- United States

- /

- Capital Markets

- /

- ARCA:URA

Assessing Global X Uranium ETF (URA) Valuation Following Major U.S.-UK Nuclear Power Policy Initiatives

Reviewed by Kshitija Bhandaru

The playing field for uranium investing has just shifted. Global X Funds - Global X Uranium ETF (ARCA:URA) is back in the spotlight after the U.S. President signed executive orders aiming to quadruple the nation's nuclear power capacity by 2050, while simultaneously launching a cross-Atlantic Technology Prosperity Deal with the UK. These developments prioritize advanced reactor deployment and domestic uranium supply, fueling discussions among investors wondering what this means for their portfolios right now.

That surge in policy support has translated directly into inflows and market performance for uranium-related investments. Over the past year, Global X Uranium ETF has delivered an 87% total return, with momentum clearly building. Three-year gains now exceed 180%, and the fund has climbed over 25% in just the past month. With investor confidence ramping up and policy tailwinds at its back, the ETF is drawing renewed attention from both long-term believers and newcomers alike.

But with those gains racking up, there is a big question: are markets already pricing in this new era for nuclear, or is there still a genuine opportunity to buy into the next phase of growth?

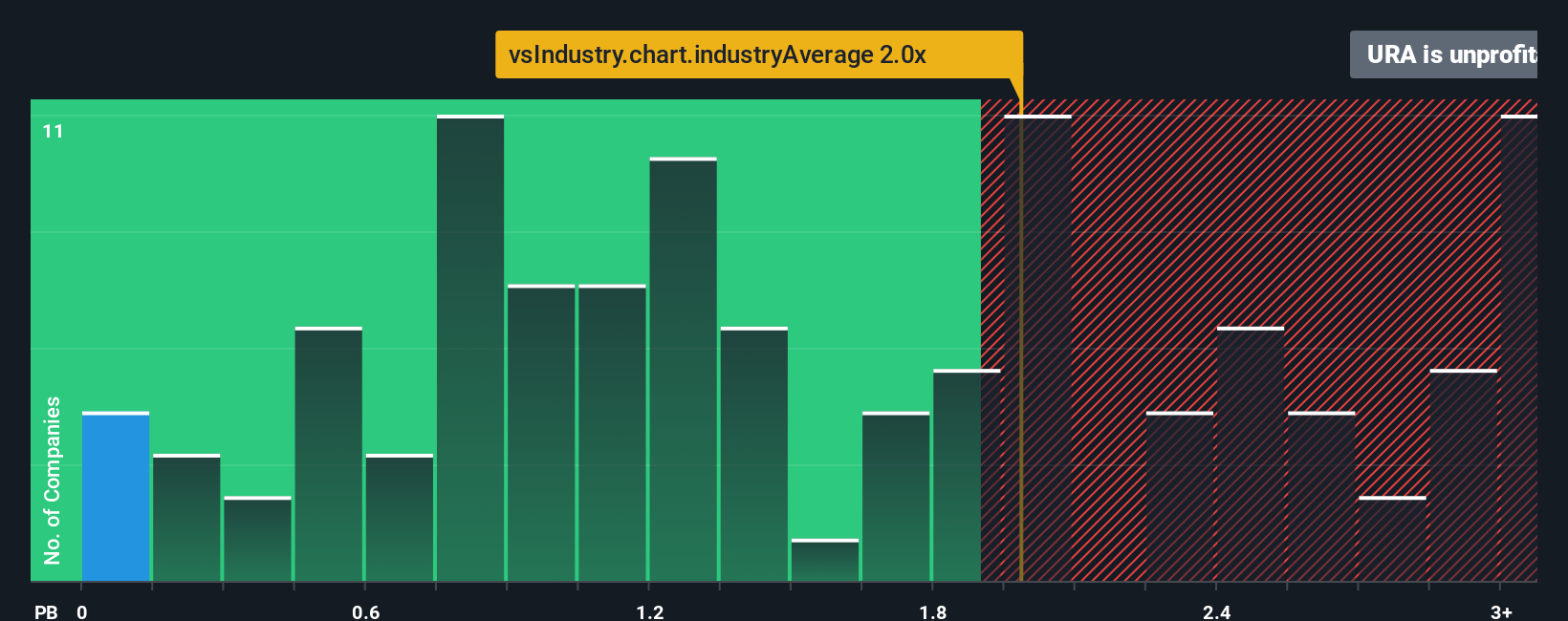

Price-to-Book Ratio: Is it justified?

There is insufficient data to calculate Global X Uranium ETF's price-to-book ratio, so it is difficult to perform a traditional valuation comparison to peers or the industry. As a result, investors lack a clear benchmark for determining whether the ETF is undervalued, overvalued, or fairly valued according to this commonly used metric.

The price-to-book ratio reflects how much investors are paying per dollar of the ETF's net assets. For companies in financial sectors or asset-based industries, this ratio can provide valuable insight into whether shares are being valued fairly in relation to what the company actually owns.

Without this figure, it remains unclear if the market is pricing URA appropriately compared to other capital markets ETFs. For now, any conclusion about value must rely on alternative methods and broader market trends, rather than concrete multiple-based metrics.

Result: Fair Value of $49.43 (ABOUT RIGHT)

See our latest analysis for Global X Funds - Global X Uranium ETF.However, uranium prices remain volatile. Any policy reversal or delays in nuclear deployments could quickly shift investor sentiment and the ETF's trajectory.

Find out about the key risks to this Global X Funds - Global X Uranium ETF narrative.Another View: Multiple-Based Analysis Leaves Questions

Looking from another angle, there's still not enough information to compare Global X Uranium ETF using industry-standard valuation multiples. This leaves investors without a second opinion. Are markets being cautious, or simply missing the bigger picture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Global X Funds - Global X Uranium ETF Narrative

If you think the story can be told differently or want to investigate the numbers yourself, you can easily build your own picture in just a few minutes using Do it your way.

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for inspiration on your next investment?

Don’t sit on the sidelines while bold opportunities take shape. Simply Wall Street gives you the keys to smarter stock selection with unique, data-driven approaches.

- Unlock growth with companies harnessing artificial intelligence by checking out AI penny stocks, featured across multiple sectors and future trends.

- Find value where others overlook by accessing undervalued stocks based on cash flows and spot stocks potentially trading below their real potential.

- Position yourself for tomorrow’s tech breakthroughs by keeping an eye on quantum computing stocks to see which players may lead in quantum computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ARCA:URA

Global X Funds - Global X Uranium ETF

An exchange traded fund launched and managed by Global X Management Company LLC.

Weak fundamentals or lack of information.

Market Insights

Community Narratives