- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Assessing Fannie Mae’s (FNMA) Valuation Following Q3 Profit Dip and Leadership Change

Reviewed by Simply Wall St

Federal National Mortgage Association (FNMA) just released its third quarter results, revealing a dip in net income compared to last year. In addition, the sudden exit of a key executive drew attention from investors.

See our latest analysis for Federal National Mortgage Association.

Both the profit dip and the executive shakeup likely contributed to recent share price turbulence, with the stock slipping 10.27% over the past month alone. That said, momentum remains impressive in the bigger picture, as the total shareholder return stands at an eye-catching 280% over the last twelve months. This has rewarded patient investors with long-term gains even as some short-term nerves appear.

If these dramatic moves have you looking for your next opportunity, now’s the perfect moment to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares recently sliding but longer-term gains still in play, the real question now is whether Fannie Mae is trading at a bargain after the pullback or if the market has already priced in its future prospects.

Price-to-Sales Ratio of 2.1x: Is it justified?

At its last closing price of $10.66, Federal National Mortgage Association trades at a price-to-sales (P/S) ratio of 2.1x, indicating investors are paying $2.10 for every $1 of revenue generated. Compared to similar companies, this figure stands out as attractive.

The price-to-sales ratio is especially important for diversified financials like Fannie Mae, where traditional profitability metrics can fluctuate due to large, industry-specific charges or losses. It reflects how much the market values current revenue streams, regardless of recent profits or losses. A lower P/S often signals a stock that market participants might be undervaluing, especially if the business has potential to improve its results in coming years.

When stacked up against the US Diversified Financial industry average of 2.5x and a peer average of 3.8x, Fannie Mae’s 2.1x appears conservative. Importantly, this is also well below an estimated “fair” P/S ratio of 7.1x, a level the market could move towards if sentiment shifts or performance improves further.

Explore the SWS fair ratio for Federal National Mortgage Association

Result: Price-to-Sales of 2.1x (UNDERVALUED)

However, slowing annual revenue growth and recent net losses indicate that any further upside may be limited if financial trends do not improve.

Find out about the key risks to this Federal National Mortgage Association narrative.

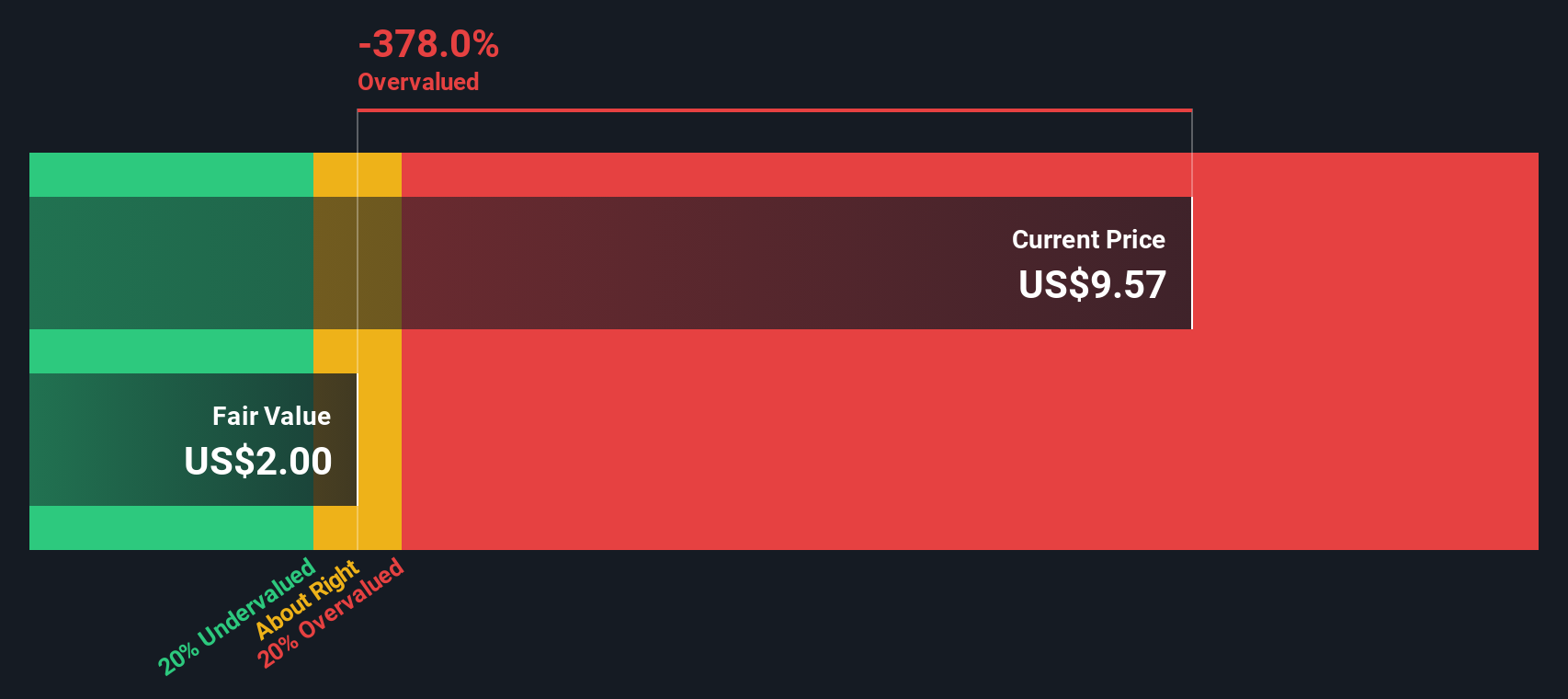

Another View: Discounted Cash Flow Says Shares Are Overvalued

While Fannie Mae’s price-to-sales ratio suggests value, our SWS DCF model points to a more cautious story. The DCF analysis estimates fair value at just $2 per share, which is well below the current market price. Does this signal a hidden risk that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal National Mortgage Association for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal National Mortgage Association Narrative

If you see things differently or want to dig into the numbers yourself, you can easily analyze the data and build your perspective in just a few minutes. Do it your way

A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for your next great investment?

Take charge and give yourself fresh ways to win by checking out a range of high-potential, carefully picked stock ideas using the Simply Wall Street Screener. Opportunities like these move fast, so don’t let them pass you by.

- Capture growth in companies at the forefront of AI breakthroughs by examining these 25 AI penny stocks, which are set to shape tomorrow’s technologies.

- Boost your income strategy with steady yielders among these 15 dividend stocks with yields > 3% that are delivering consistent returns above 3 percent.

- Stay ahead of trends by scanning these 27 quantum computing stocks focused on revolutionizing industries through quantum computing innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives