- United States

- /

- Oil and Gas

- /

- NasdaqCM:AREC

Here's Why American Resources (NASDAQ:AREC) Can Afford Some Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that American Resources Corporation (NASDAQ:AREC) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for American Resources

How Much Debt Does American Resources Carry?

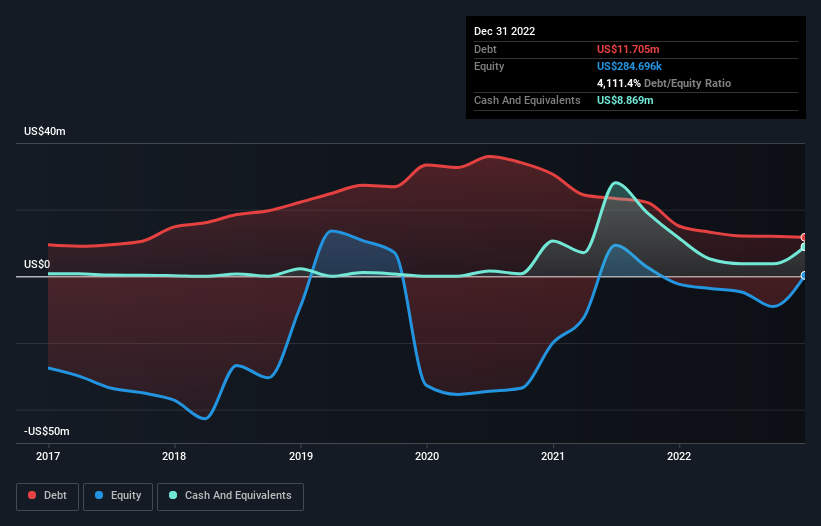

The image below, which you can click on for greater detail, shows that American Resources had debt of US$11.7m at the end of December 2022, a reduction from US$15.1m over a year. However, it does have US$8.87m in cash offsetting this, leading to net debt of about US$2.84m.

A Look At American Resources' Liabilities

According to the last reported balance sheet, American Resources had liabilities of US$27.4m due within 12 months, and liabilities of US$28.2m due beyond 12 months. Offsetting this, it had US$8.87m in cash and US$660.8k in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$46.1m.

American Resources has a market capitalization of US$103.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine American Resources's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year American Resources wasn't profitable at an EBIT level, but managed to grow its revenue by 409%, to US$39m. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

Caveat Emptor

Even though American Resources managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable US$24m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of US$1.4m. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that American Resources is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AREC

American Resources

Engages in the production of rare earth and critical mineral concentrates for the infrastructure and electrification markets.

Moderate risk with limited growth.

Market Insights

Community Narratives