- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Is Block a Bargain After Last Month’s 20% Drop?

Reviewed by Bailey Pemberton

- Wondering if Block is a bargain right now? You're not alone, especially with so much chatter around its future and whether the stock’s price truly reflects its potential.

- The stock has had a wild ride lately, climbing 2.7% in the last week, but dropping 20.5% over the past month and down a hefty 28.3% in the past year. No wonder investors are eyeing potential opportunities and risks.

- Recent headlines have focused on Block's innovations in digital payments and expansion into international markets, which have sparked both optimism and skepticism among analysts. Some see this as a turning point that could reward forward-thinking shareholders, while others caution that rapid changes carry new risks.

- On our simple 6-point valuation checklist, Block scores 3 out of 6 for being undervalued, placing it right in the middle of the pack. This means digging deeper into how we measure value is essential. Stick around to explore not just the usual price ratios, but also a smarter way to get the full story on whether Block is truly undervalued.

Find out why Block's -28.3% return over the last year is lagging behind its peers.

Approach 1: Block Excess Returns Analysis

The Excess Returns valuation approach measures how much profit a company can generate with the capital shareholders have invested, after covering the cost of equity. In simple terms, it tells us if the business is earning more than what investors reasonably demand in return for owning its stock.

For Block, the details are as follows:

- Book Value: $36.94 per share

- Stable Earnings Per Share (EPS): $3.87 per share (Source: Weighted future Return on Equity estimates from 8 analysts.)

- Cost of Equity: $3.21 per share

- Excess Return: $0.66 per share

- Average Return on Equity: 9.33%

- Stable Book Value: $41.51 per share (Source: Weighted future Book Value estimates from 8 analysts.)

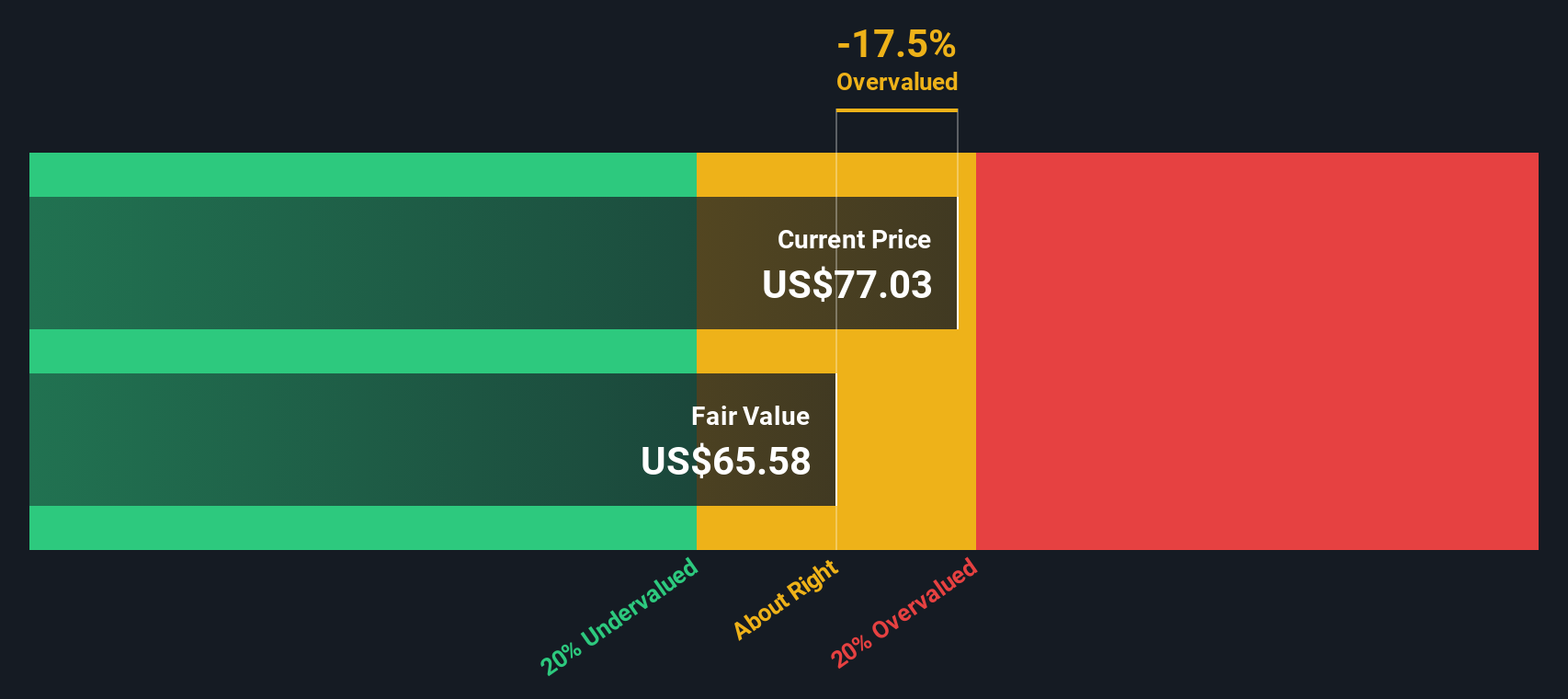

Based on these inputs, the Excess Returns model estimates an intrinsic value of $56.28 per share for Block. Compared to the current share price, this implies the stock is around 13.2% overvalued. While Block shows the ability to generate profits above its cost of equity, this premium is currently reflected in its price, making the stock less of a bargain than some might hope.

Result: OVERVALUED

Our Excess Returns analysis suggests Block may be overvalued by 13.2%. Discover 929 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Block Price vs Earnings

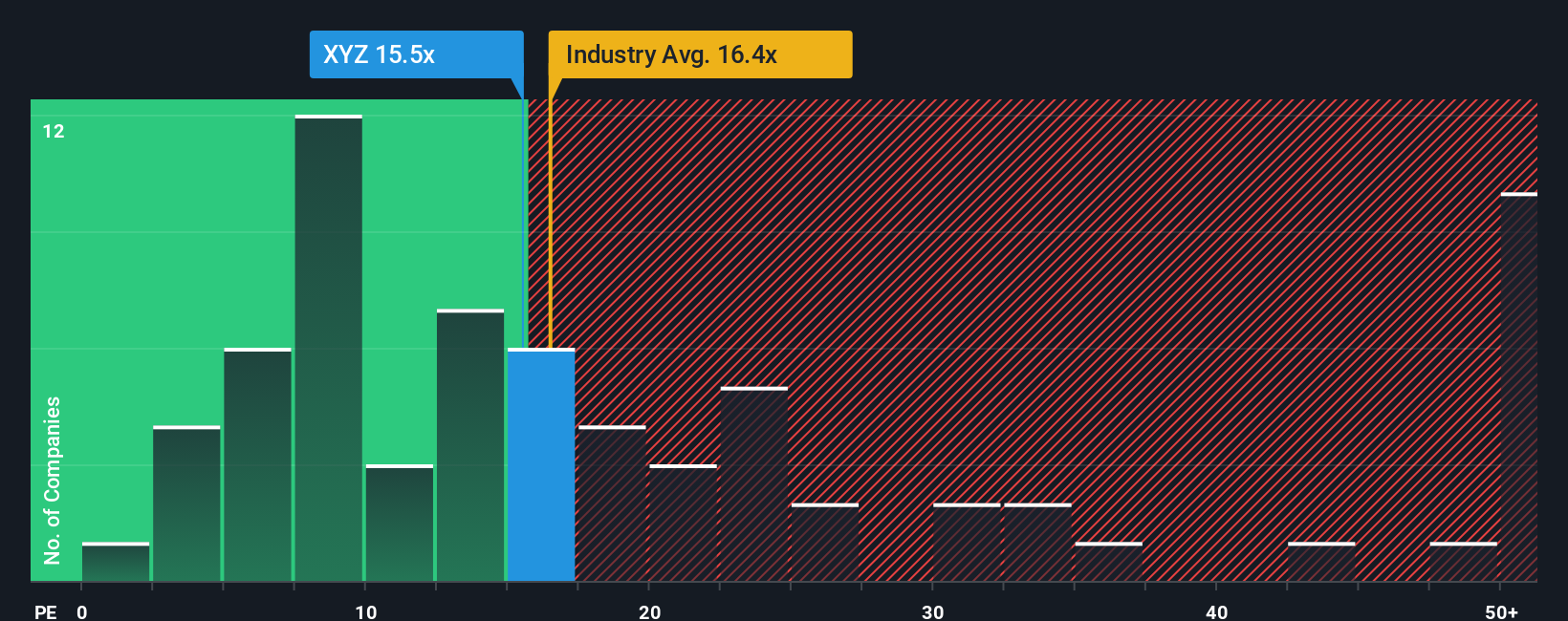

The price-to-earnings (PE) ratio is often considered one of the most effective valuation methods for profitable companies, like Block, because it directly relates a company’s share price to its per-share earnings. This makes it an intuitive way to gauge how much investors are willing to pay for each dollar of profit Block generates.

Interpreting the PE ratio is not only about comparing numbers. Factors such as earnings growth potential and business risk also play a critical role in what constitutes a “normal” or “fair” PE. Higher expected growth and lower risk usually justify a higher PE, while slower growth or higher risks should mean a lower PE.

Currently, Block trades at a PE ratio of 12.34x. For context, this is lower than the peer average of 58.05x and also below the Diversified Financial industry average of 13.56x. That suggests Block’s valuation, by this yardstick, looks modest relative to peers and the broader sector.

However, Simply Wall St’s proprietary Fair Ratio takes a more tailored approach by incorporating factors like Block’s specific earnings growth outlook, profit margins, industry dynamics, market capitalization, and company-specific risks. This comprehensive view sets a fair PE ratio for Block at 16.92x. Using this method is preferable to industry or peer comparisons alone, since it puts Block’s numbers in proper context rather than using a one-size-fits-all rule.

Given the Fair Ratio of 16.92x versus Block’s current PE of 12.34x, the stock screens as undervalued on this basis. There is a meaningful gap suggesting some upside for investors who believe in the company’s prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

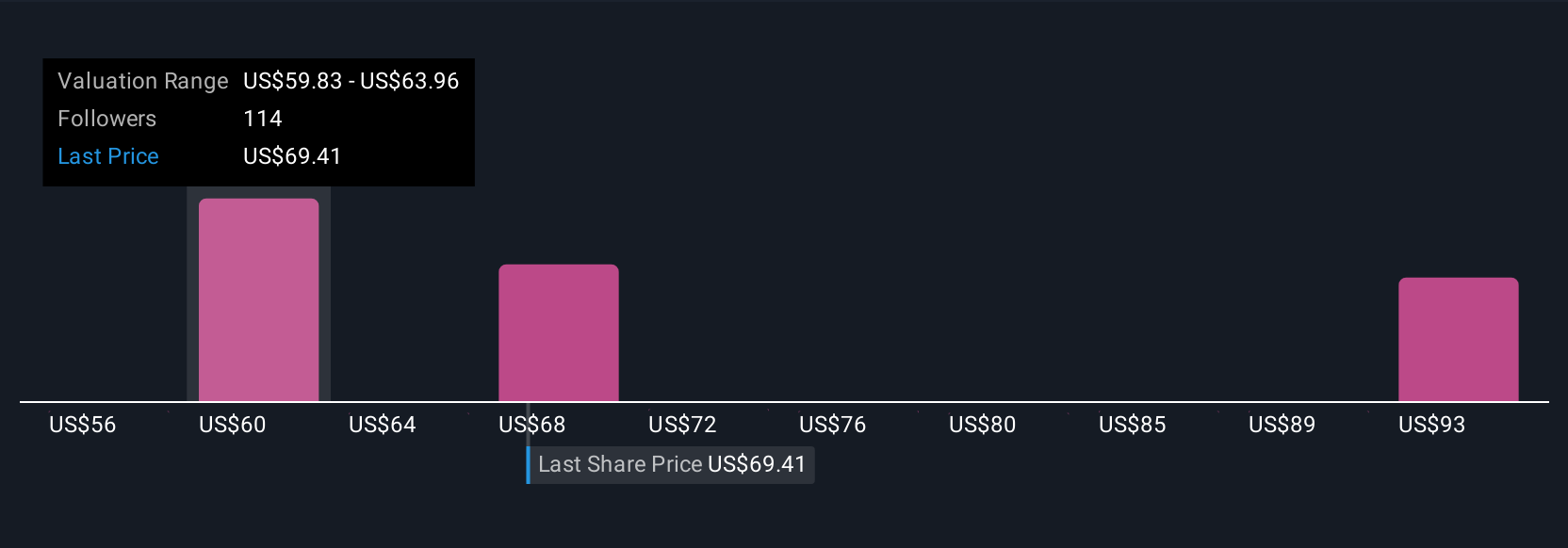

Upgrade Your Decision Making: Choose your Block Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a smarter, story-driven approach to investment decisions. A Narrative is your personal investment story for a company, connecting your view of its business, opportunities, risks, and future with concrete forecasts for revenue, profits, and margins. Narratives tie the company's story to a financial forecast, helping you define your own Fair Value and see how it compares to the current price. On Simply Wall St’s Community page, millions of investors use Narratives to quickly build, share, and update their perspectives, making this tool both powerful and accessible.

Because Narratives automatically refresh with the latest news or earnings, they help you stay flexible and make better buy or sell decisions as facts change. For example, using Block’s analyst forecasts, one investor might set a Fair Value near $104 if they believe aggressive product innovation and margin expansion will pay off. Another investor, concerned about competition and volatility, might see fair value closer to $35. Narratives let you back your opinion with real numbers, so every investment decision you make is based on your unique understanding and up-to-date information.

Do you think there's more to the story for Block? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success