- United States

- /

- Diversified Financial

- /

- NYSE:WU

Does Western Union’s New Digital Growth Roadmap Shift the Investment Case for WU?

Reviewed by Sasha Jovanovic

- Earlier this month, Western Union presented its updated multi-year growth strategy at the J.P. Morgan 2025 Ultimate Services Investor Conference in New York, outlining specific targets for revenue growth through 2028.

- This update highlights Western Union's emphasis on accelerating digital money transfer and expanding consumer services, aiming to capitalize on shifting industry trends and evolving customer preferences.

- We’ll examine how Western Union’s measurable digital growth plan could influence its investment narrative and market outlook moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Western Union Investment Narrative Recap

To own Western Union stock, you need to believe that the company’s shift to digital can overcome long-standing pressure from declining retail money transfers and agile fintech competitors. The recently announced 2028 revenue growth targets at J.P. Morgan’s investor conference may support optimism, but for now, these targets are not seen as materially changing the main near-term catalyst, digital transformation momentum, or alleviating the biggest risk: that digital growth might not fully offset retail weakness.

Of all the company’s recent moves, the upcoming launch of the U.S. Dollar Payment Token (USDPT) stands out, connecting directly to the digital catalyst discussed at the conference. By anchoring itself in blockchain-based stablecoin technology, Western Union is signaling an ambition to meet emerging customer needs and bolster its competitive position, though success will depend on market adoption and execution.

In contrast, investors should be aware that persistent regulatory scrutiny and enforcement actions around immigration could still...

Read the full narrative on Western Union (it's free!)

Western Union's narrative projects $4.3 billion in revenue and $543.0 million in earnings by 2028. This implies a 1.3% annual revenue growth rate but a $353.1 million decrease in earnings from the current $896.1 million.

Uncover how Western Union's forecasts yield a $9.42 fair value, a 6% upside to its current price.

Exploring Other Perspectives

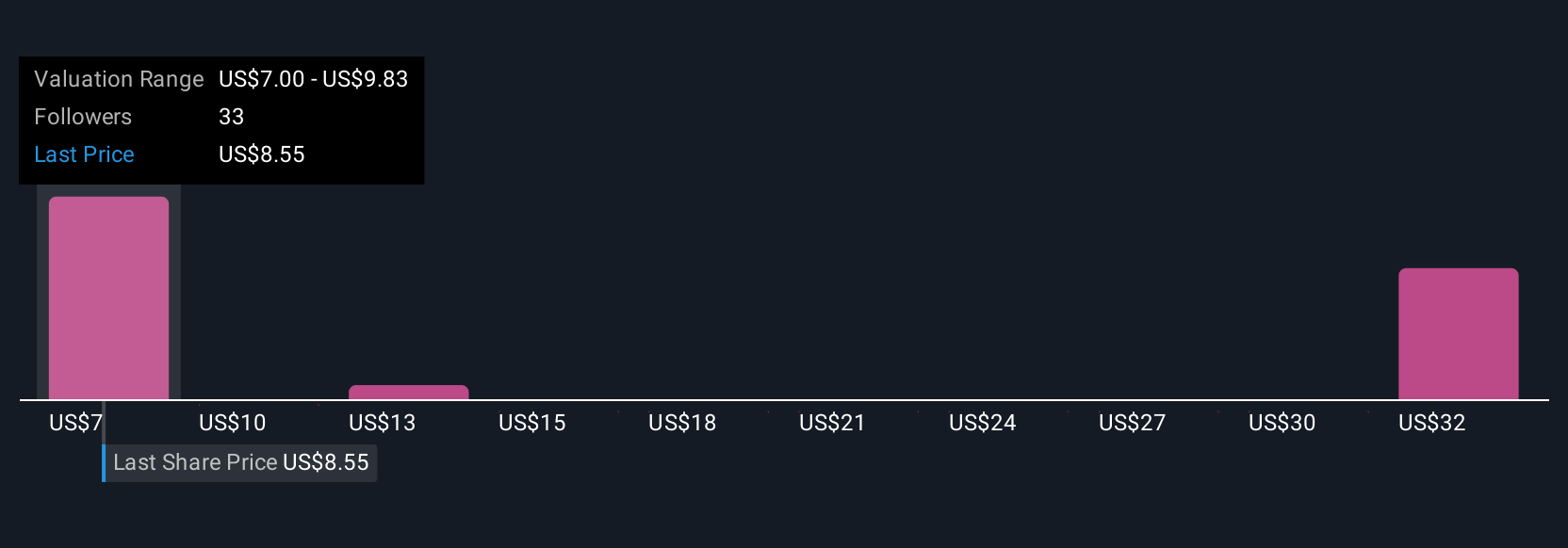

Simply Wall St Community members have shared 10 fair value estimates for Western Union ranging from US$7 to US$37.06 per share. With digital growth expected to offset retail declines, you can compare many sharply different views on the company’s future performance.

Explore 10 other fair value estimates on Western Union - why the stock might be worth 21% less than the current price!

Build Your Own Western Union Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Western Union research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Union's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives