- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

Revised Guidance and Long-Term Gas Deal Might Change The Case For Investing In Expand Energy (EXE)

Reviewed by Sasha Jovanovic

- Expand Energy Corporation recently reported third-quarter 2025 financial results, posting revenues of US$2.97 billion and net income of US$547 million for the period, alongside a revised full-year production guidance and an upcoming dividend payment.

- A key development was the company’s 15-year gas supply agreement with Lake Charles Methanol, which adds long-term revenue certainty and supports its position in the evolving clean energy market.

- We'll explore how the increased production guidance and capital efficiency gains impact Expand Energy’s long-term investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Expand Energy Investment Narrative Recap

For investors considering Expand Energy, the core thesis centers on its ability to drive operational efficiencies and capture growing US natural gas demand, particularly as new LNG capacity continues to emerge. The strong Q3 results, revised production guidance, and affirmed dividend all support the near-term catalyst of margin improvement, while ongoing asset concentration in mature basins remains the key risk; recent updates do not materially shift this balance in the short run.

Among the recent announcements, the upward revision in full-year production guidance stands out. This change signals increased operational output and efficiency gains, which directly tie into the market’s current expectation for higher near-term cash flows and could help support ongoing shareholder returns if sustained.

By contrast, investors should be aware of the lingering risk that higher output from mature basins…

Read the full narrative on Expand Energy (it's free!)

Expand Energy's outlook anticipates $13.2 billion in revenue and $4.0 billion in earnings by 2028. This is based on a forecast annual revenue growth rate of 14.3% and a dramatic earnings increase of about $3.8 billion from current earnings of $206 million.

Uncover how Expand Energy's forecasts yield a $128.78 fair value, a 25% upside to its current price.

Exploring Other Perspectives

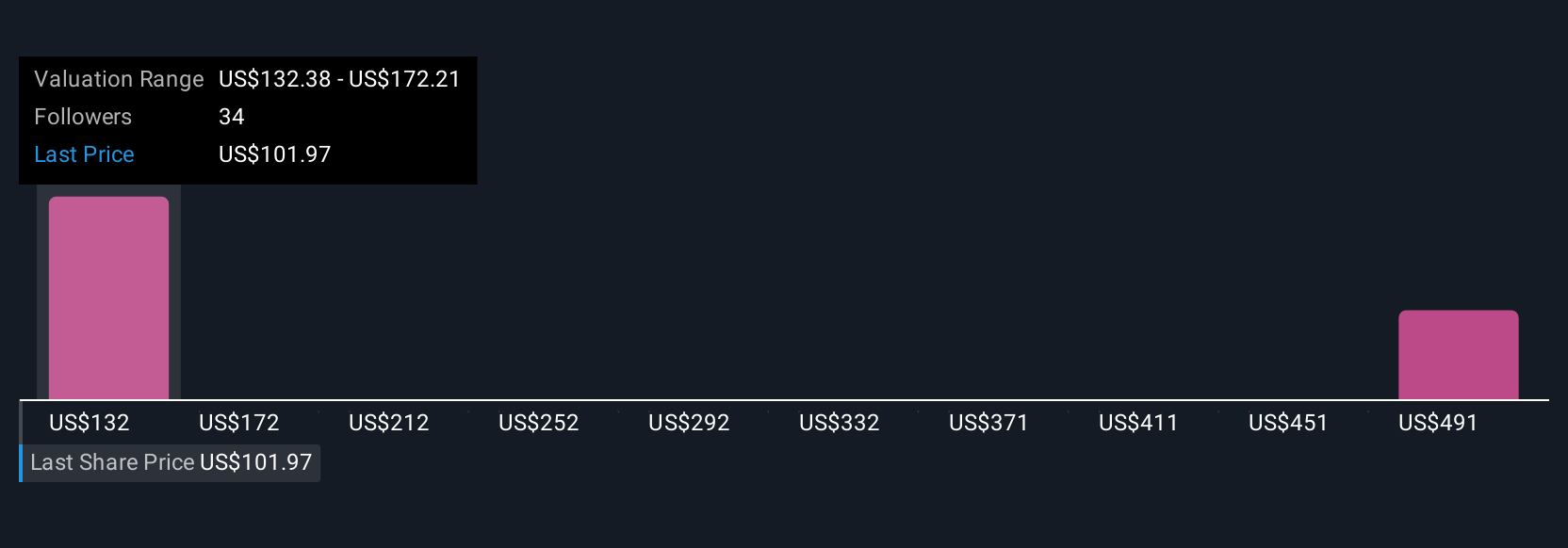

Simply Wall St Community members provided two fair value estimates for Expand Energy, ranging from US$128.78 to US$265.84 per share. While these represent diverse views, the company’s future hinges on whether efficiency gains in core basins continue to outpace structural cost risks.

Explore 2 other fair value estimates on Expand Energy - why the stock might be worth just $128.78!

Build Your Own Expand Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expand Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Expand Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expand Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives