- United States

- /

- Oil and Gas

- /

- NasdaqGS:FANG

Does Diamondback Energy’s 17.7% Drop Signal a Compelling Opportunity in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Diamondback Energy is a bargain right now? You are not alone, and figuring out what the stock is really worth is the key question for investors paying attention.

- The stock saw a 4.4% slip over the past week and has dropped 17.7% year-to-date, highlighting just how quickly the market’s perception of value can change.

- Recent headlines around the energy sector, including shifts in oil prices and heightened conversation about US shale producers, have added to volatility. Diamondback specifically has been mentioned in news about acquisitions and industry consolidation, offering both risk and opportunity for investors.

- By traditional metrics, Diamondback scores a perfect 6 out of 6 on our valuation checks, suggesting strong undervaluation. However, there are more dimensions to assessing value than checklists alone, and an even smarter approach will be revealed at the end of this article.

Find out why Diamondback Energy's -23.3% return over the last year is lagging behind its peers.

Approach 1: Diamondback Energy Discounted Cash Flow (DCF) Analysis

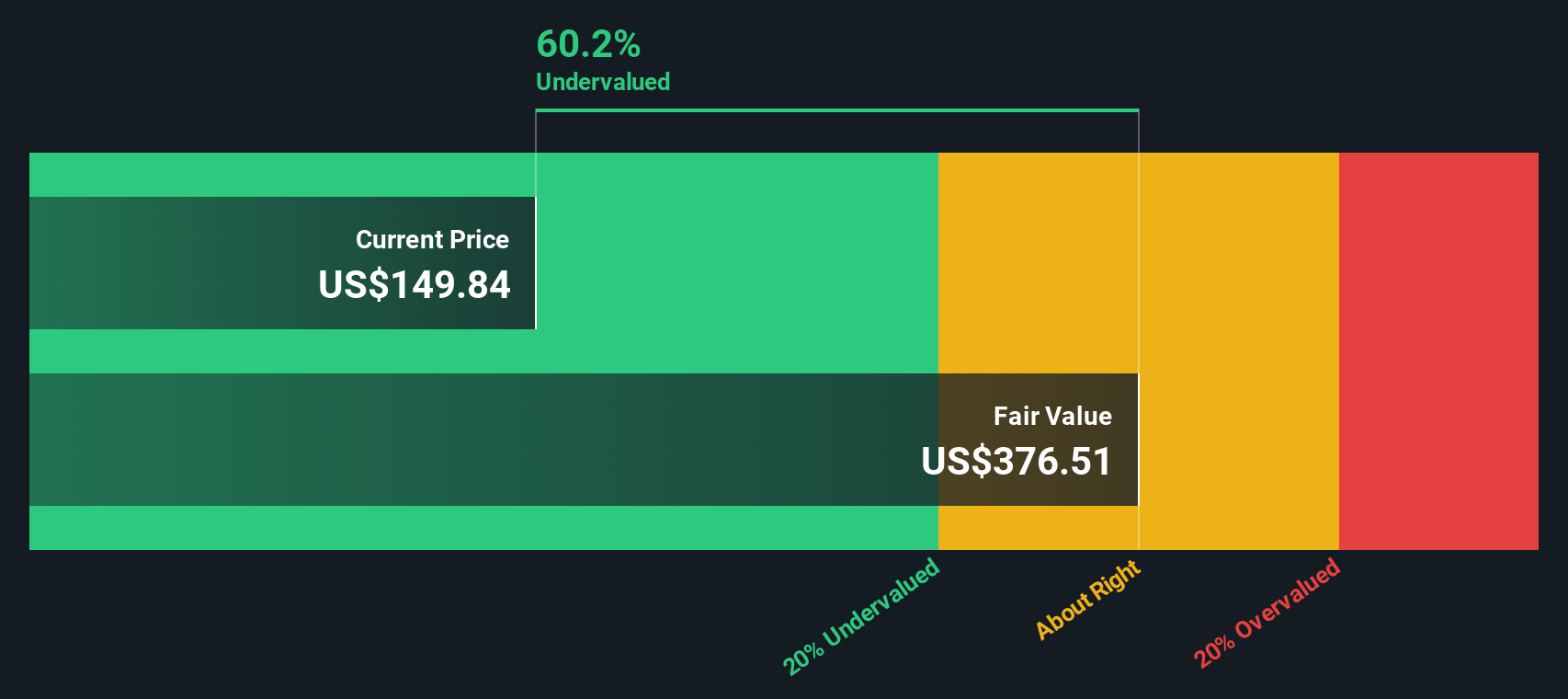

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. This approach helps investors gauge what a business is worth based on its ability to generate cash over time.

For Diamondback Energy, the DCF model uses a two-stage approach that focuses on Free Cash Flow to Equity. The company’s latest reported Free Cash Flow stands at $3.4 Billion. Analyst projections estimate that by 2029, annual Free Cash Flow will reach approximately $4.8 Billion. Analyst estimates typically extend for five years, but Simply Wall St extrapolates further and suggests even higher cash generation in subsequent years.

Using these values in the DCF model results in an intrinsic fair value of $387.41 per share. When compared to the current share price, this implies the stock is trading at a significant discount of about 64.6 percent. According to this model, Diamondback Energy appears strongly undervalued and may present an opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Diamondback Energy is undervalued by 64.6%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Diamondback Energy Price vs Earnings

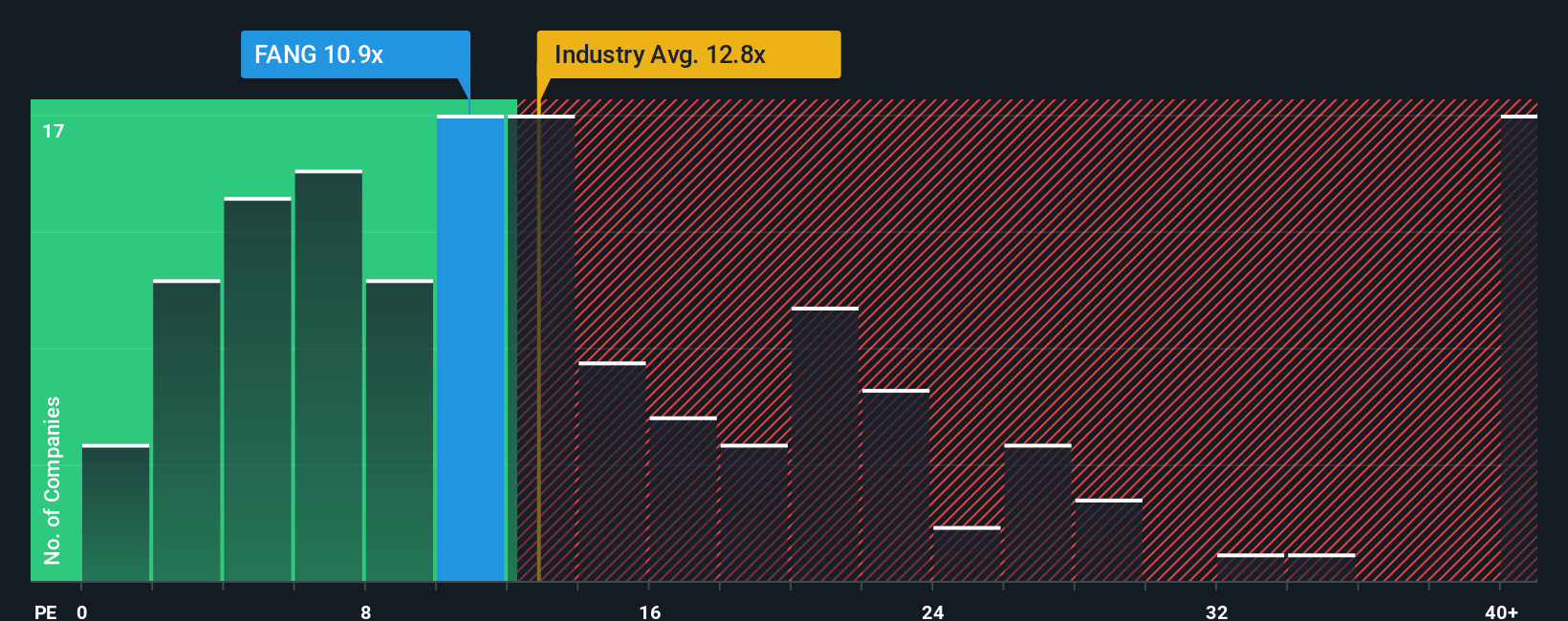

The Price-to-Earnings (PE) ratio is one of the most common ways investors value profitable companies, as it ties the company’s market value directly to its ability to generate earnings. Because Diamondback Energy is a consistently profitable business, the PE ratio is a straightforward metric for assessing if the stock is being offered at a reasonable price relative to its bottom-line performance.

However, it is important to remember that what counts as a “normal” or “fair” PE ratio does not exist in a vacuum. Higher expected earnings growth or lower risk can support a higher PE, while a riskier or slower-growing company usually deserves a lower multiple. That is why comparing multiples across different industries or risk profiles is not always apples to apples.

Currently, Diamondback Energy trades on a PE ratio of 9.5x. This stands below both the Oil and Gas industry average of 12.8x and the peer average of 22.5x. At first glance, this may signal undervaluation. To provide a more tailored benchmark, Simply Wall St calculates a “Fair Ratio,” which is a proprietary metric showing what PE multiple is justified for Diamondback, based on factors like its earnings growth, profit margin, industry position, market cap, and company-specific risks.

Unlike standard peer or industry comparisons, the Fair Ratio aims to match Diamondback’s actual business fundamentals with an appropriate valuation yardstick, bringing more nuance and context. In this case, the Fair Ratio for Diamondback is 16.2x. This is considerably higher than its current PE, indicating the market may be applying an overly cautious lens to the stock’s earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Diamondback Energy Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you believe about a company, backed up with your own assumptions about its fair value, future revenue, earnings, and margins. Instead of just relying on checklists or ratios, Narratives connect the dots between Diamondback Energy’s real-world progress, your expectations for the future, and what you think the shares are actually worth.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool used by millions of investors. They help you clarify your personal view of Diamondback Energy, compare your forecasted fair value with the stock’s current price, and decide whether now is the right time to buy or sell. Narratives are updated dynamically as news breaks or earnings are released, so your perspective always reflects the latest information.

For example, some investors might be highly optimistic, focusing on Diamondback’s successful consolidation and cost discipline, setting a fair value as high as $222. Others may be more cautious, highlighting operational risks or margin challenges, and see a fair value closer to $143. Narratives give you the tools to weigh these outlooks, as well as your own, side by side, helping you make smarter, more informed investment decisions.

Do you think there's more to the story for Diamondback Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FANG

Diamondback Energy

An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives