- United States

- /

- Oil and Gas

- /

- NasdaqGS:BRY

Berry (BRY): One-Off $3.9M Loss Challenges Bull Case on Margin-Led Growth

Reviewed by Simply Wall St

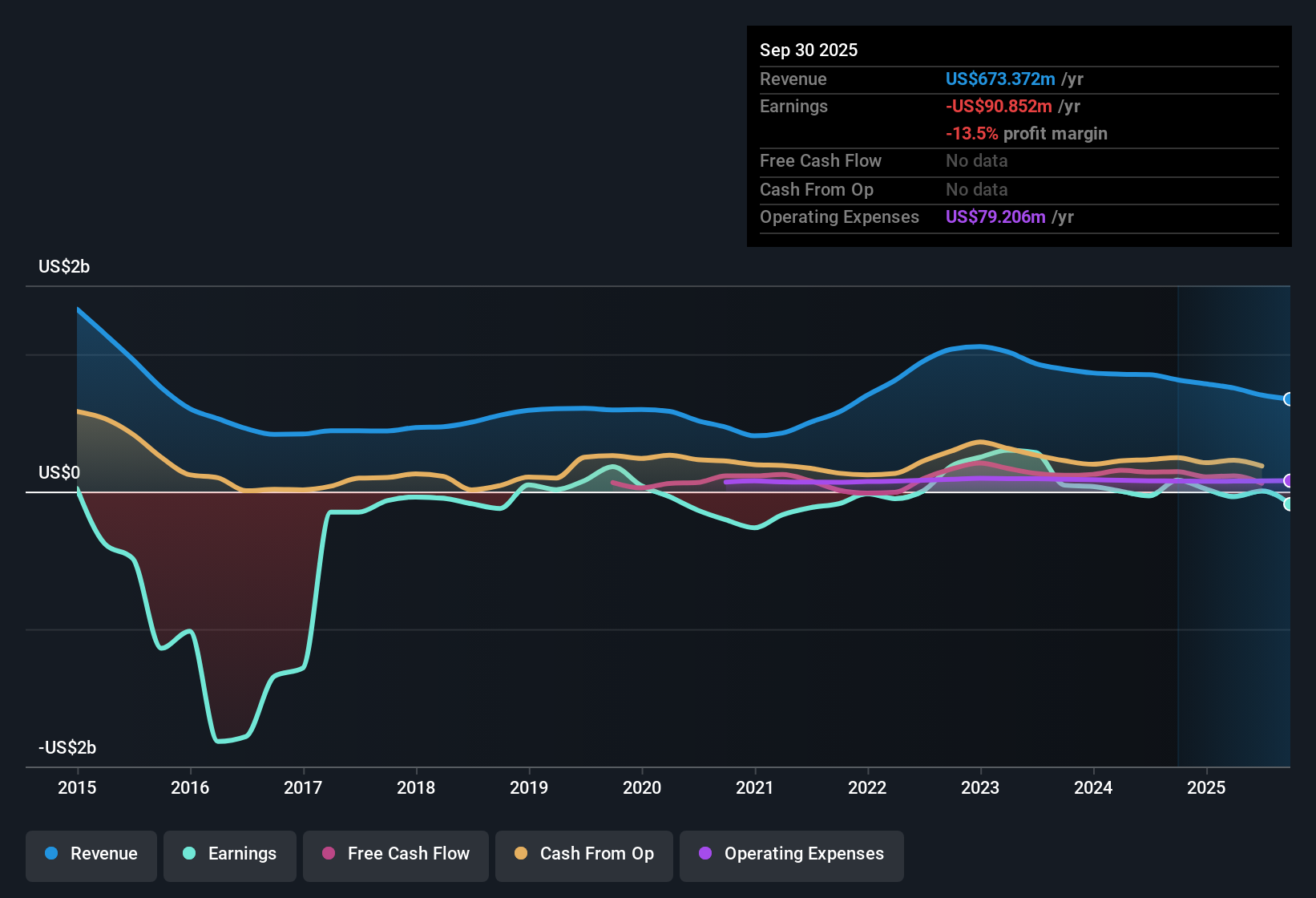

Berry (BRY) has become profitable over the past five years, reporting an average earnings growth of 41.6% per year. Looking ahead, earnings are expected to surge another 159.2% annually, but revenue is forecast to decline at an average pace of -1.1% per year for the next three years. The company also recorded a one-off loss of $3.9 million in the most recent financial year, tempering the near-term earnings outlook. Investors will be weighing this mix of rapid projected earnings growth and shrinking top-line, especially as Berry trades at a Price-to-Earnings ratio of 51.1x, well above the industry and peer averages.

See our full analysis for Berry.Next, we’ll see how these latest results measure up against the most-watched narratives. This is where the data gets put to the test; some views will be confirmed, while others may face a reality check.

See what the community is saying about Berry

Margins Expected to Climb Despite Lower Sales

- Analysts forecast profit margins increasing from 0.7% today to 3.5% in three years, even as revenue is projected to decline by 1.1% per year.

- The analysts' consensus view highlights operational efficiencies and hedging as key drivers behind this margin expansion. However,

- Persistent investment in mature fields and changes in California's energy policy could raise compliance costs or restrict production, directly threatening these higher margins.

- Tighter supply and a sizeable project portfolio may help support free cash flow if cost reductions continue as expected.

See how analysts balance these headwinds and tailwinds in their full narrative. 📊 Read the full Berry Consensus Narrative.

Valuation Premium: 51.1x PE Ratio vs Peers

- Berry currently trades at a Price-to-Earnings ratio of 51.1x, which is well above both the industry average of 12.7x and peers at 6.9x.

- According to the consensus narrative, this high valuation gap is justified only if future margin gains and projected 159.2% annual earnings growth occur as expected.

- For the current share price of $3.31 to be warranted, Berry would need to achieve 2028 earnings of $23.1 million and sustain a PE multiple of 19.9x, which is still more than 50% above the sector's present average.

- Analyst price targets of $4.04 imply almost 22% upside from current levels, reflecting optimism but also significant execution risk if those improvements do not materialize.

Risks: Heavy Geographic and Policy Exposure

- Berry’s operations are concentrated in California, where regulatory or legislative moves toward decarbonization could raise compliance costs or restrict drilling.

- The consensus narrative cautions that industry-wide transitions such as growth in renewables and the potential for more stringent local policy create significant headwinds.

- Limited diversification leaves Berry vulnerable to localized disruptions and supply chain bottlenecks that larger, more diversified competitors can better withstand.

- The need to continue investing in aging fields could reduce free cash flow, putting the durability of any future margin expansion at risk if macro conditions become less favorable.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Berry on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Bring your viewpoint to life in just a few minutes and add your voice to the conversation. Do it your way

A great starting point for your Berry research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Berry’s high valuation and dependency on margin expansion highlight the risk that disappointing earnings or persistent revenue declines could undermine investor returns.

If you want to focus on companies trading at more reasonable valuations with stronger upside potential, check out these 836 undervalued stocks based on cash flows for a fresh set of ideas that may better fit your investment strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRY

Berry

Operates as an independent upstream energy company in the western United States.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives