- United States

- /

- Oil and Gas

- /

- NasdaqGS:FANG

Diamondback Energy (FANG) Margin Miss Challenges Bullish Narratives on Profitability

Reviewed by Simply Wall St

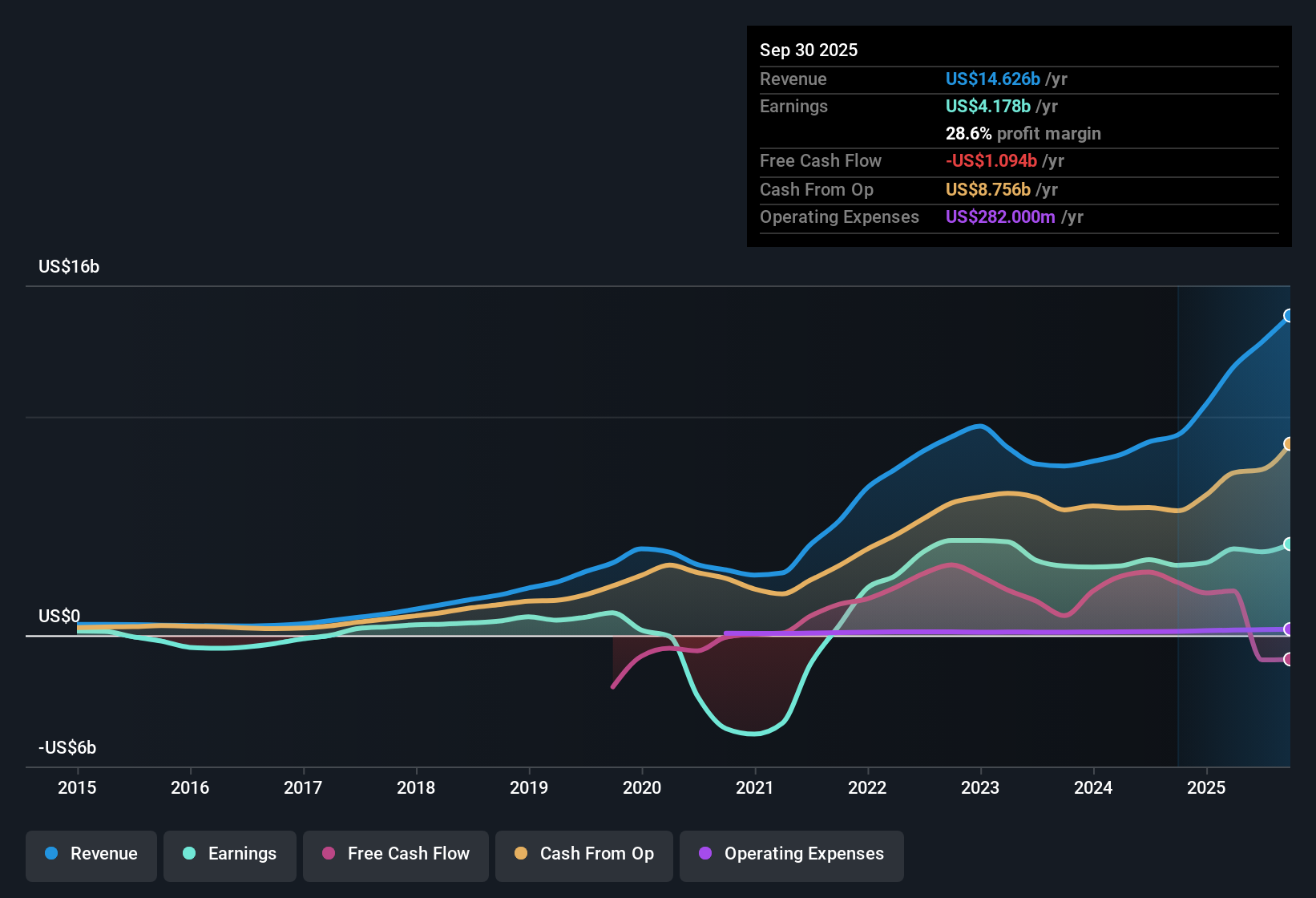

Diamondback Energy (FANG) reported a net profit margin of 28.2%, down from 35% a year ago, while earnings grew 30.4% over the past year. This growth rate is slower than its five-year average growth of 42.3%. Revenue is forecast to rise just 1.6% per year and earnings growth is expected to slow further to 0.2% annually, both trailing the broader US market. Despite tightening margins and slower growth projections, FANG trades at a 9.7x P/E, well below both its industry average of 12.7x and its peers at 22.5x. This points to continued investor interest in its value and solid historical performance.

See our full analysis for Diamondback Energy.Next, let’s see how this quarter’s results stack up against the most widely followed narratives. Here is where the numbers reinforce the crowd, and where they start to push back.

See what the community is saying about Diamondback Energy

Operating Costs Create Margin Pressure

- Profit margins dropped from 35% last year to 28.2% now, a decline of nearly 7 percentage points, reflecting rising operating costs in the business.

- According to analysts' consensus view, while recent cost reductions have supported resilient cash flow and net margins even through oil price swings, ongoing risks like electricity and water disposal inflation threaten to raise long-term operating expenses. This makes it tougher for margins to stabilize.

- Consensus notes that industry-wide efficiency gains are starting to plateau, placing more weight on cost control for future margin resilience.

- This tension adds complexity to the story. Bulls reference operational discipline, but the data shows a meaningful step down in recent margin performance.

Consistent margin pressures highlight how even leading operators must stay ahead of industry cost curves if they want to protect long-term profitability. 📈 Read the full Diamondback Energy Consensus Narrative. 📊 Read the full Diamondback Energy Consensus Narrative.

Debt Paydown Lowers Risk Profile

- No substantial insider sales and an ongoing focus on strategic asset sales (targeting $1.5 billion) have strengthened Diamondback’s balance sheet, further mitigating risk.

- Analysts' consensus view indicates that reduced financial leverage, driven by noncore asset sales and improved capital allocation, should support sustainable dividends and higher future shareholder returns.

- With dividends considered sustainable and risk described as limited, this helps explain why income investors remain engaged despite fading earnings growth rates.

- However, analysts also caution that persistent macro volatility could impact free cash flow and the sustainability of these returns if oil prices fall sharply.

Discount to Analyst Target and DCF Fair Value

- Diamondback is trading at $139.42, a 21.8% discount to the current analyst price target of $178.38 and well below its DCF fair value of $387.50.

- Analysts' consensus narrative argues this valuation gap is driven by both attractive price-to-earnings ratios (9.7x versus 12.7x industry and 22.5x peer averages) and skepticism around Diamondback’s sluggish revenue and earnings forecasts compared to broader market expectations.

- Share price upside exists if investors believe the business can sustain margins and reverse the downtrend in growth.

- However, consensus notes that to justify the price target, Diamondback would need to accelerate earnings to $4.5 billion by 2028 and see its PE ratio rise to 14.3x, now above the sector average.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Diamondback Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a different angle? Take just a few minutes to craft your own interpretation and make your perspective heard. Do it your way.

A great starting point for your Diamondback Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Diamondback Energy's margins are narrowing, and future growth looks uncertain, with both earnings and revenue forecasts trailing the broader US market.

If reliable, steady performance is a priority, use our stable growth stocks screener (2079 results) to find companies that consistently deliver solid earnings and revenue growth no matter the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FANG

Diamondback Energy

An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives