- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

Can New Fortress Energy’s (NFE) Debt Scheme Reveal Strength or Stretch Its Core Strategy?

Reviewed by Sasha Jovanovic

- New Fortress Energy recently explored a potential debt restructuring via a UK scheme of arrangement, aiming to address financial strain caused by delayed projects weakening its cash flow and burdening its balance sheet.

- This move comes as the company is set to report increased revenue but ongoing losses, reflecting both operational challenges and underlying growth in core markets.

- With New Fortress Energy considering a UK-led debt restructuring to address cash flow pressures, we'll examine how this impacts its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

New Fortress Energy Investment Narrative Recap

To believe in New Fortress Energy as a shareholder, you need conviction that its strategy in liquefied natural gas and emerging power markets will eventually translate to improved margins and sustainable growth. The recent consideration of a UK scheme of arrangement for debt restructuring puts the spotlight on the company's high leverage, which remains the most important short-term risk and has immediate consequences for its ability to fund growth. While this may help address cash flow issues, it does not materially change the near-term catalyst tied to the company bringing key FLNG assets online, which is critical for supporting revenue and reducing risk. Recent headlines around new long-term supply agreements with Puerto Rico are especially important when viewed in the context of the company's liquidity pressures and ongoing operational challenges. Locking in multi-year contracts offers potential for stable revenue, but these deals must generate sufficient cash flow to support debt obligations, otherwise, the benefits could be undermined by broader financial strain. On the other hand, investors should be alert to...

Read the full narrative on New Fortress Energy (it's free!)

New Fortress Energy's narrative projects $3.8 billion in revenue and $557.9 million in earnings by 2028. This requires 23.2% yearly revenue growth and a $1.56 billion increase in earnings from the current -$1.0 billion.

Uncover how New Fortress Energy's forecasts yield a $3.38 fair value, a 127% upside to its current price.

Exploring Other Perspectives

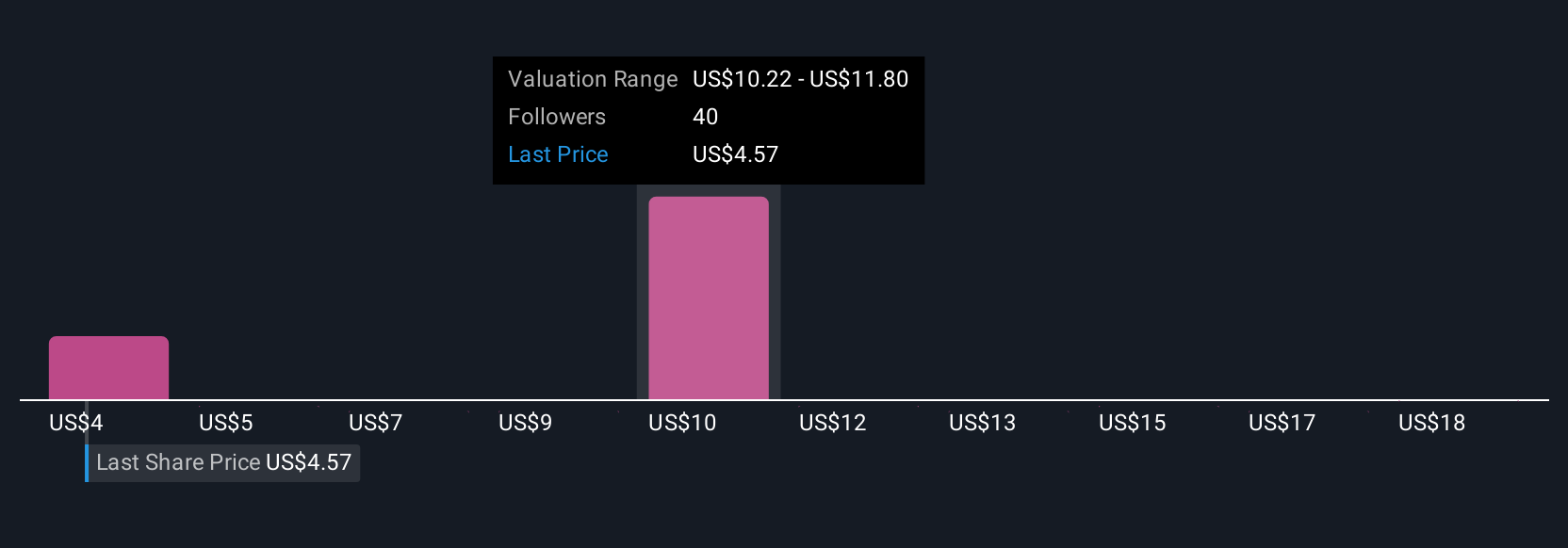

Simply Wall St Community members offer six different fair value estimates, ranging from US$0.09 to US$8.50 per share. With major long-term contracts under review and financial health in question, your outlook may depend as much on execution risk as on recent news, so it pays to consider more than one view.

Explore 6 other fair value estimates on New Fortress Energy - why the stock might be worth less than half the current price!

Build Your Own New Fortress Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Fortress Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Fortress Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Fortress Energy's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

Fair value with very low risk.

Similar Companies

Market Insights

Community Narratives