- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

Will Expand Energy’s (EXE) New $3.5 Billion Credit Facility Alter Its Growth Narrative?

Reviewed by Sasha Jovanovic

- On September 30, 2025, Expand Energy entered into an amended and restated credit agreement with JPMorgan Chase and other lenders, securing a US$3.5 billion unsecured revolving credit facility with the potential to expand to US$4.5 billion, maturing in five years.

- This substantial increase in financing capacity reflects lender confidence in Expand Energy's risk management and may support future growth or operational initiatives.

- We'll now explore how this renewed credit facility could impact Expand Energy's investment narrative, especially given the company’s increased financial flexibility.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Expand Energy Investment Narrative Recap

To believe in Expand Energy’s story as a shareholder, you need confidence in its ability to capitalize on North American gas demand and recurring operational efficiencies, while managing exposure to the global energy transition. The new US$3.5 billion unsecured credit facility, expandable to US$4.5 billion, meaningfully increases financial flexibility, but doesn’t directly change the most important upcoming catalyst: the company’s ability to drive productivity gains in its core basins. The persistent risk remains long-term demand uncertainty from global decarbonization policies. A recent development of particular interest is the completion of the latest US$99.99 million share buyback program. While not directly related to the expanded credit facility, it does indicate a focus on capital returns, which may be further supported by improved borrowing capacity, especially when paired with recurring commitments to dividend payouts. However, it’s important for investors to recognize that, unlike the additional liquidity, the threat of stricter emissions regulation could still...

Read the full narrative on Expand Energy (it's free!)

Expand Energy's narrative projects $13.2 billion in revenue and $4.0 billion in earnings by 2028. This requires 14.3% yearly revenue growth and a $3.8 billion increase in earnings from the current $206.0 million.

Uncover how Expand Energy's forecasts yield a $128.78 fair value, a 22% upside to its current price.

Exploring Other Perspectives

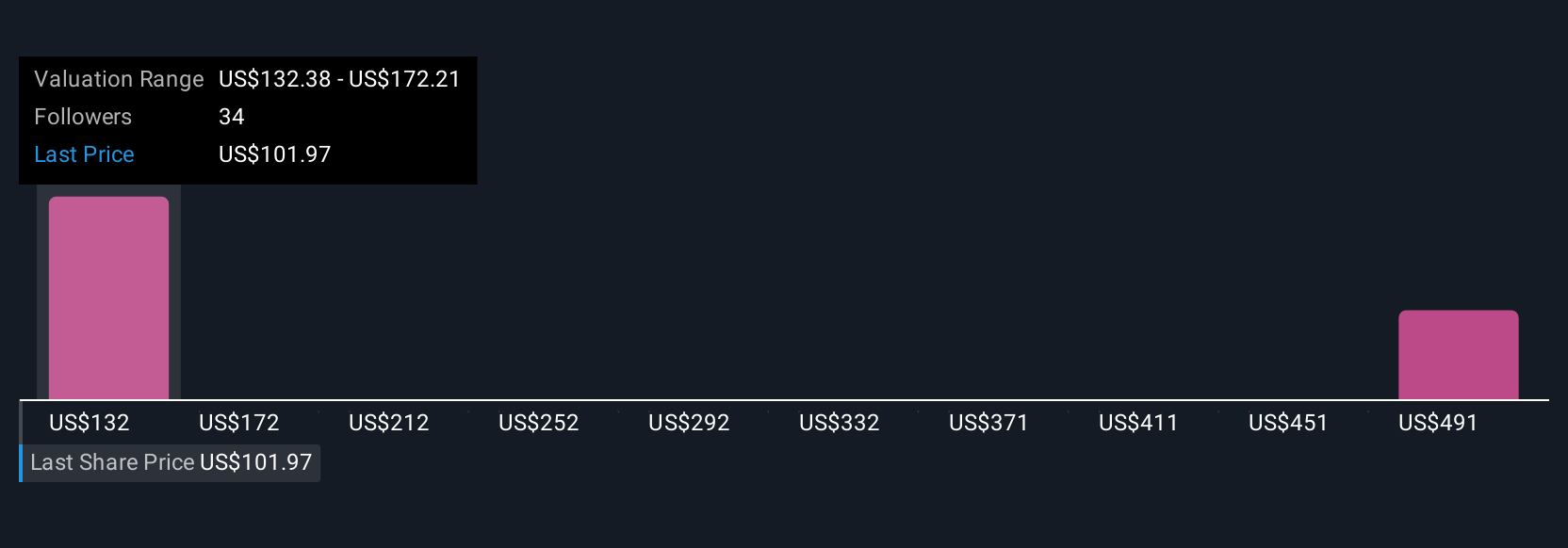

Fair value estimates from the Simply Wall St Community span from US$128.78 to US$532.34 across two viewpoints. These divergent opinions sit against the backdrop of forecasts for robust earnings growth, inviting you to consider the range of possible futures for Expand Energy.

Explore 2 other fair value estimates on Expand Energy - why the stock might be worth over 5x more than the current price!

Build Your Own Expand Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expand Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Expand Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expand Energy's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives