- United States

- /

- Capital Markets

- /

- NYSEAM:CET

How Central Securities' (CET) Flexible Distribution Choice Is Shaping Its Investor Value Proposition

Reviewed by Sasha Jovanovic

- Central Securities Corporation has declared a distribution of US$2.45 per share on its common stock, payable on December 19, 2025, to shareholders of record as of November 14, 2025, with payments made in stock unless cash is elected by a December 3 deadline.

- This distribution structure provides shareholders with flexibility in how they receive their returns and may have important implications for both investor sentiment and portfolio composition.

- We'll explore how the flexibility for shareholders to choose between stock and cash shapes the company's investment appeal and future positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Central Securities' Investment Narrative?

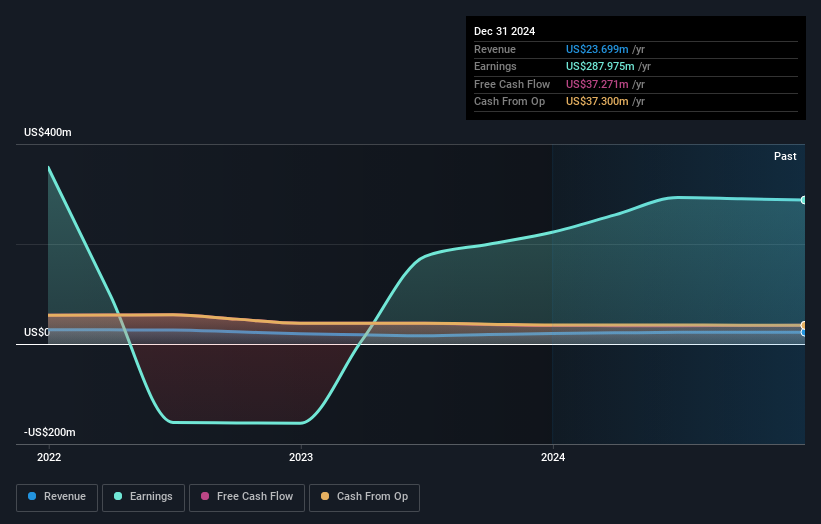

Central Securities stock tends to attract investors who value steady dividends, seasoned leadership, and a business model built on capital returns. To hold CET, you have to believe in the company's ongoing ability to deliver shareholder value even if growth is uneven, especially with current net profit margins lower than last year and some recent one-off gains boosting results. The latest US$2.45 per share distribution, with its mix of cash or stock options, may add short-term appeal, but early analysis and recent trading suggest the near-term catalysts for earnings or price appreciation are not likely to be changed in a major way by this news. The greatest risks remain: negative earnings growth over the past year, profit margin compression, and ongoing questions about dividend sustainability from free cash flows. For now, the distribution flexibility gives some comfort, but the business challenges are still present. Yet, despite the regular dividends, CET’s profit margins have fallen over the past year, a risk investors should weigh.

Despite retreating, Central Securities' shares might still be trading 44% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Central Securities - why the stock might be worth as much as 79% more than the current price!

Build Your Own Central Securities Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Central Securities research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Central Securities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Central Securities' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CET

Central Securities

Central Securities Corp. is a publicly owned investment manager.

Good value with adequate balance sheet.

Market Insights

Community Narratives