- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLNE

Clean Energy Fuels (CLNE): Assessing Valuation Following Q3 Beat and Major RNG Expansion Moves

Reviewed by Simply Wall St

Clean Energy Fuels (CLNE) just posted third-quarter results that surpassed revenue and EBITDA expectations. The company also advanced multiple renewable natural gas projects and signed several new supply agreements. Its efforts in ramping up RNG production and expanding partnerships are catching investors’ eyes.

See our latest analysis for Clean Energy Fuels.

Despite Clean Energy Fuels’ operational progress and upbeat earnings surprise, the 1-year total shareholder return of -31.3% and a year-to-date share price return of -14.8% show momentum has been difficult to sustain, with the latest price closing at $2.24. While exciting long-term prospects such as new renewable natural gas projects and fresh agreements keep investors engaged, recent price pressure suggests the market is waiting for more consistent earnings or clearer profitability before rerating the stock decisively.

If these recent moves have you interested in broader energy or sustainability trends, consider expanding your playbook and discover fast growing stocks with high insider ownership

With shares still trading at less than half the average analyst price target despite recent operational wins, the question arises: is Clean Energy Fuels undervalued at current levels, or is the market already factoring in all of the future growth potential?

Most Popular Narrative: 50.2% Undervalued

With Clean Energy Fuels trading at $2.24 and the most popular narrative pegging fair value at $4.49, there is a dramatic gap between sentiment and price. The current disconnect sits at the heart of ongoing debates about the company’s potential and risks.

Steady expansion in RNG supply capabilities, evident in the ramp-up of several new dairy RNG production facilities, should enhance vertical integration and supply security, increasing the share of high-margin RNG sales and driving revenue growth as production scales.

Want to know the numbers behind this bold fair value? One key assumption is that profit margins could undergo a dramatic transformation, shocking even seasoned oil and gas investors. Intrigued what factors might spark such a turnaround? See the framework and projections that back this view in the full narrative.

Result: Fair Value of $4.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as weak adoption of RNG vehicles and volatile credit pricing could quickly change the outlook and test these optimistic projections.

Find out about the key risks to this Clean Energy Fuels narrative.

Another View: Sizing Up Against Sales Ratios

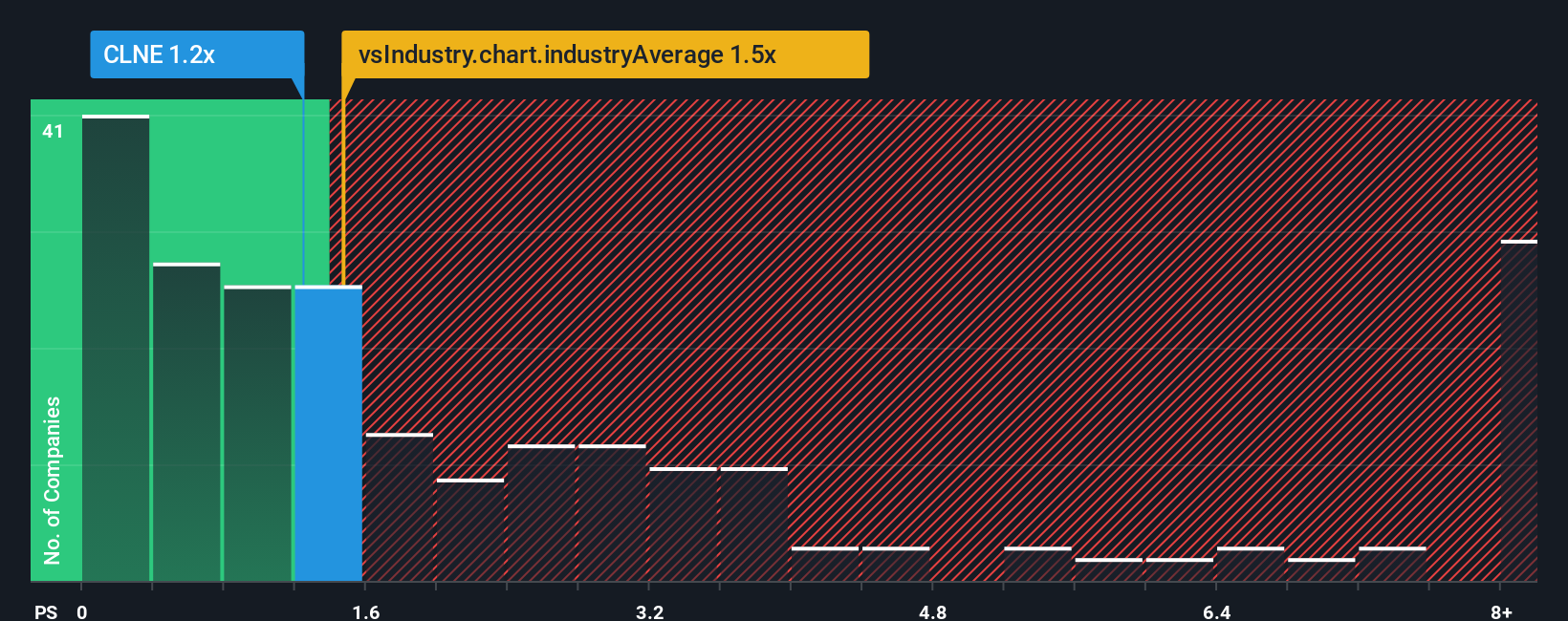

While optimism surrounds Clean Energy Fuels’ fair value versus current share price, our review of its price-to-sales ratio offers a twist. The company trades at 1.2x sales, which is cheaper than the US Oil and Gas industry average of 1.4x, but still almost double the fair ratio of 0.7x. This suggests the market is not pricing in much safety margin and could point to higher downside risk if growth falls short. Does this signal a value trap, or could momentum shift if earnings finally surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clean Energy Fuels Narrative

If you see the story differently or want to dig into the numbers yourself, it takes just a few minutes to craft your own perspective. Do it your way

A great starting point for your Clean Energy Fuels research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Use the Simply Wall Street Screener to confidently pinpoint stocks matching what matters to you most right now.

- Catch high potential with juicy yields by checking out these 17 dividend stocks with yields > 3% offering robust income streams above 3%.

- Spot up-and-coming disruptors with these 25 AI penny stocks that tap into the AI megatrend before the crowd notices.

- Seize overlooked value and target strong future returns by reviewing these 859 undervalued stocks based on cash flows picked for their underappreciated cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLNE

Clean Energy Fuels

Offers natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives