- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Did the Bechtel LNG Contract Just Shift Baker Hughes' (BKR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Bechtel announced it has awarded Baker Hughes a contract to supply primary liquefaction equipment, including two Frame 7 gas turbines and six centrifugal compressors, for Train 5 of NextDecade’s Rio Grande LNG facility in Texas, building on a framework agreement covering LNG expansion at the site.

- This contract win reflects continued demand for Baker Hughes’ advanced LNG technologies and its Cordant™ digital solution, underscoring the company's diversification into both hardware and digital infrastructure across multiple project phases.

- We'll examine how this major Bechtel contract expands Baker Hughes’ LNG order backlog and impacts the company's investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Baker Hughes Investment Narrative Recap

To believe in Baker Hughes as a shareholder, you need confidence in the company’s ability to capitalize on rising global LNG demand, expand its digital offerings, and secure large-scale orders that reinforce its backlog. The recent Bechtel contract for the Rio Grande LNG facility does grow this backlog, supporting near-term revenue visibility, but does not change the fact that Baker Hughes remains exposed to LNG policy risk and volatility in upstream oil and gas, which continue to be the primary catalysts and most material risks for the business.

One relevant recent announcement is Baker Hughes’ award to supply liquefaction equipment for Sempra Infrastructure’s Port Arthur LNG Phase 2 project, again featuring Frame 7 turbines and compressors. Together with the latest Bechtel contract, this highlights the strong momentum in landing multi-train LNG deals, which are critical to building a resilient service backlog, though execution risks and potential exposure to global policy changes remain active factors influencing future outcomes.

However, it is equally important for investors to understand that should policy shifts accelerate the adoption of renewables or electrification, the long-term LNG growth thesis could face unexpected headwinds…

Read the full narrative on Baker Hughes (it's free!)

Baker Hughes' outlook projects $29.1 billion in revenue and $2.9 billion in earnings by 2028. This assumes a 1.8% annual revenue growth rate and a decrease in earnings of $0.1 billion from the current $3.0 billion.

Uncover how Baker Hughes' forecasts yield a $52.43 fair value, a 10% upside to its current price.

Exploring Other Perspectives

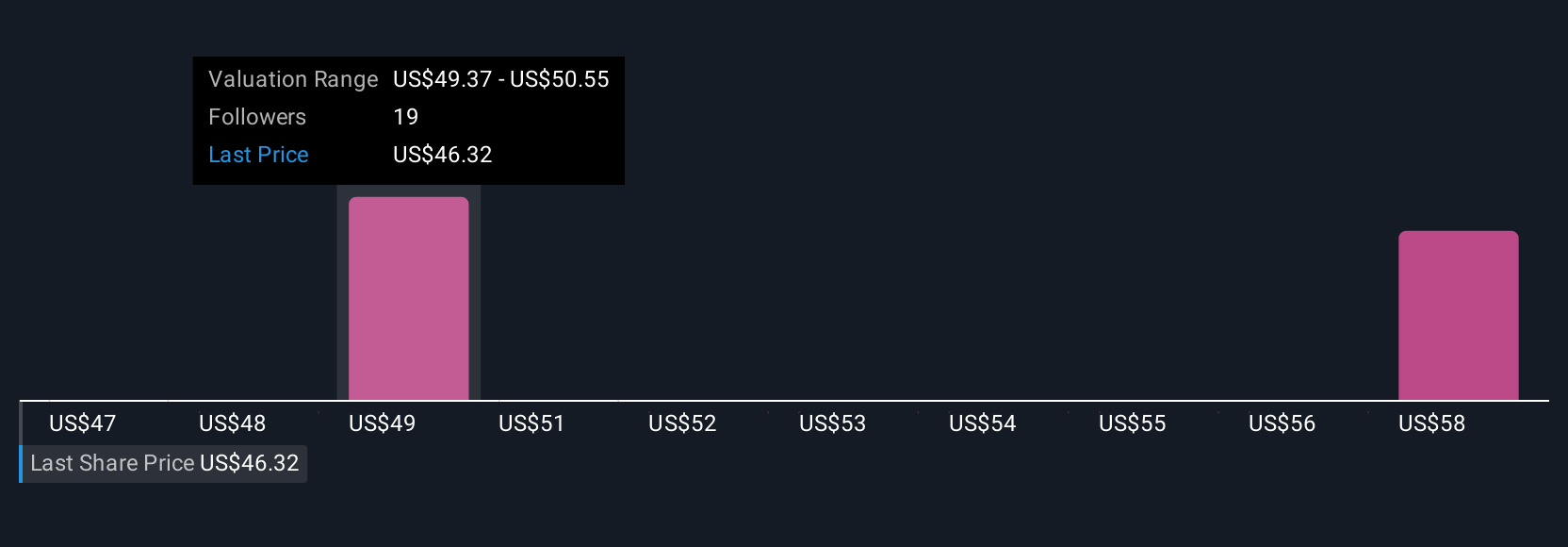

Four recent fair value estimates from the Simply Wall St Community for Baker Hughes range from US$50 to US$66.36 per share. With LNG exposure amplifying both catalysts and risks, it’s clear opinions differ, so take time to review several viewpoints.

Explore 4 other fair value estimates on Baker Hughes - why the stock might be worth as much as 39% more than the current price!

Build Your Own Baker Hughes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baker Hughes research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Baker Hughes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baker Hughes' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives