- United States

- /

- Oil and Gas

- /

- NasdaqGS:VNOM

A Closer Look at Viper Energy (VNOM) Valuation Following Asset Sale and Enhanced Capital Return

Reviewed by Simply Wall St

Viper Energy (VNOM) has announced the sale of its non-core assets outside the Permian Basin. This move is aimed at reducing debt and delivering stronger returns to shareholders. The deal comes alongside a capital return that topped expectations.

See our latest analysis for Viper Energy.

Viper Energy’s focus on its Permian Basin core has come against a backdrop of lackluster share price momentum. Even after the asset sale and a stronger-than-expected capital return, the stock’s 1-year total shareholder return stands at -26.4%, which points to lingering market caution despite solid fundamentals.

If you’re looking for ideas beyond energy, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading at a steep discount to analyst price targets and distribution yields forecast to rise, could Viper Energy offer an undervalued entry point, or is the market already reflecting all its future growth potential?

Most Popular Narrative: 28.1% Undervalued

With Viper Energy's fair value pegged at $50.94, shares trade at $36.61, creating a notable gap that has caught the market’s attention. The narrative highlights transformational moves that could shift the value proposition significantly.

The shift to aggressively return excess free cash flow, after reaching the $1.5B net debt target, to shareholders via buybacks and variable dividends leverages Viper's hard-asset, yield-focused equity profile. This approach could enhance market appeal, lower cost of capital, and drive share price appreciation, impacting net margins and total payout ratios.

Want to know what’s fueling this big valuation gap? The forecast relies on a combination of bullish operational shifts and some aggressive financial assumptions. Curious if the growth and margin forecasts are as bold as they seem? The full story holds the clues.

Result: Fair Value of $50.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on third-party operators and heavy geographic concentration could expose Viper Energy to sudden revenue shocks and market volatility.

Find out about the key risks to this Viper Energy narrative.

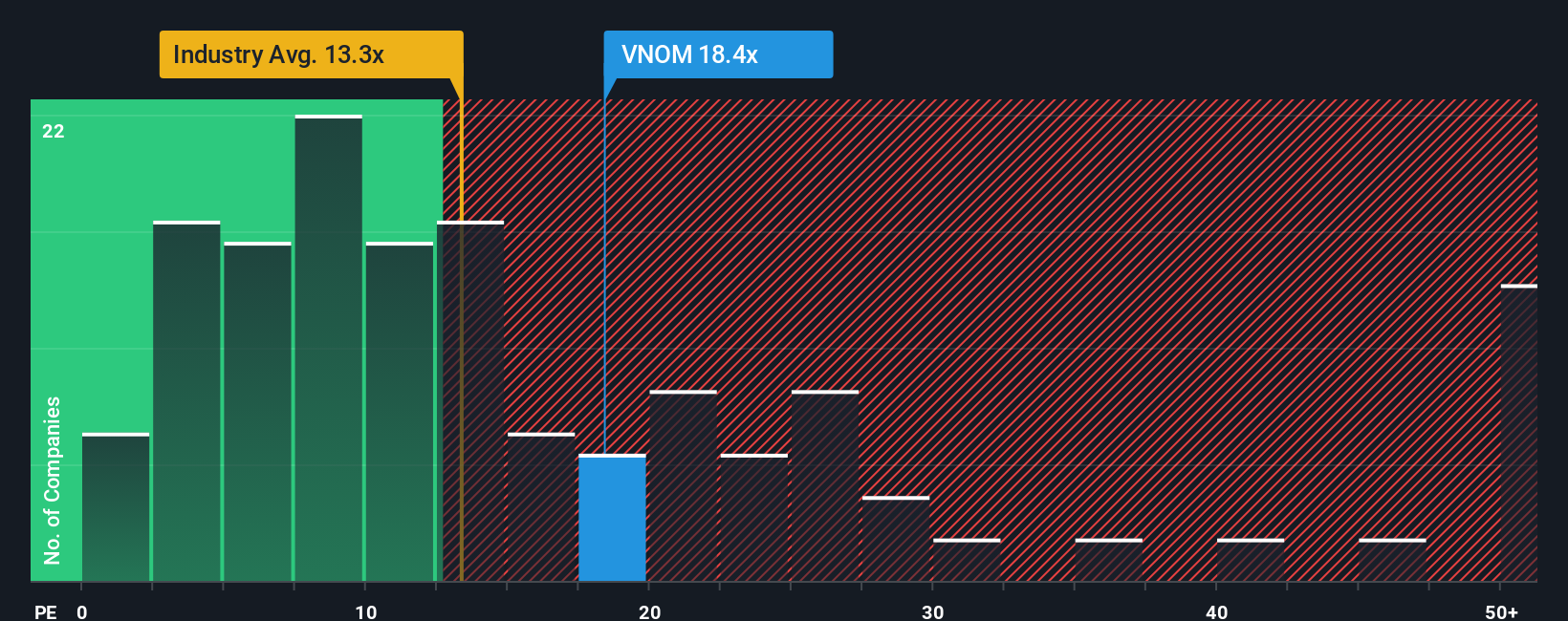

Another View: Multiples Tell a Cautionary Tale

While some models suggest Viper Energy is trading below fair value, a look at earnings multiples tells a different story. With a current price-to-earnings ratio of 25.2x, Viper appears far more expensive than both its industry average (14.2x) and the fair ratio (17.6x). This gap could limit upside or signal valuation risk. Are investors paying too high a price for perceived growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viper Energy Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own take in just a few minutes: Do it your way

A great starting point for your Viper Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to find fresh opportunities and stay ahead of the market. Missing these trends means leaving potential gains for someone else.

- Grow your portfolio by targeting passive income opportunities with these 18 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Capitalize on breakthroughs in artificial intelligence by uncovering these 27 AI penny stocks, positioned to transform entire industries.

- Secure smart value picks before the crowd with these 894 undervalued stocks based on cash flows, based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNOM

Viper Energy

Owns, acquires, and exploits oil and natural gas properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives