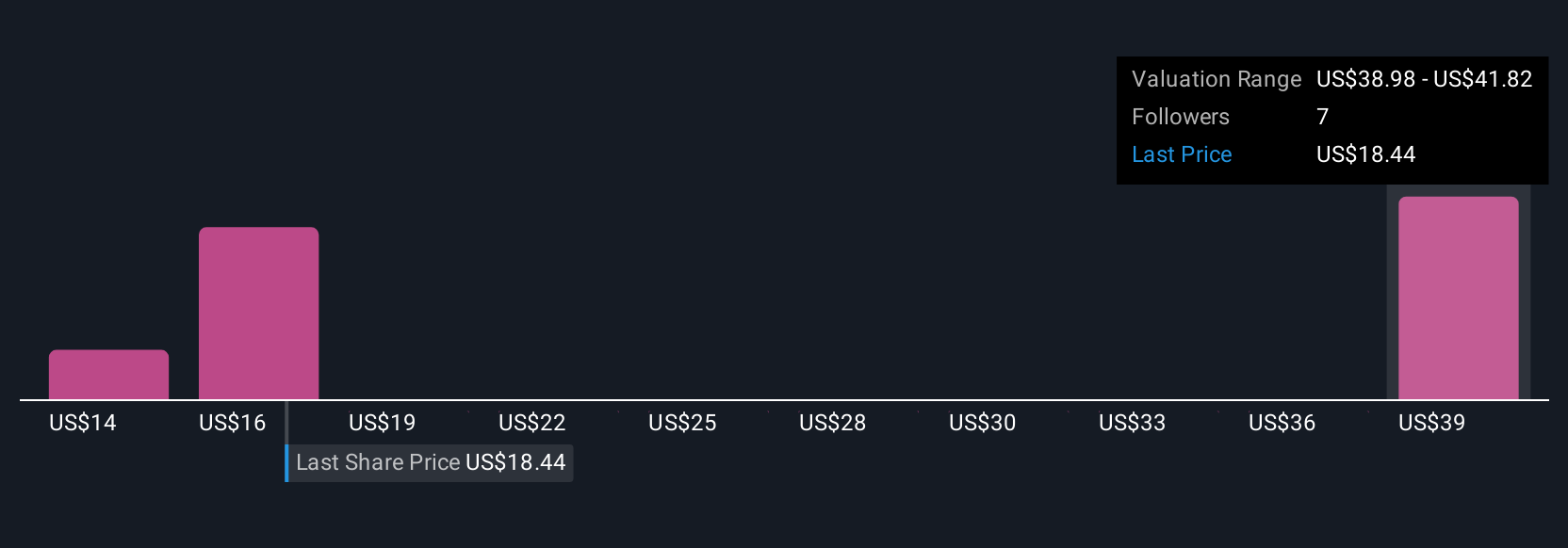

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple and powerful way to connect your perspective on a company with the numbers you expect it to achieve, such as future revenue, earnings, and profit margins. Essentially, it is the story behind your valuation assumptions.

Rather than only relying on ratios or analyst forecasts, Narratives help you link what you believe is driving Antero Midstream's future to an actual financial forecast and, from there, to an estimated fair value. This approach lets you compare your fair value with the current price, helping you decide when to buy or sell. It also makes investing more personal and insightful.

Narratives are easy to access on Simply Wall St’s Community page, used by millions of investors, and are updated automatically as new news or earnings data comes in, so your outlook always reflects the latest information.

For example, some investors believe that Antero's growth in LNG demand, supply contracts, and buyback momentum support a high target of $19.0 per share. Others are more cautious about industry risks and regulatory pressures, setting their fair value as low as $16.0. Narratives let you see and shape these scenarios for yourself, making your investment process smarter and more dynamic.

Do you think there's more to the story for Antero Midstream? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AM

Antero Midstream

Owns, operates, and develops midstream energy assets in the Appalachian Basin.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives