- United States

- /

- Capital Markets

- /

- NYSE:WT

WisdomTree (WT): $35.5 Million One-Off Loss Undermines Margin Narrative

Reviewed by Simply Wall St

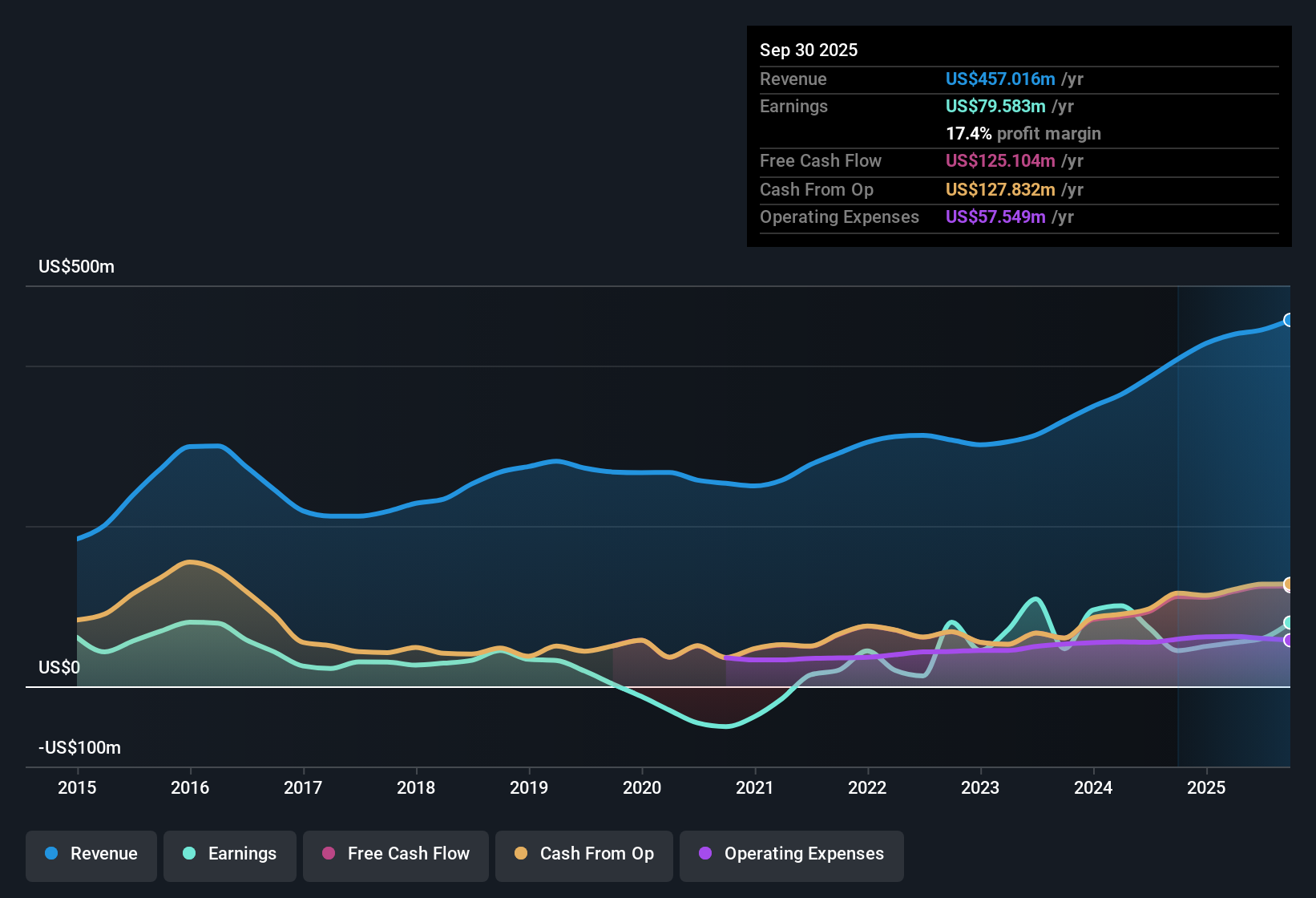

WisdomTree (WT) reported 39.9% compound annual earnings growth over the past five years, turning profitable during that time. However, recent net profit margins have slipped to 13.4% from last year’s 18.9% as a non-recurring $35.5 million loss hit the latest twelve-month period ending September 30, 2025. While earnings are forecast to grow at 14.5% per year and revenue at 10.2% per year, both a little below US market averages, the company’s stock currently trades at $11.96, above its estimated fair value but still under consensus analyst targets. With premium valuation multiples and both rewards and minor risks present, investors find themselves weighing mixed signals as margins compress and growth slows.

See our full analysis for WisdomTree.The question now is how these headline numbers compare to the main narratives shaping WisdomTree’s outlook. Let’s see where the data supports the consensus and where it challenges prevailing views.

See what the community is saying about WisdomTree

Analyst Targets Just 28% Above Current Price

- At $11.96 per share, WisdomTree trades 28% below the consensus analyst target of $15.38. This reflects a smaller upside gap than in previous years and may indicate more muted market expectations.

- According to the analysts' consensus view, several tailwinds and headwinds are now in balance:

- Growth stories include expansion into private assets and digital finance, both positioned to boost and diversify revenues beyond core ETFs.

- The relatively narrow gap to the target may signal that the recent $35.5 million loss and sub-par 10.2% revenue growth rate are causing analysts to hesitate as competition and fee pressure intensify.

Consensus now points to long-term potential, but with much less of a valuation gap than before. Read the full Consensus Narrative. 📊 Read the full WisdomTree Consensus Narrative.

Valuation Significantly Above DCF Fair Value

- The current share price of $11.96 is 84% higher than the computed DCF fair value of $6.50, indicating valuation risk despite positive forecast trends for both earnings and revenues.

- Analysts' consensus view holds that continued margin recovery (expected to rise from 13.4% to 37.9% in three years) and projected earnings growth to $227.8 million could support future pricing power. However, premium multiples leave limited room for disappointment.

- The company’s P/E ratio of 28.7x exceeds both the industry average (25.6x) and the peer average (15.4x), underscoring that investors are currently paying a premium for growth that may not materialize if competitive or regulatory pressures increase.

- Consensus therefore expects only modest share price gains unless WisdomTree can outperform already high margin and earnings forecasts or if the digital asset opportunity accelerates faster than projected.

Analysts See Margins Nearly Tripling by 2028

- Profit margins are forecast to rise from 13.4% today to 37.9% by September 2028—a sharp improvement that would require strong execution across all lines of business.

- Analysts' consensus narrative suggests this confidence is based on:

- Operating leverage improvements from product and regional diversification, especially as recent deals such as the Ceres Partners acquisition expand into higher-margin asset classes like private markets and digital products.

- This thesis will be tested by the pace of global ETF flows, regulatory changes, and ongoing industry-wide fee compression, all of which affect how much of the forecasted margin can be sustained over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for WisdomTree on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Now is your chance to craft your own perspective and share an alternative outlook in just a few minutes, Do it your way.

A great starting point for your WisdomTree research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

WisdomTree’s steep valuation above intrinsic value and shrinking margin advantage mean returns could disappoint if growth or profitability stalls further.

If you are looking for stocks whose prices better reflect their earning power, discover value-driven opportunities right now in our these 832 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WisdomTree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WT

WisdomTree

Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives