- United States

- /

- Oil and Gas

- /

- NasdaqGS:CHRD

The Bull Case For Chord Energy (CHRD) Could Change Following Weaker Q3 Results and Updated Guidance

Reviewed by Sasha Jovanovic

- Chord Energy Corporation recently announced its third quarter 2025 financial results, reporting a decrease in both revenue and net income year-on-year, along with updated production guidance for the fourth quarter and full year.

- The simultaneous affirmation of its dividend and completion of a significant share repurchase underlines management's continued focus on shareholder returns amid operational headwinds.

- We'll explore how Chord Energy's weaker-than-expected earnings and revised production outlook may impact its longer-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Chord Energy Investment Narrative Recap

To be a Chord Energy shareholder, you need to believe in the company's ability to consistently generate free cash flow and maintain operational efficiency in the Williston Basin, even as production shows only incremental improvements. The recent quarterly results, with lower revenue, earnings, and slightly reduced production guidance, represent a headwind for the near-term outlook, but do not fundamentally disrupt the potential for capital returns, which remains a key catalyst. The biggest risk continues to be ongoing high decline rates in core shale assets, creating pressure to sustain drilling and capital expenditures.

The company's decision to affirm a $1.30 per share quarterly dividend, despite weaker financials, stands out. Regular, stable payouts are especially meaningful for investors focused on income and signal continued prioritization of shareholder returns, tying directly into the investment thesis but also closely linked to the sustainability of future cash flow amid elevated operational demands.

By contrast, investors should be aware that ongoing production declines in legacy wells can create a persistent need for higher capital investment to maintain output...

Read the full narrative on Chord Energy (it's free!)

Chord Energy's outlook anticipates $4.4 billion in revenue and $1.0 billion in earnings by 2028. This reflects an annual revenue decrease of 4.3% and an earnings increase of roughly $734 million from the current $265.7 million.

Uncover how Chord Energy's forecasts yield a $129.82 fair value, a 49% upside to its current price.

Exploring Other Perspectives

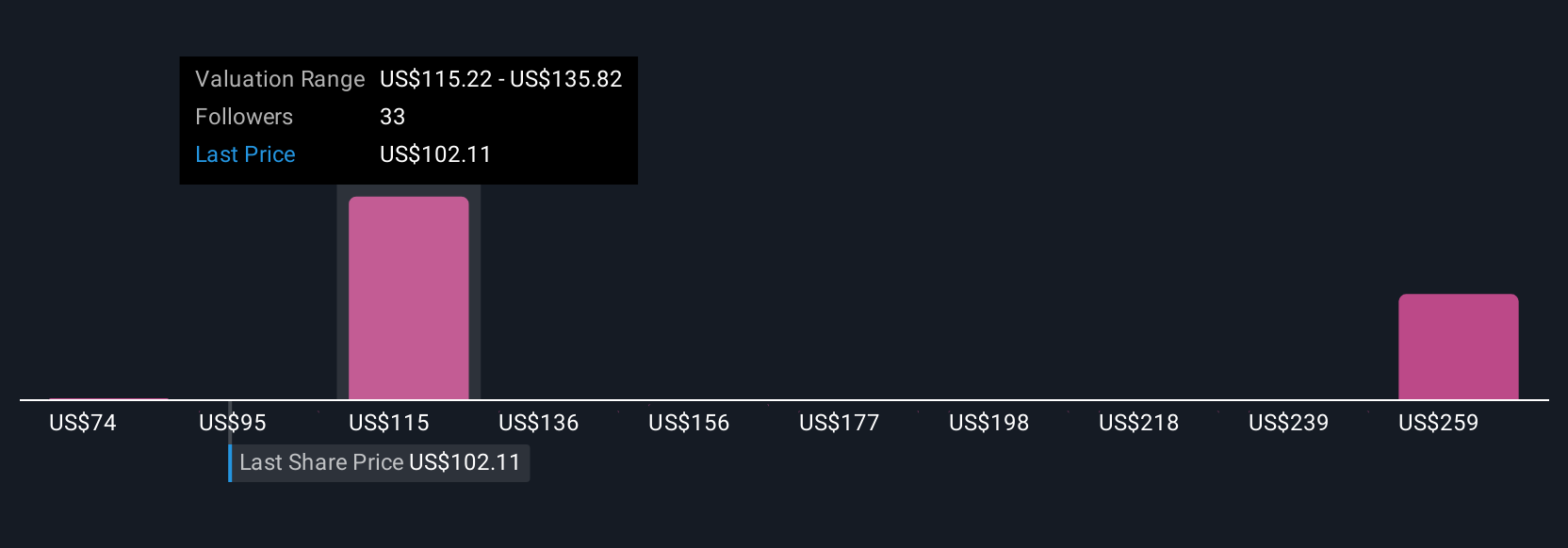

Simply Wall St Community members estimate fair values for Chord Energy ranging from US$74 to US$386, based on five distinct forecasts. While some anticipate a wide upside, the persistent risk of rising capital requirements could shape outcomes for future cash flow and margins, so consider several viewpoints before deciding where you stand.

Explore 5 other fair value estimates on Chord Energy - why the stock might be worth 15% less than the current price!

Build Your Own Chord Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Chord Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chord Energy's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRD

Chord Energy

Operates as an independent exploration and production company in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives