- United States

- /

- Oil and Gas

- /

- NYSE:AM

Antero Midstream (AM): Examining Its Valuation After a Recent Pullback in Share Price

Reviewed by Simply Wall St

Antero Midstream (AM) shares have been on investors’ radar as the energy sector navigates recent fluctuations. Over the past month, the stock has dipped nearly 10%, sparking questions about current valuation and potential opportunities.

See our latest analysis for Antero Midstream.

Antero Midstream’s share price has retreated 9.6% over the past month. However, if you zoom out, long-term investors have enjoyed a 26.6% total shareholder return in the past year and even greater gains over the last five. This recent pullback reflects some cooling momentum following an impressive multi-year run, as investors weigh short-term volatility against the company’s underlying growth story.

If you want to see what else is gaining traction beyond energy, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading below its analyst price target and strong long-term returns, the question arises: does Antero Midstream represent an overlooked bargain, or have investors already factored future growth into the current price?

Most Popular Narrative: 6% Undervalued

With the narrative’s fair value of $18.36 sitting slightly above the last close of $17.25, analysts see more upside left than recent price action suggests. This cautious optimism is driven by both fresh leadership moves and improved financial guidance.

Accelerated debt reduction and opportunistic share buybacks, fueled by strong free cash flow and reduced interest expenses, are improving the company's financial flexibility and are likely to drive earnings per share and equity value higher over the long term.

Curious what’s powering this premium valuation? It is not only about future profits. The focus is on a bold financial playbook and strict cost discipline that could shift Antero Midstream’s earnings profile. Explore which surprising forecasts and strategic levers shape this price target.

Result: Fair Value of $18.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp shifts in natural gas demand or tighter regional regulations could quickly challenge Antero Midstream’s long-term growth outlook and margin expansion story.

Find out about the key risks to this Antero Midstream narrative.

Another View: What About Earnings Multiples?

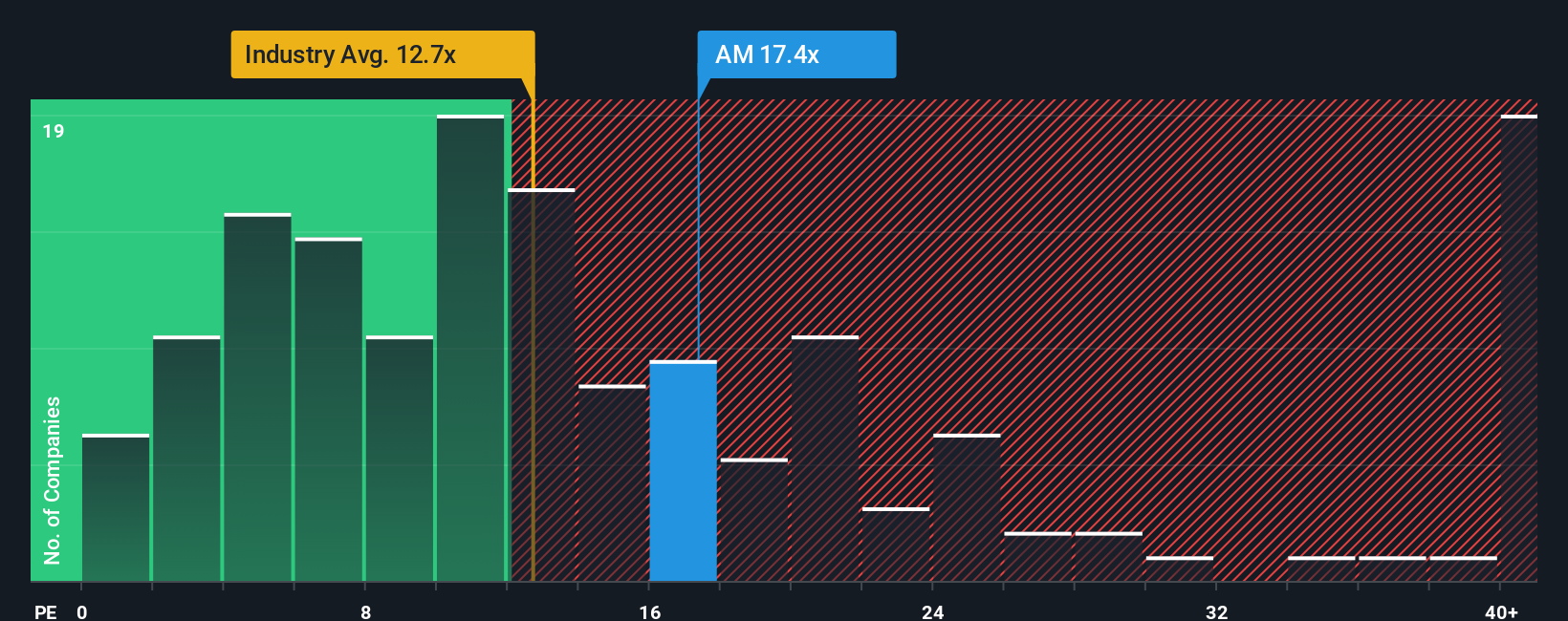

While our previous analysis sees Antero Midstream undervalued, the common price-to-earnings ratio tells a different story. At 17.4x, the company’s valuation is higher than the US Oil and Gas industry average of 12.9x. However, it remains below peers at 26.9x and under its fair ratio of 18.5x. This gap may signal either a valuation risk or a sign the market could eventually shift closer to that fair ratio. Which side do you think will win out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antero Midstream Narrative

If you think there’s more to this story or want to test your own investment thesis, you can shape your perspective using our tools in just a few minutes. Do it your way

A great starting point for your Antero Midstream research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. The Simply Wall Street Screener offers stock picks tailored to what smart investors value most right now.

- Tap into rising tech with these 26 AI penny stocks and discover high-potential companies that are redefining the AI landscape across sectors.

- Strengthen your portfolio's income with these 23 dividend stocks with yields > 3%, which focuses on stocks delivering yields above 3% and steady cash returns.

- Explore the next financial revolution by checking out these 81 cryptocurrency and blockchain stocks, featuring leaders positioned to benefit from blockchain innovation and digital currencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AM

Antero Midstream

Owns, operates, and develops midstream energy assets in the Appalachian Basin.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives