- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Block (SQ) Valuation in Focus After $5 Billion Share Buyback Expansion

Reviewed by Simply Wall St

Block (NYSE:XYZ) just announced a $5 billion boost to its share repurchase authorization, bringing the total to $9 billion. This move highlights management’s confidence and gives the stock’s valuation discussion a fresh angle.

See our latest analysis for Block.

Block’s bump in buyback firepower comes after a whirlwind few weeks for the company. Just days earlier, Cash App rolled out its largest-ever lineup of product upgrades, and Q3 results showed improving fundamentals even as headline earnings missed some expectations. Still, the 1-year total shareholder return is -30.88%, and with the share price currently at $62.00, momentum remains weak following a 7.56% single-day rebound that only partially offsets a challenging 2025 performance. Investors seem to be weighing long-term fintech potential against short-term headwinds.

If Block’s shifting momentum has you rethinking your watchlist, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors facing the classic valuation puzzle, wondering if Block's recent slump and buyback signal an undervalued opportunity, or if the market has already priced in future growth potential at the current share price.

Most Popular Narrative: 29.9% Undervalued

Block’s most widely followed narrative sets a fair value of $88.51, nearly $27 above the last close of $62.00. This suggests a major disconnect between market skepticism and long-term growth expectations.

The rapid acceleration in new product launches, especially around peer-to-peer features (like Cash App Pools) and integration of AI into product development, is heightening Cash App's network effects and virality. This is likely driving improved user acquisition and engagement, which supports recurring revenue expansion in future quarters.

Want to know what’s fuelling this massive upside? The narrative leans on a bold expansion story, game-changing tech, and eye-catching future profit assumptions. Curious which financial leaps are expected to bridge the value gap? The details in the full narrative could surprise even seasoned investors.

Result: Fair Value of $88.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on Cash App’s growth and exposure to crypto volatility could quickly change the outlook if market conditions worsen.

Find out about the key risks to this Block narrative.

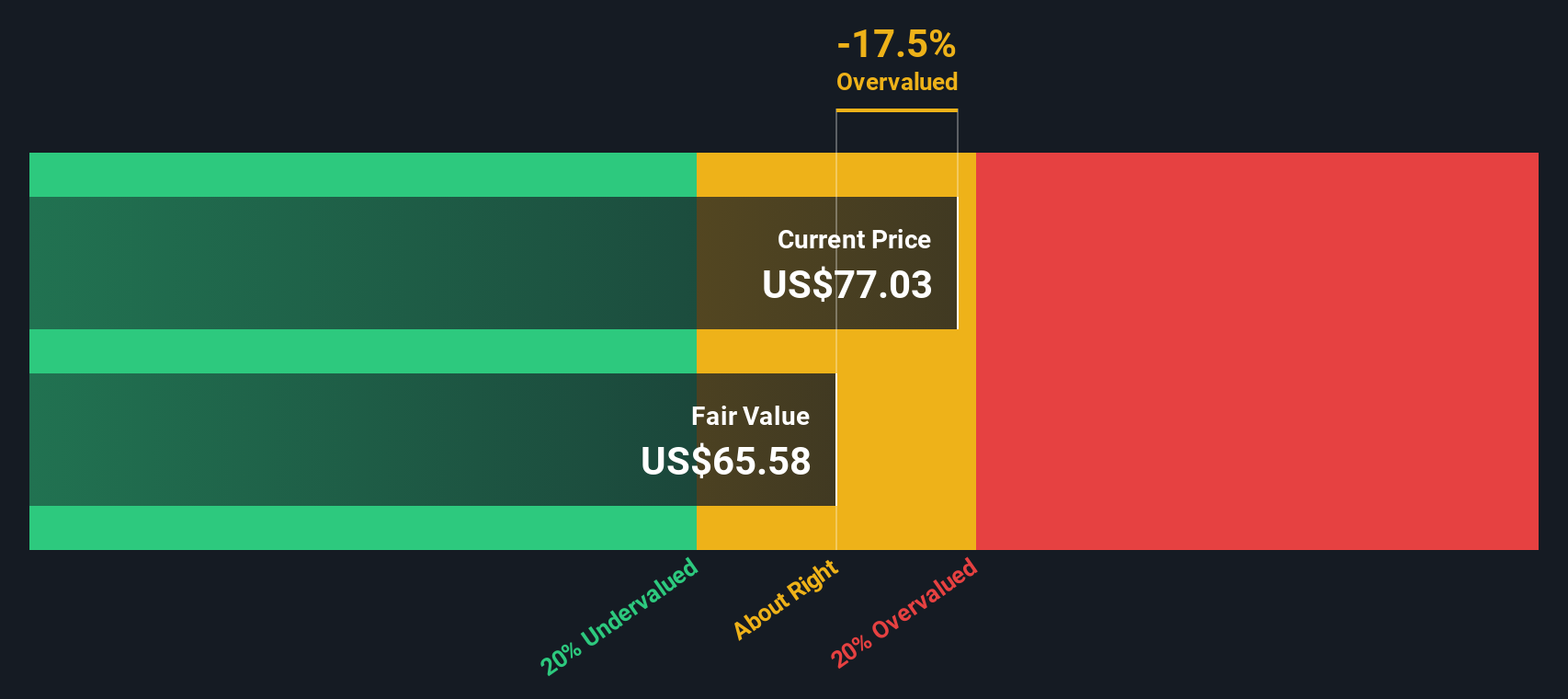

Another View: Checking the Numbers Another Way

While the popular narrative sees Block as substantially undervalued, our DCF model comes to a very different conclusion. Based on forecast cash flows, it suggests Block’s $62 share price actually sits above its estimated fair value of $57.52. This raises a clear caution flag about upside potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Block Narrative

If you see the story differently, or want to test your own forecasts, you can build your own narrative in just a few minutes using the following tool: Do it your way

A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Fresh Stock Opportunities?

Give yourself a winning edge by tapping into investment ideas many investors overlook. Don’t let the next breakout trend pass you by; move fast and make smarter portfolio choices today.

- Unlock income potential and steady returns with companies paying high yields by using these 15 dividend stocks with yields > 3%.

- Accelerate your portfolio’s future growth by targeting the innovators shaping tomorrow’s markets with these 27 AI penny stocks.

- Spot underappreciated value hiding in plain sight and seize your chance at market-beating returns through these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives