- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAGP

Earnings Miss and Portfolio Shift Could Be a Game Changer for Plains GP Holdings (PAGP)

Reviewed by Sasha Jovanovic

- Plains GP Holdings recently reported third-quarter 2025 results, revealing a year-over-year revenue decline to US$11.58 billion and net income rising to US$83 million, while also finalizing the acquisition of EPIC Crude Holdings and announcing plans to divest its Canadian natural gas liquids business.

- This combination of earnings underperformance relative to analyst expectations and a sharpened focus on core crude oil midstream operations marks a significant repositioning of the company’s business portfolio.

- We'll examine how the earnings miss alongside core business reshaping influences Plains GP Holdings' future investment outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Plains GP Holdings Investment Narrative Recap

To be a shareholder in Plains GP Holdings, you need to believe in the long-term case for crude oil midstream operations and the company's ability to generate steady cash flows amid shifting energy trends. The recent third-quarter earnings miss doesn't fundamentally alter the primary catalyst, pivoting resources into core oil pipelines, or the largest short-term risk, which remains the company's exposure to volatility in crude demand, especially after the NGL divestiture.

Among recent announcements, the finalized acquisition of EPIC Crude Holdings stands out as most relevant. This move increases the company’s asset base in the Permian Basin, a region central to Plains GP Holdings' growth ambitions and its ongoing strategy to build scale in U.S. crude oil logistics.

On the flip side, investors should be aware there are still meaningful risks if North American crude production...

Read the full narrative on Plains GP Holdings (it's free!)

Plains GP Holdings is projected to reach $49.0 billion in revenue and $417.5 million in earnings by 2028. This outlook assumes a revenue decline of 0.9% per year and an increase in earnings of $445.5 million from the current $-28.0 million.

Uncover how Plains GP Holdings' forecasts yield a $20.62 fair value, a 20% upside to its current price.

Exploring Other Perspectives

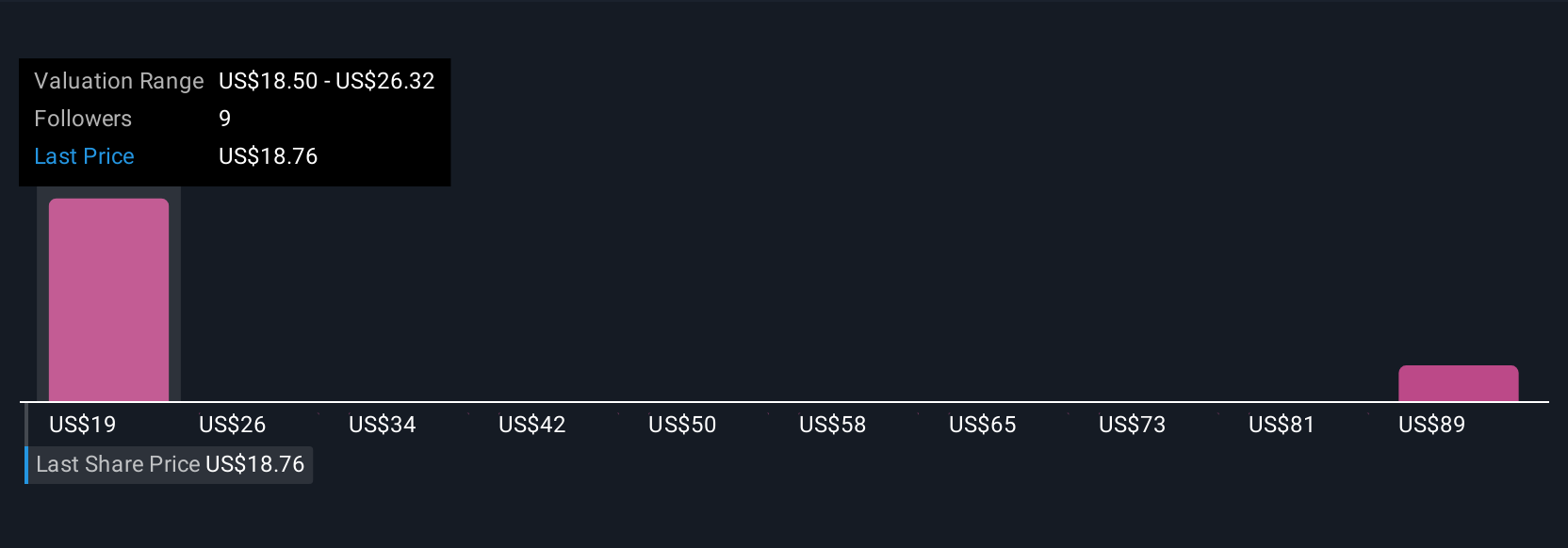

Six private investors in the Simply Wall St Community placed fair value estimates for Plains GP Holdings from US$18.50 to US$111.07 per share. With the business now almost entirely focused on crude oil midstream, you should consider how concentrated operations may influence future returns.

Explore 6 other fair value estimates on Plains GP Holdings - why the stock might be worth just $18.50!

Build Your Own Plains GP Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plains GP Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Plains GP Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plains GP Holdings' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAGP

Plains GP Holdings

Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives