- United States

- /

- Oil and Gas

- /

- NasdaqGS:ARLP

Alliance Resource Partners (ARLP): Exploring Valuation After Recent Modest Share Price Movements

Reviewed by Simply Wall St

Alliance Resource Partners (ARLP) shares have seen some modest movement lately, gaining just over 1% in the past week but dipping slightly over the past month. Investors might be eyeing recent performance for clues about where the stock could head next.

See our latest analysis for Alliance Resource Partners.

While Alliance Resource Partners’ recent share price has seen only minor shifts, its broader run tells a more compelling story. Despite a dip so far this year, its one-year total shareholder return of nearly 3% and a remarkable 1,111% total return over five years suggest the long-term momentum is still very much alive. This hints that the market continues to see underlying value and growth potential.

If you’re curious about what other fast-rising opportunities might be out there, now could be the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With Alliance Resource Partners still trading at a notable discount to analyst targets, the question remains: is this a hidden value play, or has the market already factored in all the company’s future growth?

Most Popular Narrative: 18% Undervalued

The prevailing narrative sees Alliance Resource Partners' fair value well above its last close, implying room for further upside if key catalysts materialize. The stage is set for a closer look at what is powering this upbeat outlook.

Recent legislative and administrative shifts in U.S. energy policy, such as regulatory reprieves for coal plants, the phasing out of renewable tax credits in favor of baseload power, and direct financial incentives to keep fossil fuel plants operational, have created the most favorable regulatory environment for coal in decades. These tailwinds should support stable or potentially higher future coal sales volumes and improve longer-term revenue visibility for Alliance Resource Partners.

Find out what projections are fueling this price target. The fair value is built around assumptions you might not expect about revenue and profit expansion. Discover which bold levers are driving the analysts’ consensus and see if you agree with their rationale.

Result: Fair Value of $30.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy shifts or faster than expected coal plant retirements could quickly undermine demand and challenge the optimistic outlook for Alliance Resource Partners.

Find out about the key risks to this Alliance Resource Partners narrative.

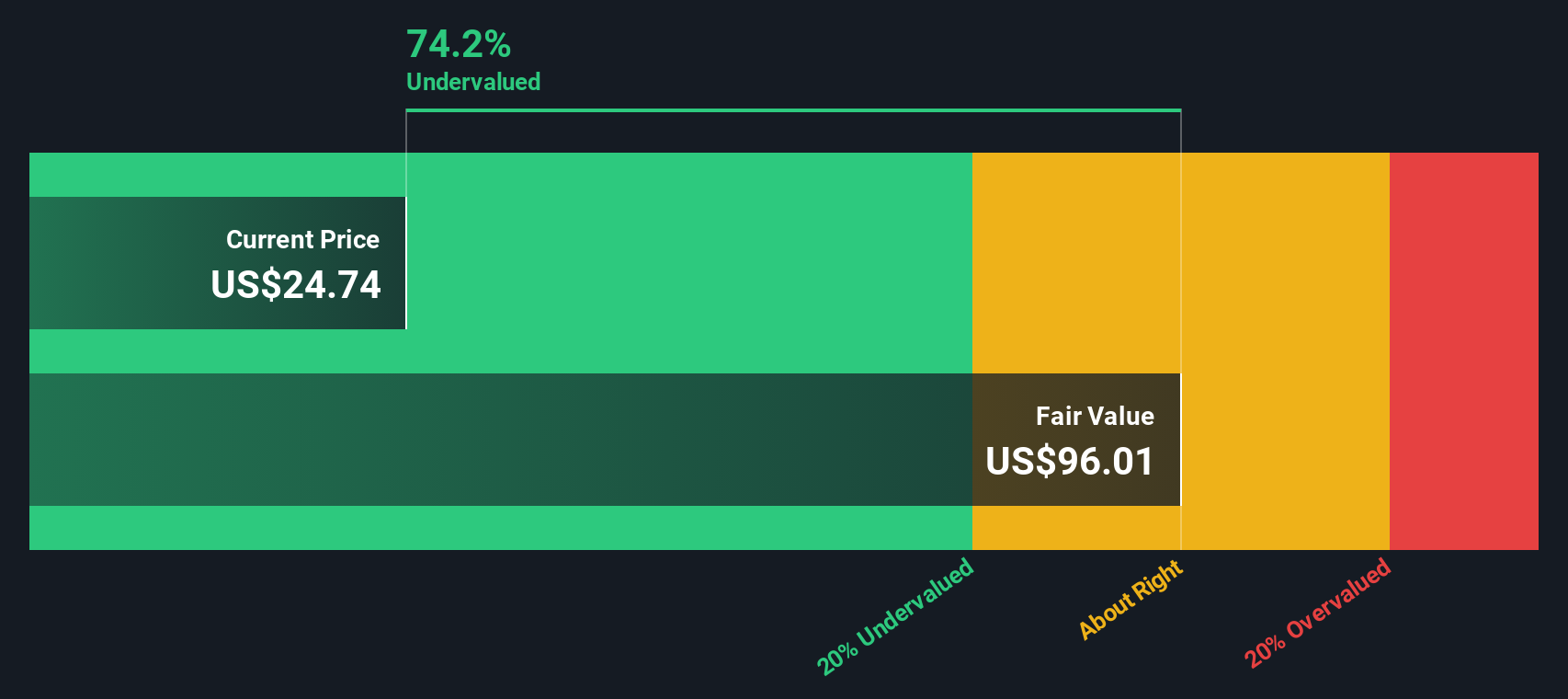

Another View: Sizing Up the DCF Perspective

Looking from another angle, the SWS DCF model arrives at a projected fair value of $95.52 per share for Alliance Resource Partners. This suggests an even deeper undervaluation compared to the consensus, emphasizing how much depends on future assumptions. Could the true upside be much greater than analysts expect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alliance Resource Partners Narrative

If you have a different perspective or want to dig into the numbers for yourself, it only takes a few minutes to craft your own view and Do it your way.

A great starting point for your Alliance Resource Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on your momentum and widen your horizons with powerful research tools that could reveal your next winning stock idea before the crowd catches on.

- Uncover potential breakout performers when you tap into these 861 undervalued stocks based on cash flows, which is packed with companies trading below their intrinsic value.

- Earn while you grow by tapping into steady income opportunities through these 17 dividend stocks with yields > 3%, featuring attractive yields above 3%.

- Stay ahead of the AI revolution by targeting innovators shaping tomorrow with these 24 AI penny stocks on your radar now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARLP

Alliance Resource Partners

A diversified natural resource company, engages in the production and marketing of coal to utilities and industrial users in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives