- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

New Fortress Energy (NFE): Valuation Deep Dive Following Debt Extension, Forbearance Deals, and Bankruptcy Warning

Reviewed by Simply Wall St

New Fortress Energy (NFE) has drawn intense attention after extending the maturity on a major credit facility and negotiating forbearance deals. These steps were taken as the company faces steep operating losses and missed debt payments.

See our latest analysis for New Fortress Energy.

Recent weeks have seen New Fortress Energy’s share price react sharply to credit extension news, surging over 20% after-hours at one point as investors responded to the extra breathing room for restructuring. However, this bounce was short-lived in the context of its longer-term performance. The 1-year total shareholder return sits at -87.59%, which shows how much momentum has faded despite brief bursts of volatility tied to debt and restructuring headlines.

If you’re interested in what else is out there and want to see which companies have a track record of strong growth and meaningful insider commitment, now’s the perfect moment to discover fast growing stocks with high insider ownership

With such extreme volatility and a steeply discounted share price, the question now is whether New Fortress Energy represents a rare buying opportunity or if the market has already priced in all foreseeable risks and outcomes.

Most Popular Narrative: 64.1% Undervalued

New Fortress Energy is trading dramatically below the fair value estimate set by the most popular market narrative, with the last close far under consensus despite a wave of recent news.

The FLNG asset coming online is expected to significantly contribute to future earnings as it allows optimization of the portfolio, leading to increased future returns and positively impacting revenue and earnings. The initiative to reduce debt and simplify the capital structure will decrease debt costs, improving net margins and overall financial health.

How are analysts justifying such a high upside? The underpinnings of this valuation rest on powerful growth levers and dramatic turnaround assumptions. Surprised how future revenues, profit margins, and share increases could combine for this verdict? The full narrative exposes the boldest financial calls keeping this story alive.

Result: Fair Value of $3.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges and heavy reliance on key markets like Puerto Rico could quickly shift the case for a recovery at New Fortress Energy.

Find out about the key risks to this New Fortress Energy narrative.

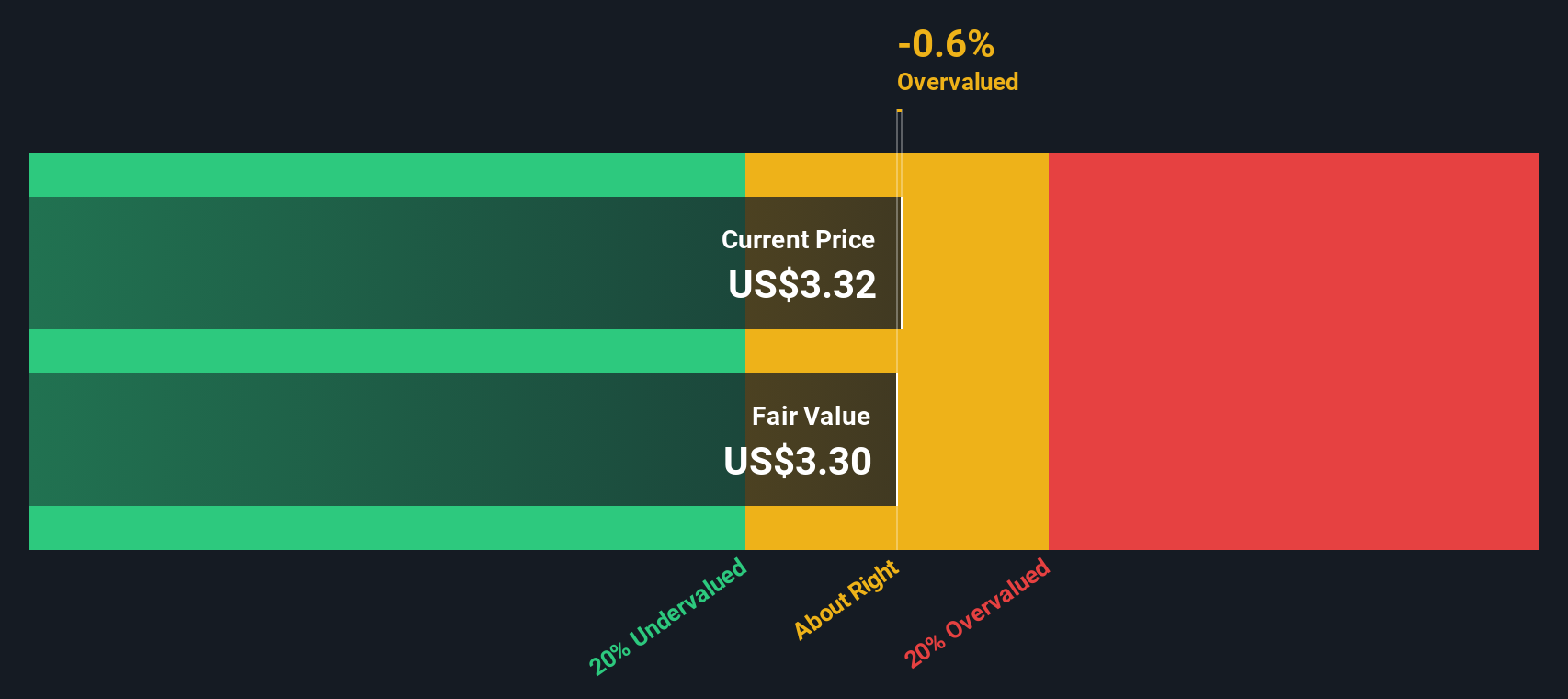

Another View: Discounted Cash Flow Perspective

For a different angle, our SWS DCF model estimates New Fortress Energy’s fair value at just $0.09 per share. This suggests the stock may actually be overvalued at current levels. This sharp contrast to the consensus "undervalued" view highlights how sensitive outcomes are to growth and profit assumptions. Could the market be overlooking critical risks, or is the truth somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out New Fortress Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own New Fortress Energy Narrative

If you see the story differently or want to interpret the data on your own terms, you can put together your own analysis in just minutes, and Do it your way.

A great starting point for your New Fortress Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself up for smarter investing by checking out companies with exciting growth trends, sector expertise, and untapped opportunities that the market might be missing.

- Capitalize on tech breakthroughs by checking out these 26 AI penny stocks that are pushing the boundaries of artificial intelligence across industries.

- Boost your passive income strategy with these 16 dividend stocks with yields > 3% offering strong yields and a history of consistent returns.

- Catch the next wave of digital innovation and review these 81 cryptocurrency and blockchain stocks shaping advancements in decentralized finance and blockchain platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives