- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAA

Plains All American Pipeline (PAA): Evaluating Current Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Plains All American Pipeline.

Plains All American Pipeline has seen its share price tick up lately, and over the past year the 7.1% total shareholder return highlights a healthy combination of current yield and gradual capital appreciation. This momentum builds on its impressive three- and five-year total returns, reminding investors that income and steady growth can go hand in hand.

If you’re watching how momentum shifts in energy stocks, it could be the perfect time to explore fast growing stocks with high insider ownership next.

With shares trading below analyst targets and solid earnings growth, the question for investors is clear: Is Plains All American Pipeline undervalued at today’s levels, or is the market accurately reflecting its long-term prospects?

Most Popular Narrative: 14.5% Undervalued

The most widely followed narrative places Plains All American Pipeline’s fair value far above its recent close, suggesting meaningful upside according to future projections. Here is a key driver behind this viewpoint.

“The divestiture of the Canadian NGL business and redeployment of ~$3 billion in proceeds will allow Plains to focus on higher-growth and higher-return U.S. crude oil assets, supporting stable throughput and cash flow, which can drive revenue and long-term earnings growth. Strong strategic positioning in the Permian Basin and the ability to acquire further interests in key pipelines (such as BridgeTex), paired with ongoing population and economic growth in North America, provide a resilient volume foundation and upward revenue trajectory.”

Want to know what bold forecasts are powering this ambitious valuation? The stage is set by projections of earnings acceleration and profit margins rarely seen in this sector. Find out how far analysts think growth and profitability can go. See which numbers truly separate this outlook from the rest.

Result: Fair Value of $20.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainties such as slower than expected Permian growth or execution missteps on acquisitions could quickly challenge the bullish outlook for Plains All American Pipeline.

Find out about the key risks to this Plains All American Pipeline narrative.

Another View: Reality Check on Multiples

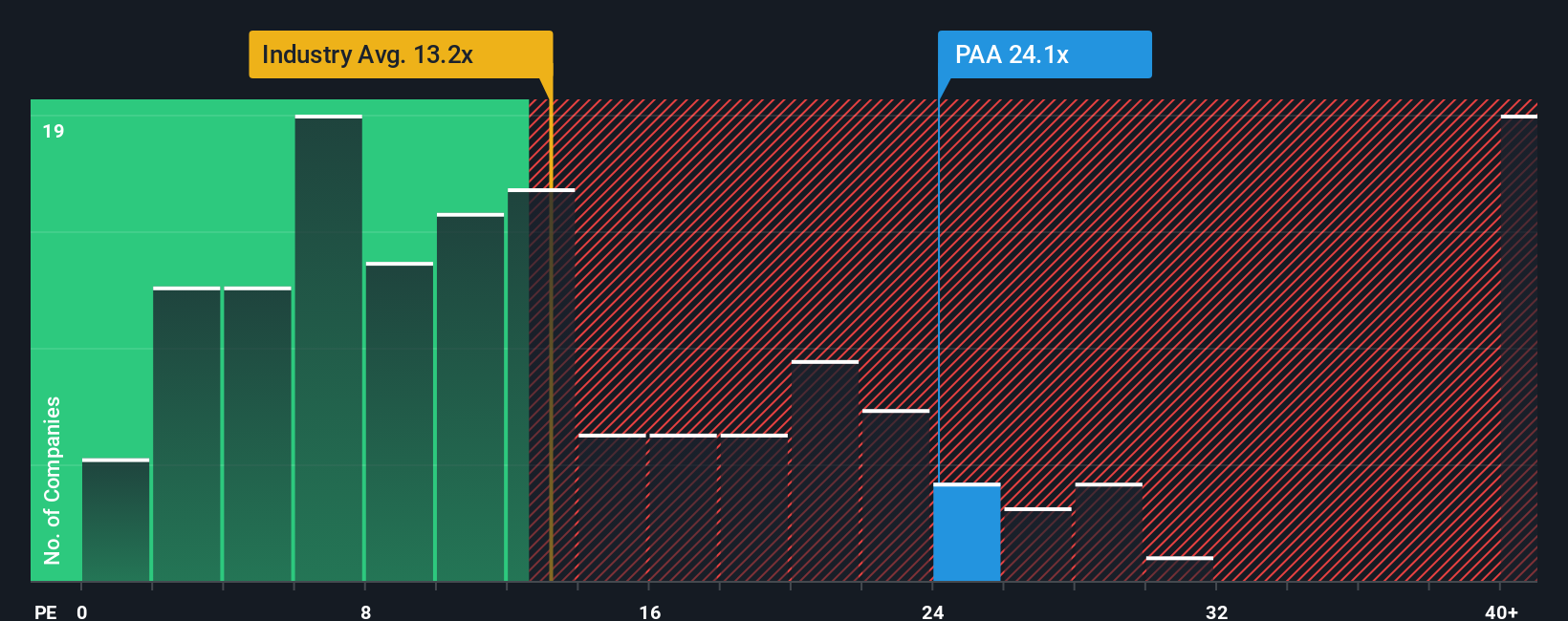

While some see big upside for Plains All American Pipeline, our take on simple valuation measures adds complexity. Its price-to-earnings ratio sits at 16.8x, higher than the US Oil and Gas industry average of 13.2x, but somewhat below the peer average of 18.1x. The market’s fair ratio could move toward 19.9x, suggesting room to run but also pricing risk if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plains All American Pipeline Narrative

If you’d rather crunch the numbers yourself or see things from a different angle, you can build your own story in just a few minutes. Do it your way.

A great starting point for your Plains All American Pipeline research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself up for smarter investing moves by checking out opportunities most investors overlook. Don't let the next big trend pass you by; these ideas could change your portfolio’s direction.

- Target stable cash flows and compound your returns by choosing from these 14 dividend stocks with yields > 3% delivering yields above 3% alongside solid fundamentals.

- Catch market opportunities early and ride momentum with these 3582 penny stocks with strong financials showing proven financial strength and upside potential.

- Position yourself for breakthrough growth in tomorrow’s most promising industries by considering these 26 AI penny stocks shaping innovation and technology leadership.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAA

Plains All American Pipeline

Through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success